Gold Price Forecast: Further losses could extend to $3,120

- Gold prices rebounded after hitting new monthly lows near $3,240.

- The US Dollar remained on the back foot on rate cut bets and trade optimism.

- Investors see the next rate cut by the Fed most likely in September.

Spot gold regained some composure at the beginning of the week, bouncing off monthly troughs near the $3,240 zone almost exclusively on the back of the intense sell-off in the US Dollar (USD).

In the meantime, the precious metal managed to set aside two daily pullbacks in a row, although the multi-week downtrend sparked soon after the June tops around $3,450 (June 16) remained well in place.

The recent loss of momentum in the yellow metal was influenced by reduced geopolitical concerns in the Middle East, especially after the Trump-brokered ceasefire between Israel and Iran, which ended more than 10 days of air battles.

Also weighing on the non-yielding metal, hopes of extra improvement on the trade front remained front and centre, especially following the recently clinched deals between the US and China involving rare earths.

Still around trade, the July 9 deadline looms closer, and further last-minute agreements should not be ruled out.

Moving forward, all the attention shifts to the upcoming US Nonfarm Payrolls due at the end of the week, although the ECB Forum on Central Banking in Sintra (Portugal) could also add bouts of volatility, as officials from top central banks will speak throughout the week.

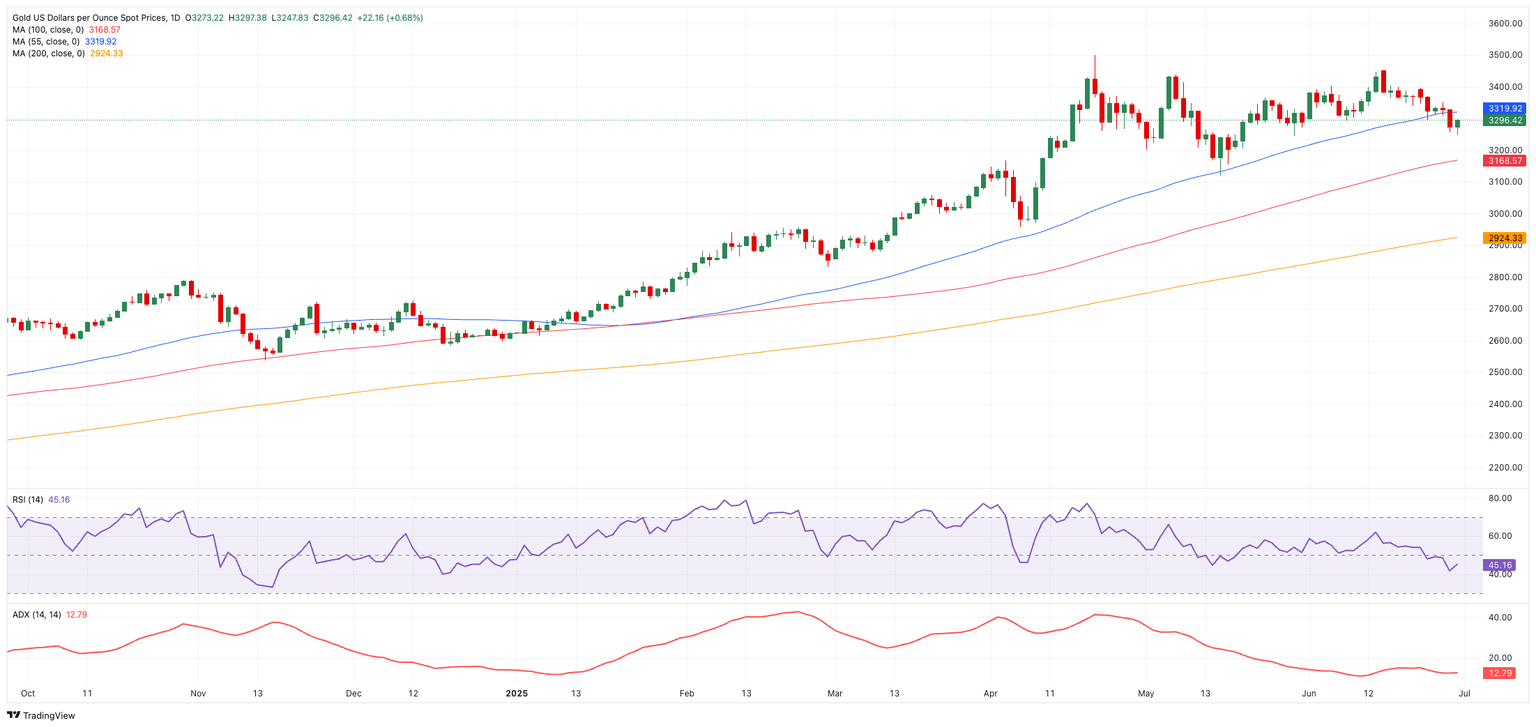

Gold’s short-term technical outlook

The loss of the June trough at $3,244 (June 30) could put a test of the interim 100-day SMA at $3,168 back on the radar. This are is also reinforced by the 78.6% Fibo retracement of the 2024-2025 rally. Down from here emerges the May base at $3,120 (May 15).

A renewed bullish bias could push Gold toward a retest of its June high at $3,451 (June 16), just ahead of the all-time peak at $3,500 (April 22).

Momentum indicators still lean bearish. The Relative Strength Index (RSI) has dropped to 45, while an Average Directional Index (ADX) around 12 confirms a weakening trend.

To sum up

The precious metal is expected to remain under scrutiny as long as the trade front continues to show signs of improvement, although rising bets over more rate cuts by the Federal Reserve than originally envisaged could potentially mitigate further losses. In addition, the fragile geopolitical situation in the Middle East should remain a potential source for strength for Gold prices. So far, in case the downtrend gathers extra steam, a potential slide toward the May base at $3,120 could return to the traders' radar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.