Gold Price Forecast: XAU/USD consolidates around $2,330 in quiet start to the week

XAU/USD Current price: $2,329.11

- United States PCE inflation stands out this week.

- Upcoming elections in Europe keep investors in cautious mode.

- XAU/USD trades with a soft tone around $2,330, bearish scope well-limited.

Spot Gold trades with a soft tone on Monday, with XAU/USD hovering around $2,330.00. A certain caution prevails across financial markets as investors await fresh news from the macroeconomic and political sides. In the United States (US), the focus will be on the May US Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve (Fed) preferred inflation gauge.

Other than that, investors are keeping an eye on European upcoming elections as France and the United Kingdom will soon go to the polls. Speculative interest also looks at Russia after President Vladimir Putin mentioned potential changes to the country’s nuclear policy, escalating tensions with the West.

The US Dollar posted a modest advance at the beginning of the day but turned lower with Wall Street’s opening amid an upsurge in US equities following Friday's poor performance. Little variation around government bond yields and a scarce macroeconomic calendar help to keep XAU/USD within familiar levels.

XAU/USD short-term technical outlook

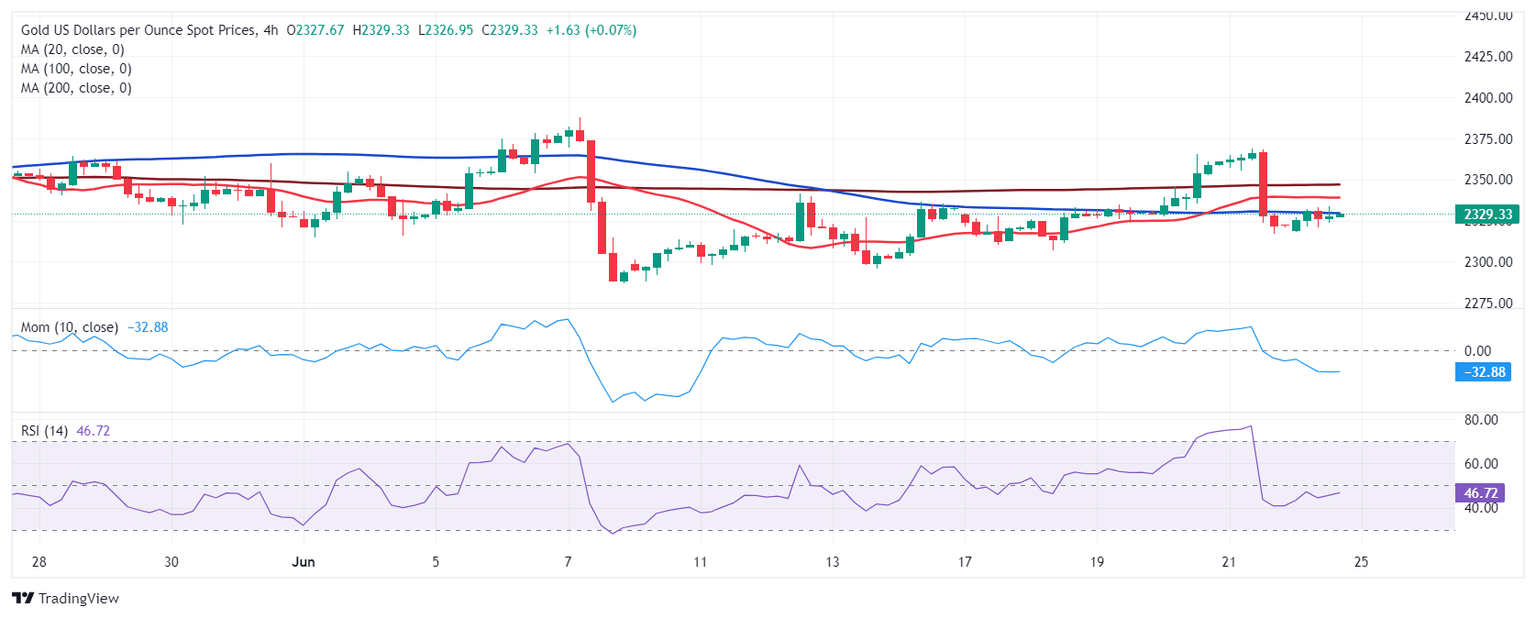

XAU/USD is technically neutral, according to the daily chart, although the bearish potential seems well-limited. The pair is currently battling a directionless 20 Simple Moving Average (SMA), while the longer moving averages maintain their upward slopes below the current level. At the same time, technical indicators lack directional strength just below their midlines, reflecting the absence of speculative interest rather than suggesting bulls are about to give up.

In the near term, and according to the 4-hour chart, XAU/USD offers a neutral-to-bearish stance. The pair develops below all its moving averages, with the 20 SMA flat between also directionless longer ones. Technical indicators, in the meantime, head nowhere just below their midlines. The bright metal traded as low as $2,316.61 on Friday, the level to pierce to expose the $2,300 threshold.

Support levels: 2,316.60 2,301.00 2,288.70

Resistance levels: 2,334.10 2,346.70 2,360.30

(This story was corrected on June 25 at 08:02 GMT to remove a reference to the FOMC Minutes, as these won't be published this week.)

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.