Gold Price Forecast: XAU/USD bears take a breather amid oversold conditions, ahead of US PCE data

- Gold price struggles to gain any meaningful traction and oscillates in a range near a multi-month low.

- A modest USD downtick, the looming US government shutdown and worries over China lend support.

- Bets for one more Fed rate hike in 2023 cap the upside ahead of the crucial US Core PCE Price Index.

Gold price (XAU/USD) enters a bearish consolidation phase during the Asian session on Friday and oscillates in a narrow band, just above its lowest level since March 10, around the $1,858-$1,857 region touched the previous day. The US Dollar (USD) edges lower for the second straight day and retreats further from a nearly 10-month peak set on Wednesday. This, in turn, is seen as a key factor lending some support to the US Dollar-denominated commodity. Increasing odds of a partial US government shutdown on October 1, which poses a risk to the economy, and persistent worries about a real estate crisis in China act as a tailwind for the safe-haven precious metal. That said, any meaningful recovery still seems elusive.

The divergent paths of the two chambers have increased the possibility that federal agencies will run out of money on Sunday. The Democratic-led US Senate, meanwhile, moved forward on Thursday with a bipartisan stopgap funding bill to extend federal spending until November 17, which should pass, though perhaps not before the weekend deadline. Some conservative House Republicans, however, are pushing for deep spending cuts and said they'll refuse to support the Senate's bill or any short-term legislation that would buy Congress more time to act. House Republicans have already rejected spending levels for fiscal year 2024 set in a deal between Speaker Kevin McCarthy and President Joe Biden in May 2023.

The supporting factor, to a larger extent, is offset by firming expectations that the Federal Reserve (Fed) will stick to its hawkish stance and continue tightening its monetary policy. In fact, the US central bank warned last week that still-sticky inflation will likely attract at least one more interest rate hike by the year-end. Furthermore, the incoming US macro data continue to provide ample evidence of ongoing economic strength and should allow the Fed to keep rates higher for longer. The final estimate published by the US Bureau of Economic Analysis (BEA) on Thursday showed that the world's largest economy expanded by a 2.1% annualized pace during the second quarter, in line with market expectations.

A separate report by the Labor Department revealed that Initial Jobless Claims rose by a modest 2,000, to 204K during the week ended September 23, suggesting that tight labour market conditions continue to prevail. This, in turn, favours the USD bulls and suggests that the path of least resistance for the Gold price is to the downside. Trades, however, seem reluctant to place fresh directional bets and prefer to wait for the release of the US PCE Price Index data, due later during the early North American session. The core measure, which is the Fed's preferred inflation gauge, will influence expectations about the next policy move, which, in turn, will drive USD and provide a fresh directional impetus to the non-yielding yellow metal.

Nevertheless, the Gold price remains on track to record heavy weekly losses and register its lowest weekly close since March. Moreover, the aforementioned fundamental backdrop suggests that any attempted recovery might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly. Hence, any immediate market reaction to softer US data is more likely to be short-lived.

Technical Outlook

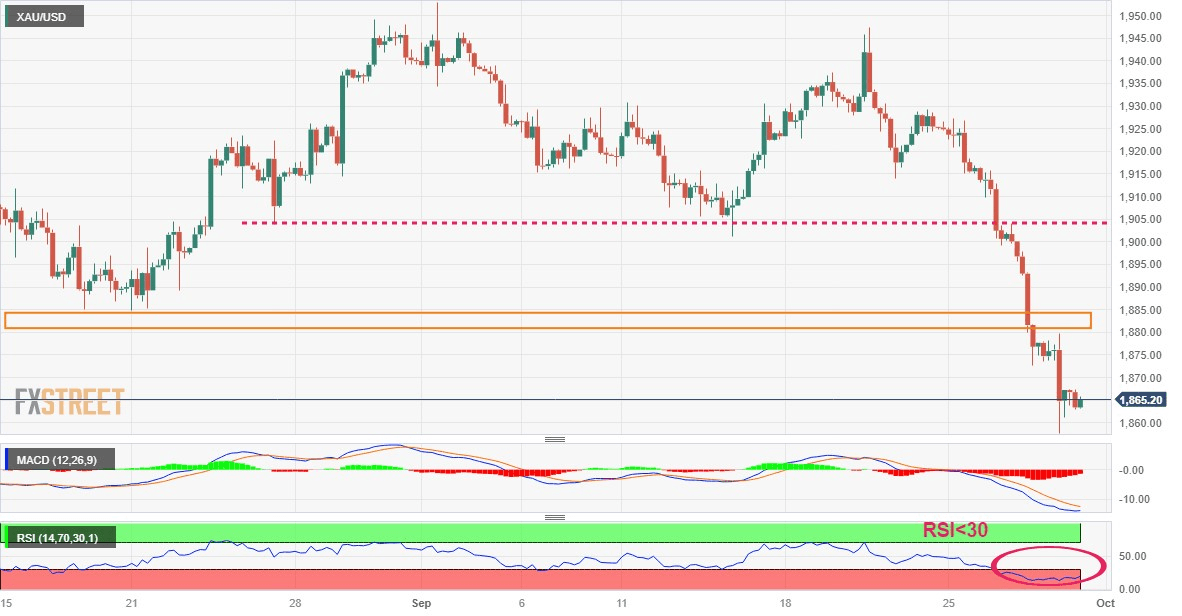

From a technical perspective, the Relative Strength Index (RSI) on the daily chart is flashing oversold conditions and makes it prudent to wait for some near-term consolidation or a modest bounce before positioning for any further losses. That said, the overnight swing high, around the $1,880 region, is likely to act as an immediate strong barrier. A sustained strength beyond could prompt a short-covering rally and allow the Gold price to reclaim the $1,900 round-figure mark.

On the flip side, the $1,858-$1,857 region, or a multi-month low touched on Thursday, now seems to protect the immediate downside. Some follow-through selling will be seen as a fresh trigger for bearish traders and make the Gold price vulnerable to accelerate the slide towards the next relevant support near the $1,820 zone. The downward trajectory could get extended further towards the $1,800 mark, which should act as a key pivotal point for short-term traders.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.