Gold Price Forecast: Rally to extend amid dollar’s weakness, bullish technical set up

- Gold bulls remain in control amid dollar weakness.

- US stimulus talks and coronavirus risks underpin.

- Bull pennant on hourly chart points to more gains.

Monday’s risk-on rally in the US equities, in the wake of the optimism over the coronavirus vaccine and a breakthrough at the European Union (EU) Summit, downed the US dollar and benefited gold (XAU/USD). The bright metal hit the highest level since September 2011 at $1820.61. Further, talks about the further US stimulus to cushion the economic blow from the pandemic also boosted the sentiment around the non-yielding gold. The congressional Republicans said on Monday that they were working on a USD1 trillion relief bill.

Gold prices are set to refresh multi-year highs in the day ahead, as the upbeat market mood will continue to pressure the greenback. Also, growing concerns over the economic risks from the continued rise in the infections globally will also likely bode well for gold. Meanwhile, the risk sentiment will remain the main market driver amid a lack of relevant economic news from the US docket.

Short-term technical outlook

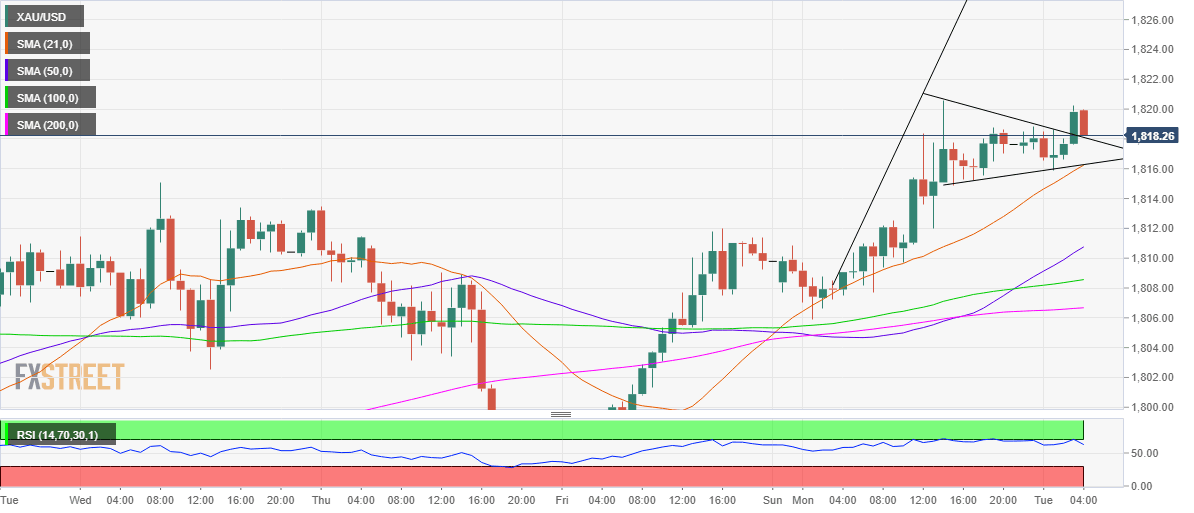

Gold: One-hour chart

The break higher prompted the bulls to test the nine-year highs of $1820.61. Acceptance above the latter will trigger a fresh rally towards the pattern target at the $1827/30 zone.

The path of least resistance appears to the upside amid a lack of any healthy resistances. The hourly Relative Strength Index (RSI) has turned south from the overbought territory but remains well above the midline, indicating room for additional upside.

The price trades above all major hourly Simple Moving Averages (SMA), adding credence to the ongoing bullish bias.

The immediate downside is likely to be capped by the aforesaid resistance now turned support at $1818.28.

The powerful support awaits at $1816.28, which the confluence of the bullish 21-HMA and rising trendline (pattern) support. The bulls will continue to guard that level in the near-term.

A break below that level will trigger a fresh drop towards the upward sloping 50-HMA support at $1810.76.

Gold: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.