Gold Price Forecast: Sell the bounce above $1,700 in play, with eyes on ECB, Powell

- Gold price turns cautious ahead of the ECB verdict, Powell’s speech.

- US dollar finds support from 75bps Fed rate hike bets, despite weaker yields.

- Risks remain skewed to the downside for XAU/USD amid bearish technicals.

Having found support near $1,690 again, Gold price staged a solid comeback on Wednesday, as markets witnessed a positive shift in the risk sentiment and the US Treasury yields retreated. The return of risk flows triggered a sharp correction in the US dollar index from a new two-decade high of 110.78, which helped the bright metal recover almost $30 from the day’s low of $1,691. Investors are resorting to profit-taking on the dollar longs ahead of Thursday’s ECB rate hike decision and Fed Chair Jerome Powell’s speech, which could significantly impact risk sentiment and the dollar valuations. With a 76% chance of a 75 bps Fed rate hike this month, investors remain hopeful that an outsized rate increase could help bring inflation down, boding well for global stocks.

Also read: ECB Preview: Will tough times call for tough measures?

In Thursday’s trading, XAU/USD is consolidating the previous recovery, as investors refrain from placing fresh bets ahead of the ECB rate hike decision. Increased expectations of a 75 bps rate hike are keeping a check on the non-interest-bearing metal. Meanwhile, traders also look forward to Powell’s speech for fresh hints on the size of the rate increment due later this month. Strong US ISM Services PMI combined with optimistic Fed’s Beige Book and hawkish Fed commentary lends support to the dollar, allowing investors to sell the bounce in the bullion.

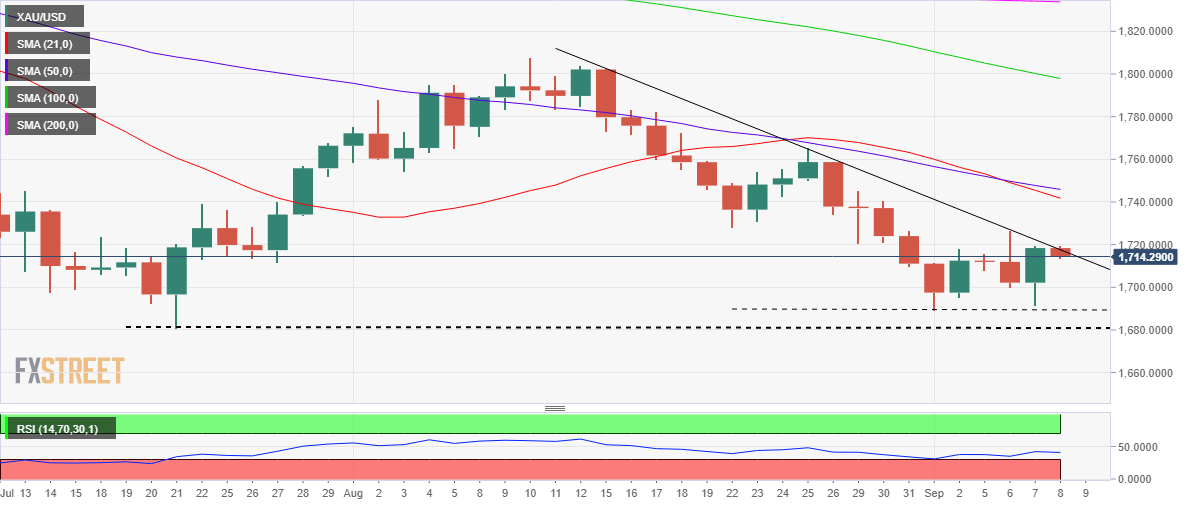

Gold price technical outlook: Daily chart

Gold price is challenging the critical daily trendline resistance at $1,718, which has capped the recovery for now.

Daily closing above the latter is needed to confirm a bearish reversal in the near term. The next upside hurdle is seen at around $1,720 the round figure.

Further up, the August 31 high of $1,727 will come into play.

With the bear cross and 14-day Relative Strength Index (RSI) pointing south below the midline, the downside appears more compelling.

A sustained move below the $1,700 mark is critical to unleashing the additional downside. On a breach of the strong support of around $1,690, sellers will again target the 2022 low of $1,681.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.