Gold Price Forecast: XAU/USD appears ‘buy-the-dips’ trade, seeks acceptance above $3,400

- Gold price hit two-week highs near $3,410 on US tariffs on one-kilo Gold bars, then retreats so far this Friday.

- The US Dollar eyes a weekly loss amid Fed, economic and trade concerns, focus shifts to US CPI data.

- Gold price could retest $3,350 confluence support if profit-taking intensifies heading into the weekend.

Gold price is seeing a sharp pullback after hitting fresh two-week highs near $3,410 early Friday. Traders digest the latest tariff headlines as the bright metal heads for a second straight weekly advance.

Gold price retreat appears temporary

The latest leg lower in Gold price is largely seen on the back of profit-taking as traders cash in on the spike in Gold futures to fresh record highs.

This follows a Financial Times (FT) report on Thursday, citing a letter from Customs Border Protection that stated the United States (US) has imposed tariffs on imports of one-kilo Gold bars.

Despite the corrective move lower, Gold price will continue to draw safe-haven flows as traders believe the tariffs on Gold bars are likely to cause a big disruption in trade from Switzerland and London. Note that Switzerland is the world's largest Gold refining hub.

On Thursday, US President Donald Trump's higher reciprocal tariffs on imports from dozens of countries took effect, with heavy levies on Switzerland, Brazil and India. Trump also threatened additional tariffs on China and Japan against their oil imports from Russia.

Concerns over the impact of tariffs on the already dwindling US economic momentum remain a drag on market sentiment and the US Dollar (USD), limiting any downside in Gold price.

Additionally, investors remain wary about the independence of the US Federal Reserve (Fed) even after Trump nominated Council of Economic Advisers Chairman Stephen Miran to replace Fed Governor Adriana Kugler. Miran is also seen replacing Jerome Powell when his term ends in May 2026.

Furthermore, markets are now expecting the Fed to cut interest rates by a total of 100 basis points (bps), starting later this year and finishing early next year, in the face of renewed economic and trade worries.

The discouraging sentiment around the Fed continues to undermine the performance of the US Dollar (USD) while keeping the ‘dip-buying’ interest around Gold price intact.

However, Gold price remains at risk of further correction due to the repositioning ahead of next week’s crucial US Consumer Price Index (CPI) inflation data.

Gold price technical analysis: Daily chart

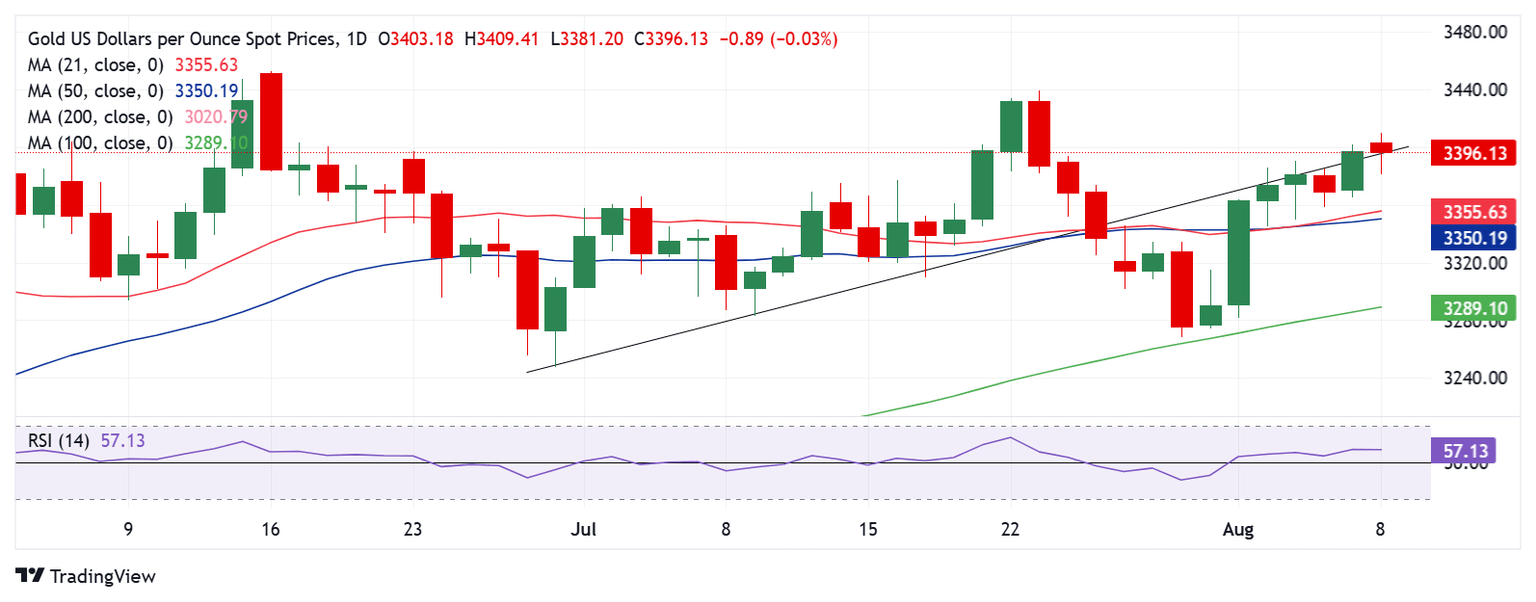

Gold time is battling the critical barrier at $3,395, although the bias remains positive amid a Bull Cross in play and a bullish daily Relative Strength Index (RSI).

The leading indicator holds comfortably above the midline, currently near 57, suggesting that the bullish potential remains intact in Gold price.

The 21-day closed above the 50-day SMA on Tuesday, confirming a Bull Cross.

Gold price needs a weekly closing above the rising trendline support-turned-resistance at $3,395 for a sustained uptrend toward the record highs of $3,500.

Ahead of that, the $3,440 static hurdle and the June 16 high of $3,453 will challenge bearish commitments.

To the downside, strong support is placed at the 21-day SMA and 50-day SMA confluence near $3,350. Acceptance below that level will unleash additional downside toward the $3,300 round figure. Deeper declines will challenge the 100-day SMA at $3,289.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.