Gold Price Forecast: XAU/USD downside appears limited, focus shifts to BoE and US data

- Gold price tests critical support at $1,925 as US Dollar stands tall.

- US Treasury bond yields and the US Dolla surge on hawkish Federal Reserve pause.

- Bull Cross confirmation and a bullish RSI could cushion Gold price downside.

Gold price is trading at the lowest level in three days near $1,925 early Thursday, challenging critical confluence support amid an unabated US Dollar demand and surging US Treasury bond yields, courtesy of a hawkish US Federal Reserve (Fed) interest rate pause on Wednesday.

Gold price looks to the BoE and the US data for fresh impetus

Having witnessed good two-way wild swings on Wednesday, Gold price managed to settle with modest losses. Gold price hit a fresh three-week high at $1,947, in anticipation of the Fed interest rate decision, as traders resorted to profit-taking on their US Dollar long positions. On the Fed policy announcements, the US Dollar rebounded firmly and triggered a $20 pullback in God price.

As expected, the Federal Reserve held rates steady at the range of 5.25%-5.5% following the September policy meeting. But the Summary of Economic Projections (SEP), the so-called ‘Dot Plot’ chart, showed that the “Fed projections imply one more 25 basis points (bps) rate hike this year and 50 bps of rate cuts in 2024, versus 100 bps of 2024 cuts in June projections.”

After Fed Chairman Jerome Powell strengthened the hawkish stance by emphasizing the ‘higher for longer’ rate view, US Treasury bond yields rallied hard across the time horizon, with the benchmark 10-year US Treasury bond yield clinching fresh 16-year highs above 4.40% while the US Dollar refreshed the half-year high at 105.47 against its main peers.

At the time of writing, the US Dollar Index is extending the previous gains to close in on the March high of 105.88 while Gold price is attempting a tepid recovery toward $1,930 notwithstanding the ongoing advance in the US Treasury bond yields.

Gold price is finding a floor amid broad risk aversion, as investors weigh prospects of the Fed’s stiffened monetary policy stance on the global markets. The focus also shifts toward the Bank of England interest rate decision due later in the day. Until Tuesday, markets were pricing in an 80% probability of a 25 bps BoE rate hike on Thursday but surprisingly softer UK inflation data poured cold water on tightening hopes, as odds for a rate hike or a pause stand at a coin flip level – 50%.

A dovish verdict by the BoE could work in favor of the non-interest-bearing Gold price. However, the weekly Jobless Claims and other minority reports from the United States could also impact the US Dollar valuation, in turn, influencing Gold price.

Gold price technical analysis: Daily chart

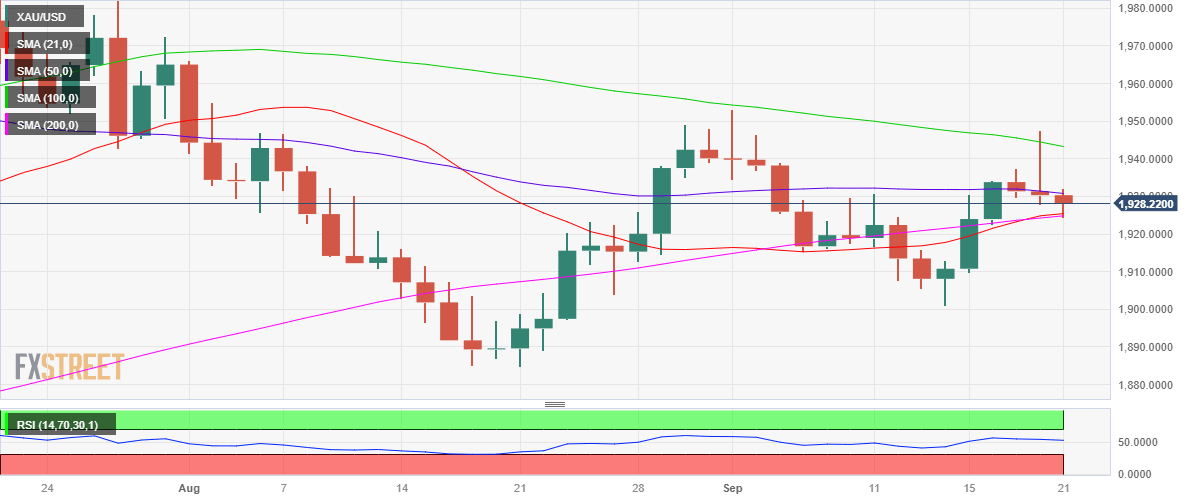

Gold price closed Wednesday just below the 50-Daily Moving Average (DMA) at $1,931, having faced rejection above the 100 DMA at $1,943 following the Fed decision.

The 14-day Relative Strength Index (RSI) indicator is looking south but defends the 50 level, keeping Gold buyers hopeful.

Further, the 21 DMA broke through the 200 DMA on a daily closing, validating a Bull Cross.

Therefore, the downside appears limited, with strong support seen at $1,925, the intersection of the 21 and 200 DMAs.

A sustained break below the latter could challenge the $1,910 round figure. The next crucial support awaits at the $1,900 threshold.

Amidst bullish technical indicators, however, a rebound cannot be ruled out in Gold price. Gold buyers need to recapture the 50 DMA barrier at $1,931 for the additional upside toward the 100 DMA at $1,943.

Subsequently, a fresh upswing September high of $1,953 could be in the offing.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.