Gold Price Forecast: XAU/USD aims for $4,300 and beyond

XAU/USD Current price: $4,285.70

- Financial markets remain risk-averse amid the extended US government shutdown.

- The US Senate is expected to vote again on Thursday on a funding bill.

- XAU/USD maintains its positive momentum despite extreme overbought conditions.

Speculative interest keeps hoarding Gold, with the bright metal nearing the $4,300 mark on Thursday. The XAU/USD pair reached $4,291.89 in the American afternoon, maintaining the upward pressure and aiming to test the next psychological threshold. Spot Gold ran throughout the day, accelerating north amid the poor performance on Wall Street.

The broad US Dollar (USD) weakness adds to the bullish case of Gold, with the Greenback suffering from the continued United States (US) government shutdown. The lack of funding triggered a tug of war between Democrats and Republicans, who are still unable to agree on some form of funding.

Meanwhile, a federal judge has temporarily blocked the administration from firing workers during the shutdown. US President Donald Trump has threatened massive layoffs should the shutdown continue. The US Senate is expected to vote once again on Thursday to end the ongoing crisis.

XAU/USD short-term technical outlook

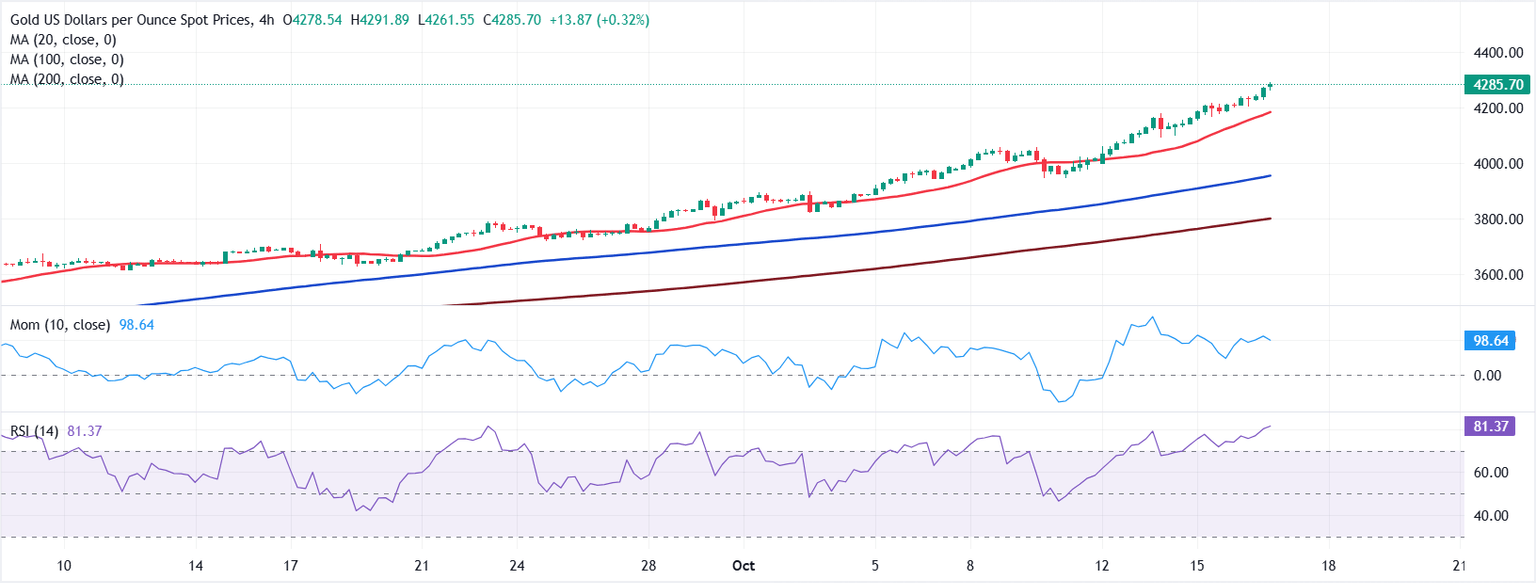

The XAU/USD pair is up for the fifth consecutive day, and maintains the strong upward momentum in the daily chart, despite extreme overbought conditions. The Momentum indicator aims firmly higher at around 113, while the Relative Strength Index (RSI) offers the same behaviour, standing at 86. At the same time, the pair is far above all bullish moving averages, with the closest being the 20 Simple Moving Average (SMA) at around $3,923.

The 4-hour chart for the XAU/USD pair shows that the Momentum indicator heads north almost vertically, reflecting substantial buying interest. The indicator, however, is yet to reach its October monthly high, which means there’s plenty of room to go. At the same time, the RSI indicator consolidates at around 79, overbought but no signs of giving up just yet. Finally, a firmly bullish 20 SMA accelerates above also bullish 100 and 200 SMAs, while below the current level, also reflecting buyers’ strength.

Support levels: 4,271.90 4,255.60 4,243.10

Resistance levels: 4,300.00 4,320.00 4,335.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.