Gold Price Forecast: Sellers keep defending the $1,680 price zone

XAUUSD Current price: $1,672.02

- Central banks put inflation before growth, but policymakers' concerns are evident.

- US government bond yields soared to fresh multi-year highs, underpinning the dollar.

- XAUUSD trades within familiar levels, but the risk is skewed to the downside.

Spot gold trades around its daily opening, just above $1,670 a troy ounce. The bright metal consolidated within Wednesday’s $30 range as multiple central banks’ monetary policy decisions maintained traders busy since the day started. For the most, global policymakers are worried about bringing inflation down but seem more concerned about economic growth, regardless of refraining from commenting on potential recessions.

As investors finish digesting the latest batch of announcements, financial markets are clearly indicating risk aversion. Asian and European stock indexes closed in the red, while Wall Street navigates negative territory, with the three major indexes pressuring their weekly lows.

Meanwhile, Russia’s decision to escalate its attacks on Ukraine exacerbated the dismal mood. Moscow decided to mobilize troops on Wednesday, while President Vladimir Putin brought the possibility of a nuclear war to the table.

Higher government bond yields have prevented the dollar from falling after the US Federal Reserve delivered but failed to impress. The 10-year Treasury note currently yields 3.69%, while the 2-year note yield reached a multi-year peak of 4.16%, now hovering at around 4.13%.

Gold price short-term technical outlook

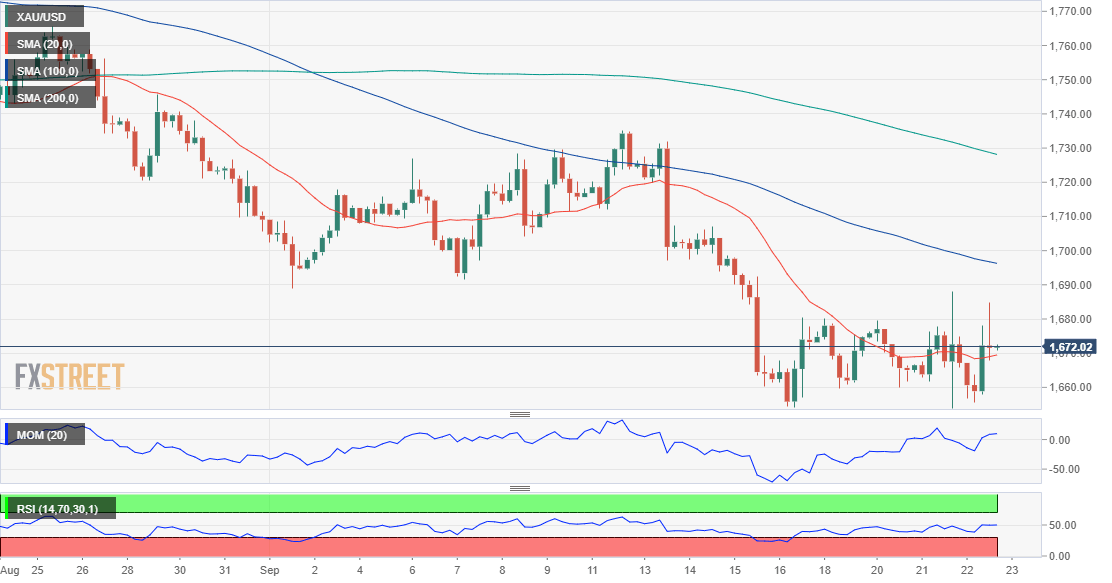

Technically, the daily chart shows that XAUUSD is at risk of falling. Technical indicators remain within negative levels, the Momentum slowly grinding lower and the RSI consolidating at around 36. The 20 SMA accelerated its slide below the longer ones, all of them above the current level and reflecting prevalent selling interest.

The near-term picture is neutral. Technical indicators in the 4-hour chart stand directionless around their midlines. The 20 SMA is flat below the current level, but the longer ones keep marching downwards, far above the current price. Selling interest is aligned around the $1,680 price zone, with limited chances of a bullish breakout. On the other hand, XAUUSD bottomed twice at around $1,654, and a clear break below it should lead to a steeper decline.

Support levels: 1,654.00 1,643.90 1,631.75

Resistance levels: 1,680.30 1,692.35 1,707.10

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.