Gold Price Forecast: XAU/USD down but not out while $2,950 support holds

- Gold price keeps the corrective downside intact toward $3,000 early Monday.

- Upbeat mood on WSJ’s US tariffs report and Ukraine peace deal optimism weigh on Gold price.

- Gold price stays a ‘buy-the-dips’ trade on the daily chart so long as $2,950 is defended.

The gold price is trading on the back foot early Monday, looking to continue Friday’s correction from its all-time high of $3,058. Gold price bears the brunt of a risk-on market profile, diminishing its safe-haven appeal.

Gold price finds fresh sellers; what’s next?

At the onset of a new week, the Gold price maintains its corrective downside as markets shift back to riskier assets amid renewed optimism over US President Donald Trump’s reciprocal tariffs, hopes for Chinese stimulus, and a potential Ukraine peace deal.

According to the latest report carried by the Wall Street Journal (WSJ), the White House is expected to narrow its list of tariffs due to take effect on April 2, likely omitting a set of industry-specific tariffs while applying reciprocal tariffs aimed at countries with significant trade ties to the United States (US).

Additionally, recent news that China is looking to boost consumption remains supportive of the risk flows, as markets remain hopeful of a likely end to the Russia-Ukraine conflict following Sunday’s meeting between US and Ukrainian officials in Saudi Arabia.

Ukrainian Defense Minister Rustem Umerov said that the talks on Sunday in Saudi Arabia were “productive and focused.”

Attention now turns to separate talks between Russian and US delegates on Monday regarding the Ukraine peace deal, as traders brace for the preliminary readings of global Purchasing Managers' Index (PMI) gauges, which will likely shed light on the prospects of the global economy in the face of Trump’s tariff-induced recession fears.

Furthermore, markets will closely monitor any developments surrounding Trump's plans to implement global reciprocal tariffs starting April 2, which drive risk sentiment and the Gold price action in the near term.

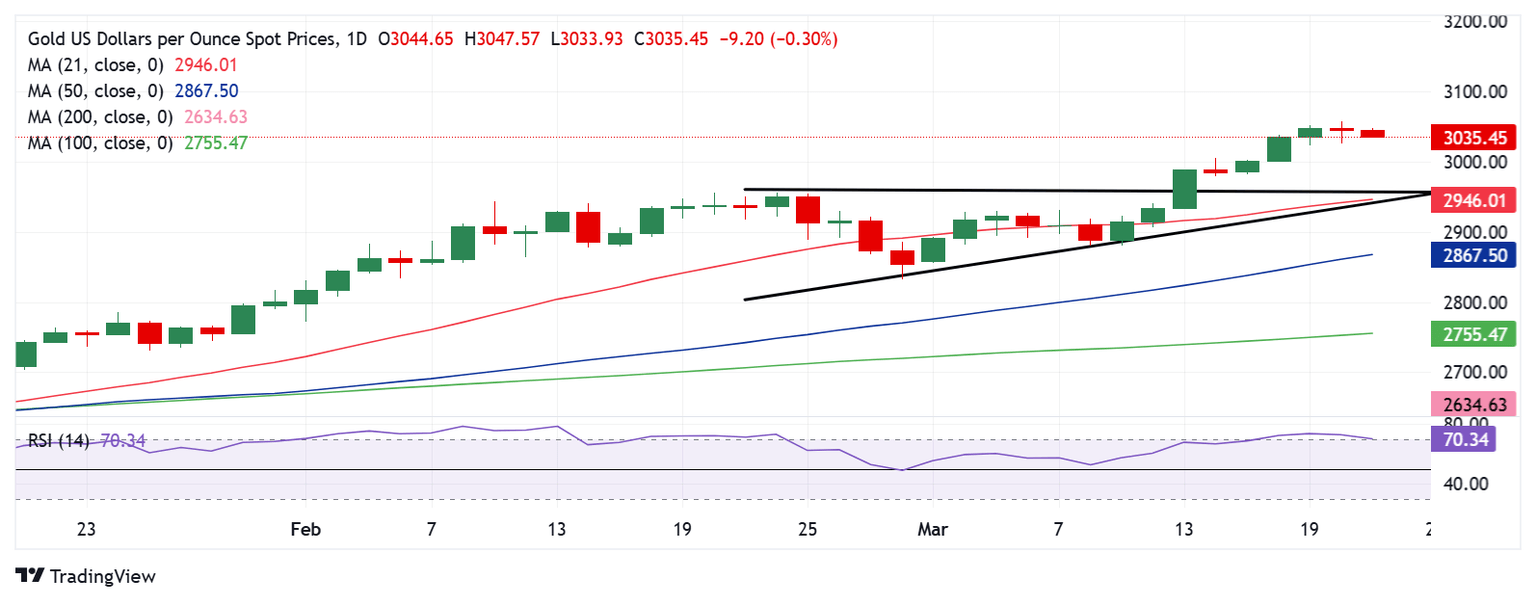

Gold price technical analysis: Daily chart

Technically, the Gold price maintains its ‘buy-the-dips’ status amid the confirmed breakout from the ascending triangle earlier this month.

However, with the 14-day Relative Strength Index (RSI) pointing south at the time of writing, a further retracement appears to be on the cards. That said, as long as the RSI holds above the midline, any pullbacks in the Gold price will be quickly bought back into.

On the extension of the latest leg down, Gold price could test Friday’s low of $3,000, below which the previous week’s low of $2,982 will be tested.

Further south, the 21-day Simple Moving Average (SMA) and the triangle support confluence at $2,950 will be a tough nut to crack for sellers.

Conversely, if buyers jump back into the game, Gold price could retest the record high of $3,058 if buyers regain poise. The door will then open up to test the triangle target measured at $3,080.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.