Gold Price Forecast: XAU/USD at crossroads amid bearish RSI and potential Bull Cross

- Gold price preserves weekly recovery gains so far this Thursday.

- Hawkish Fed expectations check the recovery in the Gold price.

- Eyes remain on the Fedspeak amid US weekly Jobless Claims on the docket.

- Gold price could struggle amid mixed technical indicators on the daily chart.

Gold price is continues its effort toward the $1,900 mark for the fourth straight on Thursday, as the United States Dollar (USD) struggles to extend its recovery despite hawkish Federal Reserve rate hike expectations back in play.

Even though Fed Chair Jerome Powell’s recent speech was read as less hawkish, other policymakers continue to voice their support for further rate increases, given that the latest US Nonfarm Payrolls blowout allows the Fed more room on rate hikes in its pursuit of taming inflation. Federal Reserve Governor Christopher Waller warned on Wednesday that interest rates could go higher than expectations. New York Fed President John Williams also suggested the same, citing that “We still have some work to do to get interest rates in the right place.”

In absence of high-impact economic data from the United States, traders are focused on the speeches from the Fed officials for any hints on the central bank’s future rate hike path. Markets currently expect the Fed to deliver two 25 basis points (bps) rate increases in March and May meetings, according to CME Group’s FedWatch Tool. However, in the face of the recent hawkish commentary from the Fed policymakers, interest-rate options traders have started betting big this week on the Fed’s terminal rate touching 6% by September, Bloomberg reported Wednesday, citing preliminary open-interest data from CME Group (CME).

The market’s repricing of the Fed’s policy outlook is reflective of the recent rally in the US Treasury bond yields across the curve, which has been a factor limiting the recovery in the Gold price. With the US Dollar, however, struggling with its recovery, the Gold price could remain afloat. The sentiment on Wall Street will be closely followed in the day ahead, as the US stocks tanked on Wednesday, led by a sharp sell-off in Alphabet Inc. The American tech giant sank nearly 8.0% after its new AI chatbot Bard delivered an incorrect answer in an online advertisement. Expectations of higher US rates for longer also dampened the market mood on Wednesday.

Gold price technical analysis: Daily chart

Technically, the Gold price outlook remains more or less the same as Gold traders maintain the daily technical setup.

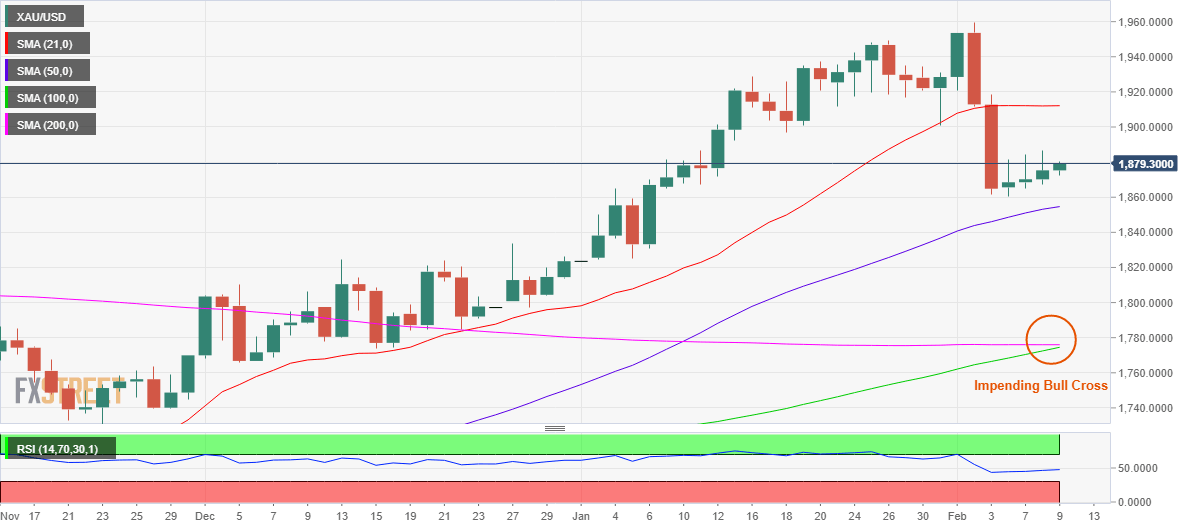

A potential bear flag is still in the making, following the last week’s downside break below the critical short-term ascending 21-Daily Moving Average (DMA), now at $1,912.

The 14-day Relative Strength Index (RSI) is extending its gradual recovery but continues to stay below the midline, suggesting that risks remain skewed in favor of sellers.

The ongoing higher lows formation combined with an impending bullish crossover, however, is still keeping Gold buyers in the game.

The 100DMA is on its way to cross the 200DMA for the upside, which if materialized will validate a bullish crossover.

The Gold price upturn could gather strength on acceptance above the strong resistance at around $1,885, above which the journey toward the $1,900 threshold will be a smooth one.

Further up, the 21DMA barrier will be a tough nut to crack for Gold bulls.

Alternatively, the four-week low of $1,860 will continue to cap the downside, below which the bullish 50DMA at $1,854 will offer further support to Gold bulls.

Daily closing below the latter will initiate a fresh downswing toward the January 5 low of $1,825.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.