Gold Price Forecast: XAU/USD bull-bear tug-of-extends around $2,000, eyes on US Core PCE Price Index

- Gold price extends range play around the 21-Day Moving Average while moving within a rectangle pattern.

- US Dollar rebounds after United States advance Q1 Gross Domestic Product data, then reverses on risk-on trading.

- Focus shifts to the US Federal Reserve’s preferred inflation measure, Core PCE Price Index, for fresh impetus.

Gold price is treading water below the $2,000 threshold early Friday, having failed once again to sustain above the latter amid Thursday’s renewed upswing in the United States Dollar (USD). Looking ahead, all eyes now remain on the US Federal Reserve (Fed) preferred inflation measure, the Core Personal Consumption Expenditures (PCE) - Price Index, for fresh directional impetus on the Gold price.

United States Q1 Gross Domestic Product revives hawkish Federal Reserve bets

The United States preliminary Gross Domestic Product (GDP) data for the first quarter came to the rescue of the US Dollar bulls, as the publication offered legs to the recovery in the Greenback across its major peers, capping the upside attempts in Gold price yet again.

Despite the headline US Q1 GDP number missing estimates of 2.0% QoQ by a wide margin to arrive at 1.1%, resilient personal consumption, inventories accumulation and higher inflation component grabbed investors’ attention and ramped up odds of a 25 basis points (bps) Fed rate hike next week to 86% vs. roughly 72% probability seen pre-data release.

The details of the report triggered a fresh rally in the US Treasury bond yields across the curve, with the benchmark 10-year US Treasury bond yields recapturing the critical 3.50% level. The US Dollar tracked the US Treasury bond yields higher. The improvement in risk sentiment, courtesy of the upbeat US tech earnings, also underpinned the yields by reducing the demand for the safe-haven US government bonds and Gold price.

The risk-on flows, however, curbed the US Dollar upswing, allowing Gold price to finish the day almost unchanged. Wall Street’s main indices jumped 1.50% to 2.50%, capitalizing on the recent string of strong techs earnings from the United States. After markets closed on Thursday, Amazon (AMZN) reported first quarter earnings, which beat expectations and initially sent shares surging.

Attention moved back toward expectations surrounding the upcoming Federal Reserve rate hike decision, as investors looked past the banking sector worries. Therefore, traders now look forward to the US Core PCE Price Index data for a fresh directional move in the Gold price. The US Core PCE Price Index is seen arriving at 0.3% MoM and 4.5% YoY in March. The end-of-the-week flows and repositioning ahead of next week’s Federal Reserve policy announcements could also influence the US Dollar valuations, in turn, impact Gold price action.

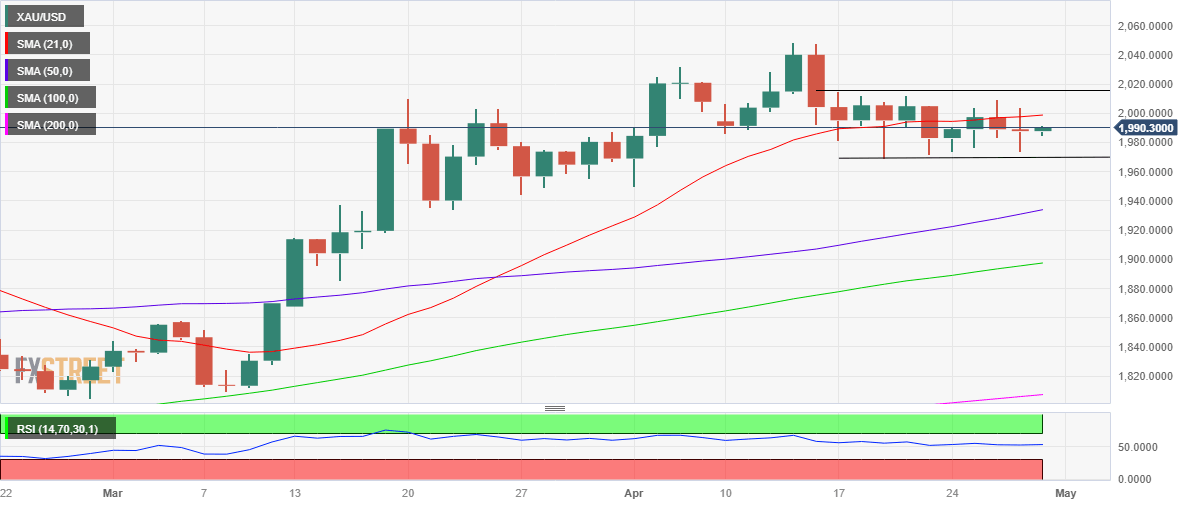

Gold price technical analysis: Daily chart

Gold price made another attempt above the mildly bullish 21-Daily Moving Average (DMA) support-turned-resistance, now at $1,999, on Thursday. But in vain, as Gold sellers continued to lurk at higher levels, dragging the bright metal back toward the critical demand area of $1,970.

At the moment, Gold price continues to trade within a ten-day-old rectangle formation, with the downside cushioned by the bullish 14-day Relative Strength Index (RSI), which continues to sit just above the midline.

On the upside, Gold bulls need to yield a weekly closing above the 21 DMA barrier to initiate a sustained upside toward the static resistance at $2,015. Further up, they could challenge the round figure of $2,020 on their way to the previous yearly high at $2,032.

On the flip side, another failed attempt above the 21 DMA or the $2,000 psychological mark reinforces the ongoing corrective consolidation in the Gold price, putting the range lows near $1,970 back at risk. The previous day’s low at $1,974 could offer some support to Gold buyers beforehand.

A sustained below $1,970 will open doors for a test of the $1,950 hurdle, the intersection of the key psychological level and the April 3 low at $1,950.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.