Gold Price Forecast: XAU/USD defends critical daily support line, eyeing US-China trade talks

- Gold price reverses previous bounce and retests $3,300, watching US-China trade talks.

- The US Dollar picks up strong bids early Tuesday amid USD/JPY rebound, trade optimism.

- Gold buyers stay hopeful until the 21-day SMA and RSI midline hold fort.

Gold price is back to testing the $3,300 threshold early Tuesday amid resurgent US Dollar (USD) demand. However, traders continue to maintain caution, watching the US-China trade talks in London.

Gold price awaits more US-China London trade talks

Bloomberg reported that trade talks between the United States (US) and China will continue into a second day after the first day of talks were fruitful, per US Commerce Secretary Howard Lutnick.

US President Donald Trump said late Monday that “China is not easy but we are doing well with China,” giving no specifics on the key contention topics of shipments of technology and rare earth elements.

Alongside the US-China trade optimism, the latest leg down in Gold price is fuelled by a solid rebound in the US Dollar (USD).

The Greenback is mainly driven by the upswing in the USD/JPY pair after the Japanese Yen (JPY) tumbled on Bank of Japan (BoJ)Governor Kazuo Ueda’s cautious remarks on the interest rates outlook.

Ueda said: “We will raise interest rates if we have enough confidence that underlying inflation nears 2% or moves around 2%.”

The further upside in the Greenback will likely remain limited as traders refrain from placing fresh bets before any decisive outcome from day 2 of US-China trade talks in London.

Markets will also look forward to Wednesday’s US Consumer Price Index (CPI) data for fresh direction on the USD and Gold price.

On Monday, the latest Survey of Consumer Expectations conducted by the Federal Reserve (Fed) Bank of New York showed that the year-ahead inflation expectation decreased to 3.2% in May from 3.6% in April.

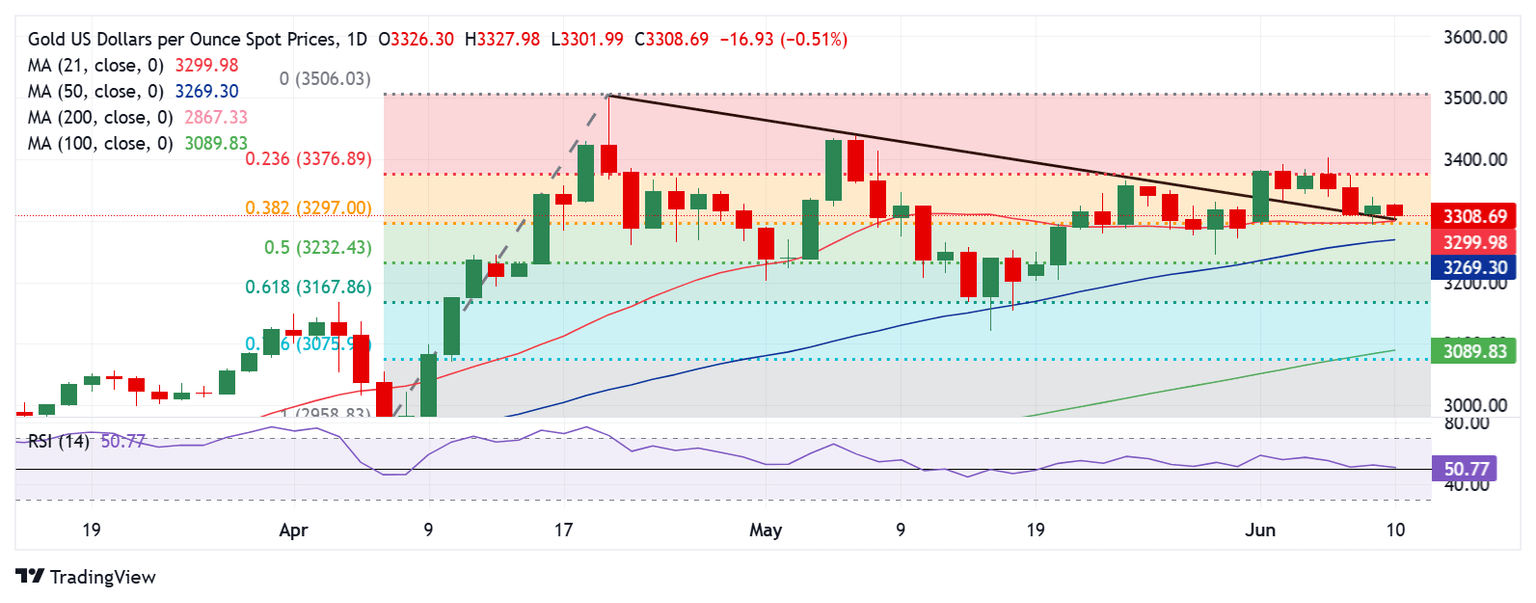

Gold price technical analysis: Daily chart

There are no changes to the short-term technical outlook for Gold price so long as the critical $3,297 level is defended.

That level is the confluence of the 21-day Simple Moving Average (SMA) and the 38.2% Fibonacci Retracement (Fibo) level of the April record rally.

Further, the 14-day Relative Strength Index (RSI) has managed to hold its ground above the midline, currently near 51, supporting the bullish bias.

Gold sellers need a daily candlestick closing below the abovementioned strong support at $3,297 to challenge the 50-day SMA cap at $3,262.

The last line of defense for buyers is aligned at $3,232, the 50% Fibo level of the same ascent.

On the flip side, Gold buyers will likely find strong offers at the $3,350 psychological level if the rebound gathers strength.

The next resistance is spotted at the 23.6% Fibo resistance at $3,377, above which the May high of $3,439 could be threatened.

(This report was corrected on June 10 at 04:03 GMT to say that "Gold price is back to testing the $3,300 threshold early Tuesday," not Thursday.)

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.