Gold Price Forecast: Hovering around $1,820 in a quiet start to the week

XAU/USD Current price: $1,819.83

- A holiday in the US maintains the asset's trading within familiar levels.

- The macroeconomic calendar has nothing relevant to offer this week.

- XAU/USD is neutral in the near term, with the risk skewed to the upside in the wider perspective.

Spot gold seesaws around Friday’s close, with trading limited amid US markets closure due to Martin Luther King day. The dollar managed to advance modestly during the European session, resulting in the metal trimming early gains.

Generally speaking, the week will be a quiet one, as the macroeconomic calendar has nothing relevant to offer. Nevertheless, market participants will be keeping their eyes on government bond yields, which lately reflect inflation-related fears.

Gold price short-term technical outlook

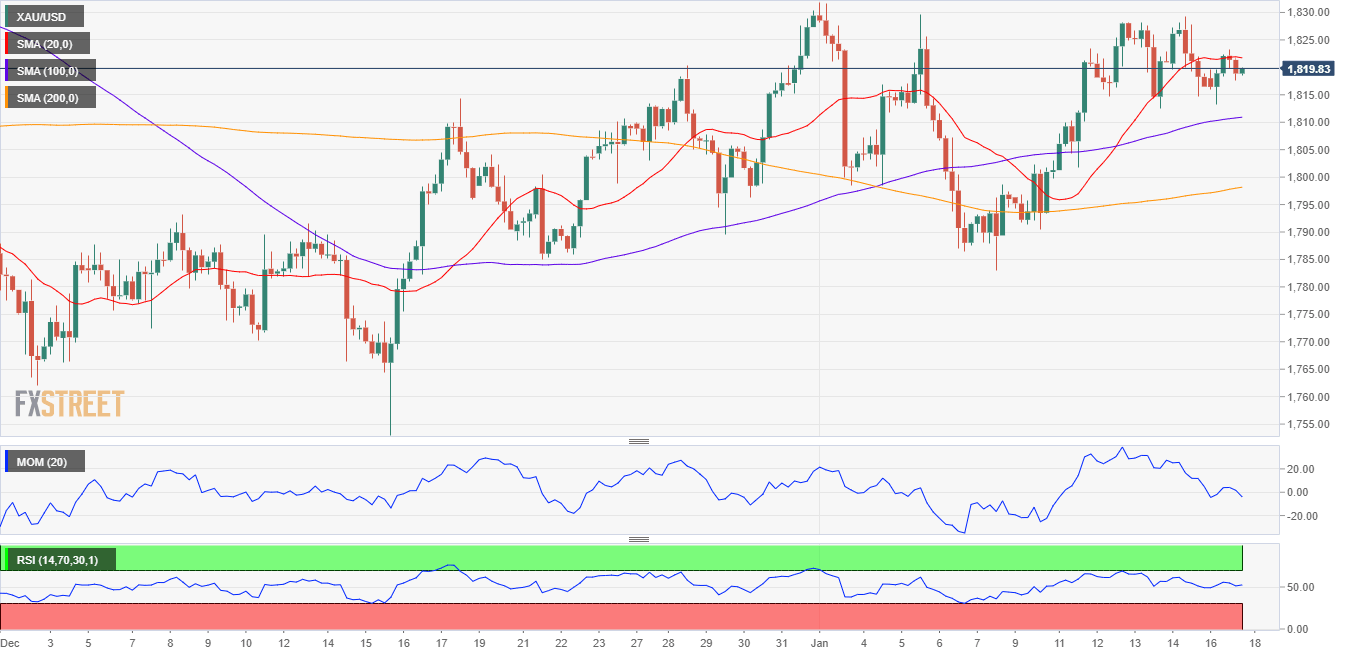

Gold trades at around $1,819 a troy ounce, neutral-to-bullish according to the daily chart. The bright metal holds above all of its moving averages, with the 20 SMA grinding higher above the longer ones. Technical indicators, in the meantime, remain within positive levels, although lacking directional strength.

The near term picture for the XAU/USD pair is plain neutral, as a flat 20 SMA provides intraday resistance, while technical indicators hover directionless around their midlines. Bulls may have better chances if the metal breaks above 1,829.60, a relevant resistance level.

Support levels: 1.812.30 1,805.00 1,797.70

Resistance levels: 1,829.60 1,842.85 1,851.30

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.