Gold Price Forecast: XAU/USD downside opens up toward $1,885, Fed’s Powell eyed

- Gold price snaps recovery and retests multi-month lows just above $1,900.

- US Dollar rebounds firmly with US Treasury bond yields on solid United States data.

- Gold price eyes $1,885 amid a potential Bear Cross, ahead of Fed Chair Jerome Powell.

Gold price nursing losses while languishing in three-month lows near the 1,910 level early Wednesday, as the United States Dollar (USD) is looking to build on the previous rebound amid an uptick in the US Treasury bond yields and a mixed market mood. Investors are trading with caution ahead of a slew of speeches from Chiefs of major global central banks at the European Central Bank (ECB) Forum on Central Banking in Sintra.

Eyes on Fed Chair Jerome Powell and United States bank stress results

Disappointing economic data from China and Australia weighs the market mood in Wednesday’s Asian trading, motivating the safe-haven US Dollar to recover further ground across its main competitors. The Australian consumer price inflation rate slowed to a 13-month low of 5.6% YoY in May, driven by a sharp pullback in fuel. Meanwhile, profits at China's industrial firms shrank by 18.8% YoY in the first five months of 2023, adding to worries over stuttering Chinese economic growth.

The US Dollar also benefits from a fresh uptick in the US Treasury bond yields across the curve, leaving Gold price wallowing in pain, especially after Tuesday’s about $20 drop in response to the solid economic data from the United States.

In the first half of Tuesday’s trading, Gold price extended its rebound and retested the $1,930, as the US Dollar remained on the back foot in the wake of a positive shift in risk sentiment driven by China optimism. However, the tide turned against the Gold price in American trading after upbeat US Durable Goods and housing data revived the US Dollar bulls while the US Treasury bond yields also staged an impressive comeback.

US Durable Goods Orders rose 1.7% MoM in May, the third such increase in a row, while Core orders, excluding transportation, rose 0.6%, beating estimates of a drop of 0.1% and improving from April's 0.6% drop. Further, sales of newly constructed homes were up 12.2% in May from April and up 20% from a year ago, a joint report from the US Department of Housing and Urban Development and the US Census Bureau showed on Tuesday. Improving economic performance in the United States eased recession fears, implying that the US Federal Reserve (Fed) could keep interest rates higher for longer. Markets are pricing in a 77% probability of a 25 basis point (bps) hike by the Fed next month, according to CME Group’s FedWatch tool.

Amidst increased hawkishness around the Fed interest rates outlook, all eyes will be on the speech from Fed Chair Jerome Powell later this Wednesday as he participates in a policy panel along with ECB President Christine Lagarde, Bank of England (BoE) Governor Andrew Bailey and Bank of Japan’s (BoJ) Governor Kazuo Ueda at the ECB Forum at 13:30 GMT. Gold traders will likely refrain from placing fresh bets ahead of central bankers’ speeches, which could stir volatility in the market.

Additionally, the US bank stress results will be closely scrutinized for fresh hints on the credit conditions in the world’s largest economy, which could significantly impact the Fed’s policy outlook.

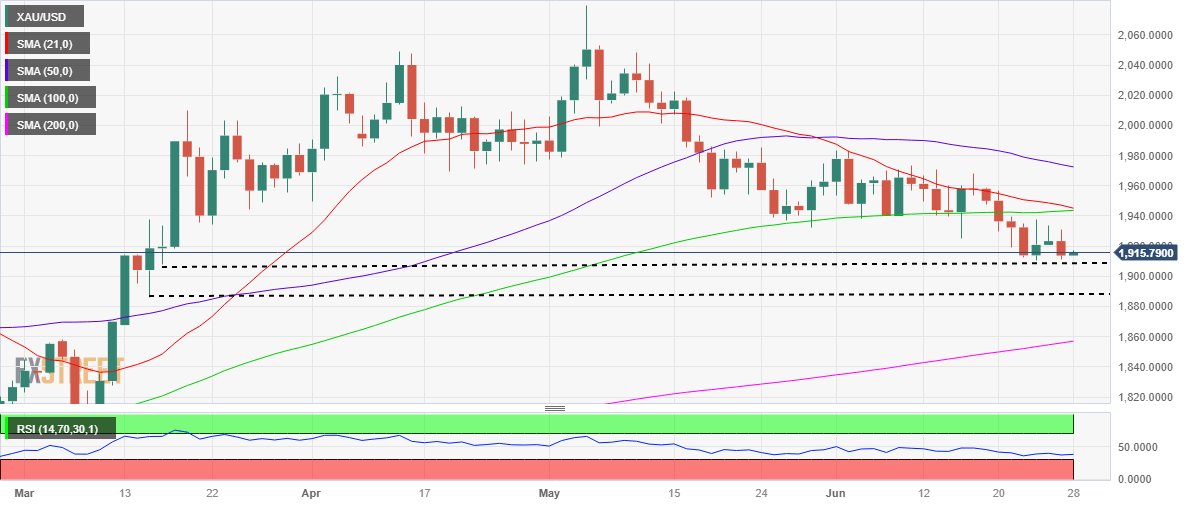

Gold price technical analysis: Daily chart

Gold traders seem to be paying attention to the impending Bear Cross on the daily chart, justifying the latest downside in the Gold price.

Gold price awaits a confirmation of the Bear Cross on a daily closing basis to extend the bearish momentum. The downward-sloping 21-Daily Moving Average (DMA) is on the verge of cutting the 100 DMA from above.

Meanwhile, the 14-day Relative Strength Index (RSI lurks below the midline, suggesting that risks remain to the downside for Gold price.

Therefore. immediate support awaits at the March 16 low at $1,908, below which floors will open toward the $1,900 threshold. Further down, the March 15 low of $1,886 will be the line in the sand for Gold buyers.

On the upside, a powerful resistance is seen near the $1,930 region, above which the confluence of the 21 and 100 DMAs at $1,944 will challenge bearish commitments. The next relevant upside target is seen at the $1,950 psychological level.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.