Gold Price Forecast: XAU/USD breaks through $1900, room for additional upside?

- Gold price refreshes multi-month highs, as $1900 caves in.

- Uptick in Treasury yields, overbought conditions could limit the advance.

- Fedspeak draws attention amid a data-light US calendar.

Gold price (XAU/USD) outperformed on Tuesday, reaching over four-month highs at $1900, a slide in the US Treasury yields and the dollar helped the metal yield a much-needed break above the critical $1890 level. A dip in the US consumer confidence and new home sales exacerbated the pain in the greenback, as it continued to remain pressured by the dovish Fed expectations. The recent Fedspeak dismissed inflation concerns and thus, pointed towards an accommodative monetary policy for a longer period. Meanwhile, inflation hedge gold continued to draw support from rising inflation expectations.

Gold price is building on Tuesday’s break higher, sitting at fresh four-month tops of $1908. The upbeat market mood undermines the sentiment around the greenback, exerting additional upside pressure on gold. Meanwhile, gold traders ignore a minor uptick in the Treasury yields, as they cheer a clear break above the key $1900 threshold. Gold price will continue to track the dynamics in yields and the dollar amid a quiet US docket. Fedspeak will be closely followed.

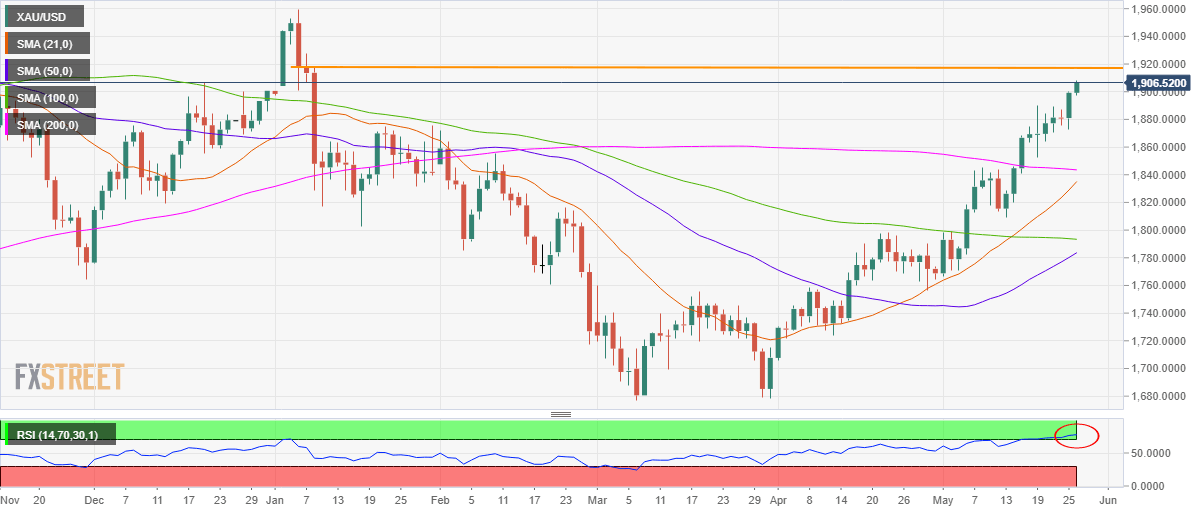

Gold Price Chart - Technical outlook

Gold: Daily chart

Despite the overbought Relative Strength Index (RSI) on the daily chart, gold buyers defy the bearish odds and remain on track to test the January 8 high of $1917.

However, the further upside appears elusive, as gold bulls could take a breather before resuming the uptrend towards $2000.

The next upswing could likely get fuelled by prospects of bearish crossovers on the said time frame.

Meanwhile, any corrective pullbacks could meet initial demand at $1890, the static resistance now support.

Further south, strong support near the $1872/70 region could guard the downside.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.