Gold Price Forecast: Upward pressure intact despite signs of near-term exhaustion

XAUUSD Current Price: $1,979.70

- UK inflation and US wholesale prices soared in March, surpassing the market’s estimates.

- The greenback is under selling pressure amid a sharp retracement in government bond yields.

- XAUUSD has room to advance towards $2,000, although a corrective decline seems possible.

Spot gold maintains its bullish bias, trading near a fresh multi-week high of $1,981.57 a troy ounce. A generalized risk-averse mood alongside the dollar’s weakness during the American session maintained the metal bid throughout the day.

Concerns remain the same, with the focus on the Russian invasion of Ukraine and the persistent pressure on inflation forcing central banks to take aggressive monetary policy decisions. On Wednesday, the UK published the March Consumer Price Index, which jumped to a three-decade high of 7%, while the US reported that the March Producer Price Index jumped to 11.2% YoY, both above anticipated.

Meanwhile, European indexes traded in a dull fashion, but US indexes shrugged off discouraging figures and are on the rise. Government bond yields, on the contrary, are sharply down, weighing on the American currency. The yield on the 10-year Treasury note currently hovers around 2.66%, well below the weekly high at 2.83%.

XAUUSD Technical Outlook

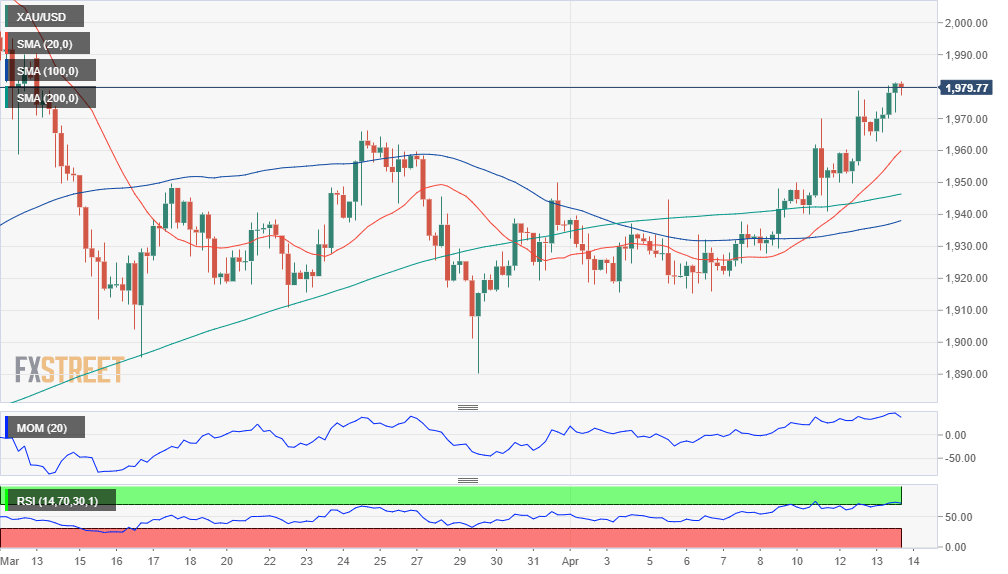

The technical picture for XAUUSD continues to favor the upside. The daily chart shows that the price continues to trade above all of its moving averages, with the 20 SMA slowly grinding higher above the longer ones. The Momentum indicator remains directionless within positive levels, while the RSI heads north at around 62.

In the 4-hour chart, technical indicators are showing tepid signs of upward exhaustion after the metal advanced for six consecutive days. The Momentum turned south but remains above its midline, while the RSI keeps consolidating in overbought territory. Nevertheless, XAUUSD holds above its moving averages, which advance at an uneven pace, suggesting absent selling interest at the time being.

Support levels: 1,971.80 1,961.00 1,948.90

Resistance levels: 1,982.00 1,994.50 1,203.10

View Live Chart for the XAU/USD

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.