Gold Price Forecast: XAU/USD awaits the Fed... and Trump

XAU/USD Current price: $3,687.07

- The Federal Reserve is expected to cut rates for the first time in 2025.

- US President Donald Trump is likely to add noise to the Fed’s decision.

- XAU/USD aims to extend its record rally, in pause ahead of Fed’s decision.

Gold prices stand near the recent record high at $3,703.20 a troy ounce, trimming early losses. The US Dollar (USD) found some modest demand throughout the first half of the day, but gave it up as the Federal Reserve’s (Fed) monetary policy decision looms. The central bank is widely anticipated to cut the benchmark interest rate by 25 basis points (bps) after a two-day meeting, delivering the first interest rate cut for this 2025.

The Fed is ready to drop the hawkish stance adopted earlier in the year, when United States (US) President Donald Trump announced his massive world-spread tariffs. Chair Jerome Powell and co. Noted the potential upward risks to inflation associated with trade levies, and decided to pause their loosening cycle ahead of more clarity.

President Trump has claimed multiple times that the Fed’s decision to keep rates at high levels damages the American economy, and came to the point of threatening to fire Powell, despite the fact that he can not do so. Calling Powell names and firing and suing other Fed officials have been part of Trump’s pressure strategy.

Anyway, the day comes when the Fed is widely anticipated to deliver, but the question is what. The Fed will hardly go for something different from what is actually priced in. The question is what officials would do from now on. The Summary of Economic Projections (SEP) or dot plot will paint a clearer picture of whether policymakers plan to cut rates two times this year, as previously reported, or if they will go for three, as the market believes.

If the SEP keeps showing two interest rate cuts in 2025 and one in 2026, that would be considered hawkish, while three this year and two the next one, will confirm what the market anticipates and lean to the dovish side.

Once the Fed makes its announcement, it would be interesting to see what President Trump has to say about it. Most likely, Trump will stick to his view that Powell is moving too slowly and too late.

XAU/USD short-term technical outlook

Ahead of the announcement, the daily chart for the XAU/USD pair shows that it trades around its opening level, still largely overbought. Technical indicators turned flat within extreme levels, but are far from signaling an upcoming slide. At the same time, the pair is far above all its moving averages, with a bullish 20 Simple Moving Average (SMA) heading firmly north at around $3,530 while further extending its advance above the 100 and 200 SMAs.

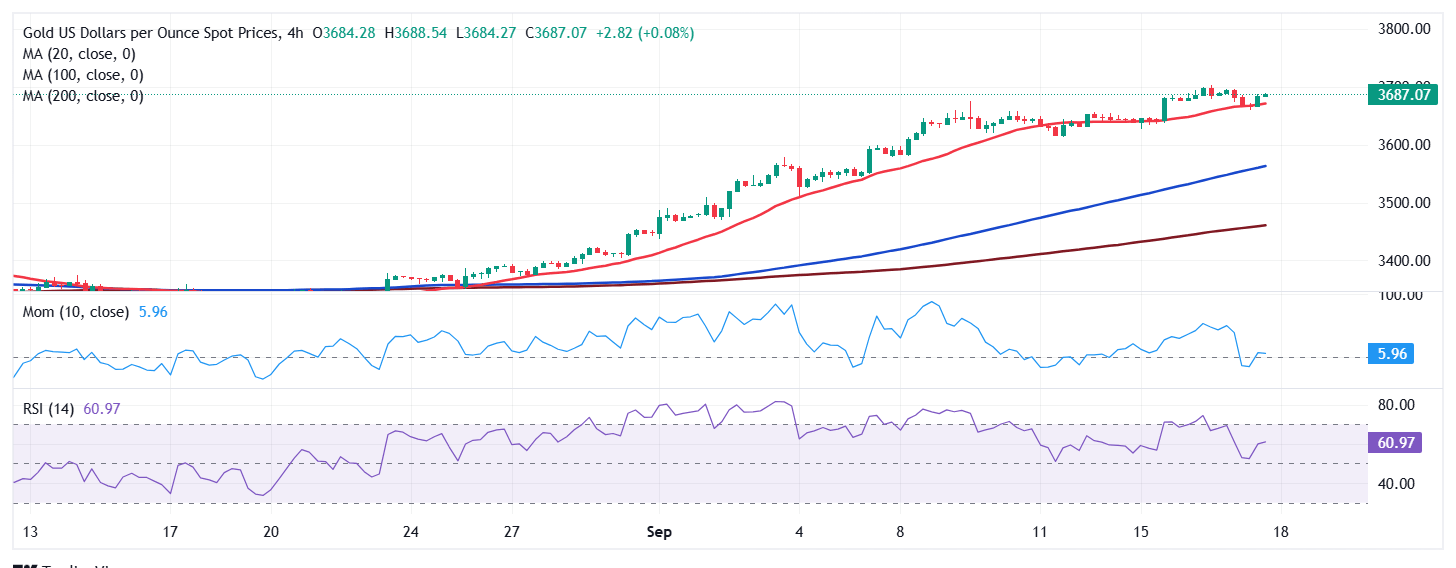

In the near term, and according to the 4-hour chart, the XAU/USD bounced after briefly piercing a mildly bullish 20 SMA, while technical indicators recovered their upward slopes after correcting overbought readings, in line with additional gains ahead. At the same time, the 100 and 200 SMAs accelerated north far below the shorter one, also supporting an upward continuation.

Support levels: 3,670.20 3,657.30 3,642.00

Resistance levels: 3,705.00 3,720.00 3,735.00

(This story was corrected on September 17 at 17:58 GMT to say that XAU/USD current price is $3,687.07, not $3,68.)

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.