Gold Price Forecast: Risks remain skewed to the downside for XAU/USD as key support caves in

- Gold price bounces again but receding Omicron covid fears to cap upside.

- The US dollar drops with yields ahead of Fed Chair Powell’s testimony.

- Daily technical setup remains in favor of gold bears, as November lows beckon.

Gold price fell for the second straight day on Monday, starting out a fresh week on the wrong footing while extending the previous week’s broad decline. After reattempting the $1800 mark in the first half of the day, gold price came under fresh selling pressure and fell back to test the key $1,780 support area. The bright metal’s price action was mainly driven by the recovery in the US dollar, as investors assessed the potential impact of the new Omicron on the global economic recovery. The improvement in the risk sentiment amid downplaying of the covid concerns by global leaders and scientists added to the weight on gold price. US President Joe Biden, during his press conference on the Omicron response, said that new lockdowns are not on the table. The Wall Street indices rebounded alongside risk, as gold prices ended 0.22% lower at $1,784 on Monday, with the losses capped by the persistent weakness in the Treasury yields across the curve.

Gold price is rebounding in the Asian trading so far this Tuesday, helped by renewed downside in the safe-haven dollar, courtesy of the upbeat market mood. The unexpected expansion in China’s manufacturing sector activity combined with receding fears over the Omicron covid variant underpins the risk sentiment. Falling Treasury yields also lift the demand for the non-yielding gold, as investors digest Fed Chair Jerome Powell’s prepared remarks from his testimony on CARES Act due later on Tuesday. Powell said the Omicron variant poses a downside risk to the economy and complicates the inflation picture.

On the macro data front, the US CB Consumer Confidence data will draw some attention, in the face of covid resurgence ahead of the payrolls and next month’s Fed meeting.

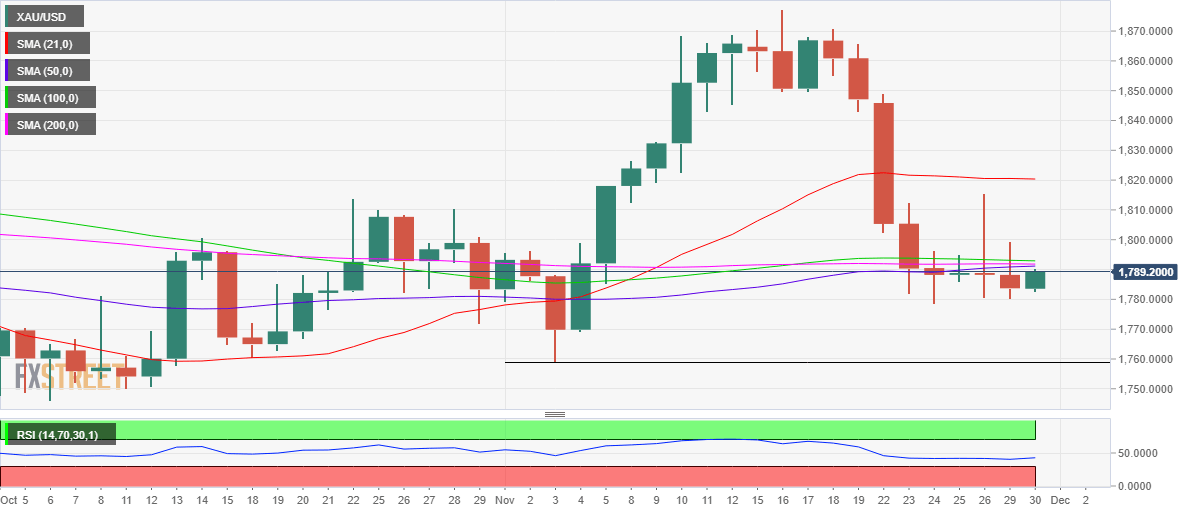

Gold Price Chart - Technical outlook

Gold: Daily chart

On the daily chart, gold price closed Monday below a bunch of critical support levels around $1,792, strengthening the bearish case.

That level is the confluence of the 50-, 100- and 200-Daily Moving Averages (DMA).

The Relative Strength Index (RSI) is hovering listlessly below the 50 level, keeping the sellers hopeful.

A sustained break below the previous week’s lower range near $1,780 will open up the additional downside towards the November 3 low of $1,759.

Further south, the $1,750 psychological level will be challenged.

On the flip side, the bulls will need to find a strong foothold once again above the aforesaid crucial support now resistance for an extended recovery.

The next significant hurdle is envisioned at the $1,800 threshold.

If the buying pressure accelerates, then gold bulls will reach out to test the horizontal 21-DMA at $1,820

Ahead of that, Friday’s high at $1,816 will be the level to beat for bulls.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.