Gold Price Forecast: Cautious optimism underpins the metal

XAU/USD Current price: $1,791.38

- Global stock indexes are up, while government bond yields tick higher.

- The US ISM Manufacturing PMI contracted to 60.8 in October, beating the 60.6 expected.

- XAU/USD is technically neutral, needs to break its October high at 1,813.80.

Gold is in recovery mode this Monday, trading in the $1,791 price zone after bottoming on Friday at 1,771.88. Market participants are cautiously optimistic ahead of multiple central banks’ announcements, with the US Federal Reserve and the Bank of England are expected to announce tightening changes to their monetary policies before the year-end. The Reserve Bank of Australia is meeting on Tuesday and will likely introduce changes to its forward guidance.

Meanwhile, global stocks indexes are up, while government bond yields ticked higher, although holding within familiar levels, amid thinned market conditions due to a holiday in most European countries. At the same time, the better market mood was backed by upbeat US data, as the ISM Manufacturing PMI contracted to 60.8 in October, better than the 60.6 expected. However, the Markit manufacturing PMI for the same period was downwardly revised from 59.2 to 58.4.

Gold price short-term technical outlook

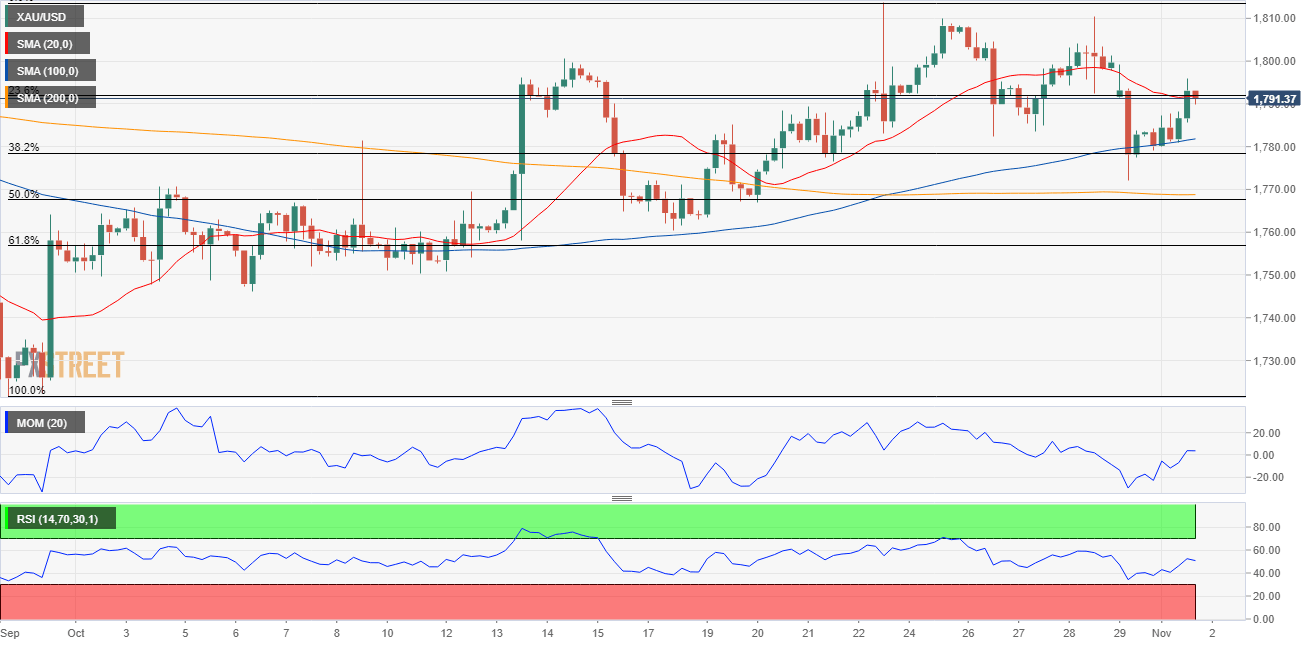

The XAU/USD pair is trading at around the 23.6% retracement of its latest daily advance, technically neutral. The daily chart shows that it met buyers around the 38.2% retracement of the same advance and a mildly bullish 20 SMA, both converging around 1,778.60. Gold price is stuck around mildly bearish 100 and 200 SMAs, while technical indicators head nowhere within positive levels.

The 4-hour chart shows that the bright metal is just below a flat 20 SMA while technical indicators lack directional strength just below their midlines, hinting at limited buying interest. The bright metal topped at 1,813.80 in October, the level to overcome to turn bullish.

Support levels: 1,778.60 1,767.40 1.756.60

Resistance levels: 1,800.60 1,813.80 1,823.15

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.