Gold Price Forecast: XAU/USD at around $3,330 without directional strength

XAU/USD Current price: $3,332.20

- US President Trump urged Fed Chair Powell to trim interest rates.

- The US will release May PCE inflation figures on Friday.

- XAU/USD holds within familiar levels with a limited downward potential.

Spot Gold advanced throughout the first half of Thursday, meeting buyers in the $3,350 region. It quickly returned to its recent comfort zone around $3,320-30, where it stays in the American session, despite broad US Dollar (USD) weakness.

Market players paid no attention to the safe-haven metal, as the focus shifted to potential interest rate cuts in the United States (US). President Donald Trump criticised Federal Reserve (Fed) Chairman Jerome Powell and claimed he is already studying his replacement, despite Powell’s mandate ending in May 2026.

US President Trump has long urged Chair Powell to trim interest rates. "We have no inflation. We have a tremendous economy. Hundreds of billions of dollars of tariff money is pouring in. Factories are being built," he said in a press conference following the NATO Heads of State and Government Summit in the Netherlands. He then added he doubts about Powell’s mental abilities and called him names.

The USD plunged while stocks rallied amid speculation the Fed would end up trimming rates before previously anticipated.

Mixed US data did not help the Greenback. The country reported that Durable Goods Orders rose 16.4% in May, much better than the -6.6% posted in April. The Q1 Gross Domestic Product (GDP) was confirmed at -0.5% in the first quarter of the year, worse than the preliminary estimate of -0.2%.

Additionally, Initial Jobless Claims rose by 236K in the week ended June 21, beating expectations. Finally, the Goods Trade Balance posted a deficit of $96.6 billion in May, worse than the -$88.5 billion expected.

On Friday, the US will release the May Personal Consumption Expenditures (PCE) Price Index, foreseen stable on a monthly basis, albeit marginally higher on a yearly one.

XAU/USD short-term technical outlook

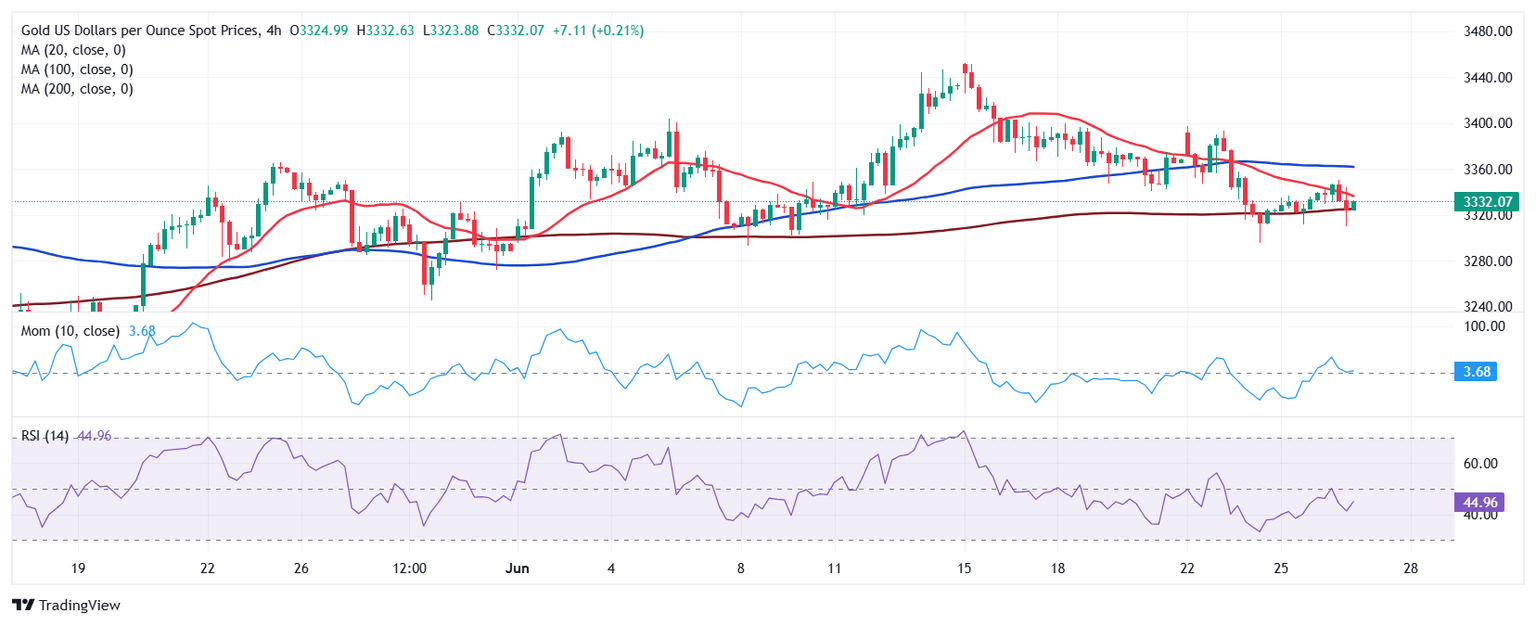

From a technical point of view, the risk skews to the downside for Gold, although the downward momentum remains limited. The daily chart shows that XAU/USD met sellers around a flat 20 Simple Moving Average (SMA) at $3,355.80, while holding well above bullish 100 and 200 SMAs. Technical indicators, in the meantime, seesaw around their midlines without clear directional strength.

In the near term, and according to the 4-hour chart, the XAU/USD pair remains below its 20 and 100 SMAs, but holds above a directionless 200 SMA, with slides below the latter being quickly reverted. Technical indicators turned higher, but with the Momentum indicator within neutral levels and the Relative Strength Index (RSI) indicator at around 45, falling short of anticipating another leg north.

Support levels: 3,311.90 3,295.45 3,279.2

Resistance levels: 3,355.80 3,374.45 3,389.40

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.