Gold Price Forecast: XAU/USD bears await US Q4 GDP for the next leg lower

- Gold price is consolidating the Fed-led sell-off to weekly lows just above $1,810.

- Fed’s take on balance sheet reduction, faster rate-hikes powered yields, DXY.

- Death cross and bearish RSI to likely keep any recovery short-lived.

Gold price snapped its recent uptrend to two-month highs of $1,854 and slumped to five-day lows of $1,815, incurring sharp losses on the much-awaited US Federal Reserve’s (Fed) January interest rate decision. The US central bank left the key policy settings unchanged but the statement suggested that the balance-sheet reduction will kick-off after the Fed has begun its rate-hike cycle. The outlook on the balance-sheet run-off indicated the Fed’s hawkishness, which triggered a sharp sell-off in the US Treasuries, driving the shorter and longer-dated yields through the roof while boosting the greenback. Further, Fed Chair Jerome Powell hinted that rate hikes could come sooner, as policymakers are ready to act to address the inflation risks. The hawkish pivot from the world’s most powerful central bank smashed the non-interest-bearing gold, as investors looked past the looming Russia-Ukraine concerns.

Gold price is licking its wounds near weekly lows of $1,813, as bears take a breather in the aftermath of the Fed decision while waiting for the US advance Q4 GDP and Durable goods data. The US economy is likely to have regained steam in Q4, 2021, as the growth is seen at the best level in 37 years, arriving at 5.4% YoY. The bearish tone around gold remains intact, as the two-year Treasury yields jump to 23-month highs while the ten-year rates hover near-weekly top on the Fed’s hawkish rhetoric. The slump in the Asian stocks combined with the yields-led US dollar strength exacerbates the pain in gold price. Meanwhile, easing geopolitical tensions around Ukraine, especially after the US said it had set out a diplomatic path to address sweeping Russian demands in eastern Europe, weigh negatively on the traditional safe-haven gold.

Going forward, a fresh batch of top-tier US economic releases will be closely followed for fresh trading opportunities in gold price. Additionally, Fedspeak and the Russia-Ukraine developments will also remain on traders’ radars.

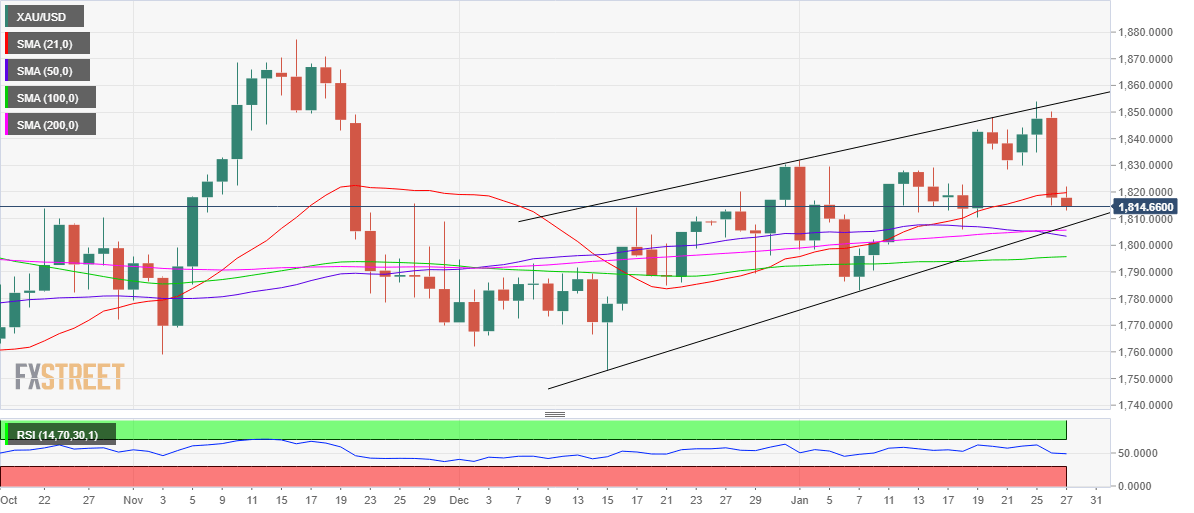

Gold Price Chart - Technical outlook

Gold: Daily chart

Gold price faced rejection at the upper boundary of a month-long rising wedge formation, then aligned at $1,853.

Rejection at that level prompted a sharp correction in gold price, knocking off the healthy support levels towards $1,810, which is the January 19 lows.

A sustained break below the latter is needed to test the critical support near $1,805, where the 200-Daily Moving Average (DMA) and the 50-DMA coincide, having confirmed a death cross earlier this week. That level also brings in the wedge support line.

The 14-Relative Strength Index (RSI) is pointing slightly lower, below the midline, allowing room for more declines.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.