Gold Price Forecast: Bulls poised to challenge six-month highs

XAU/USD Current price: $1,859.43

- Chinese news continue to lead the market’s sentiment, spurring optimism on Wednesday.

- Easing government bond yields worldwide undermined demand for the US Dollar.

- XAU/USD recovered its firmly bullish stance and could storm through $1,878.91, the June high.

Spot gold resumed its advance and traded as high as $1,865.12 a troy ounce, a level that was last seen early in June 2022. The US Dollar came under selling pressure during Asian trading hours, giving up all of Tuesday’s gains and even falling to fresh weekly lows, mainly against commodity-linked currencies.

Market players are still looking at China for direction. Optimism about a potential economic comeback, despite the fact it would not be easy or fast, fueled demand for high-yielding assets. The initial catalyst came from market talks suggesting the world’s second-largest economy will resume importing coal from Australia after banning the import of multiple goods from the country in the early stages of the coronavirus pandemic.

Global government bond yields are on the back foot, with the US Treasury yield down roughly 10 bps. Financial markets entered wait-and-see mode ahead of the upcoming FOMC Meeting Minutes. The United States Federal Reserve (Fed) will provide clearer clues on why policymakers decided to upwardly revise their inflation forecasts, alongside what they plan next on monetary policies.

XAU/USD price short-term technical outlook

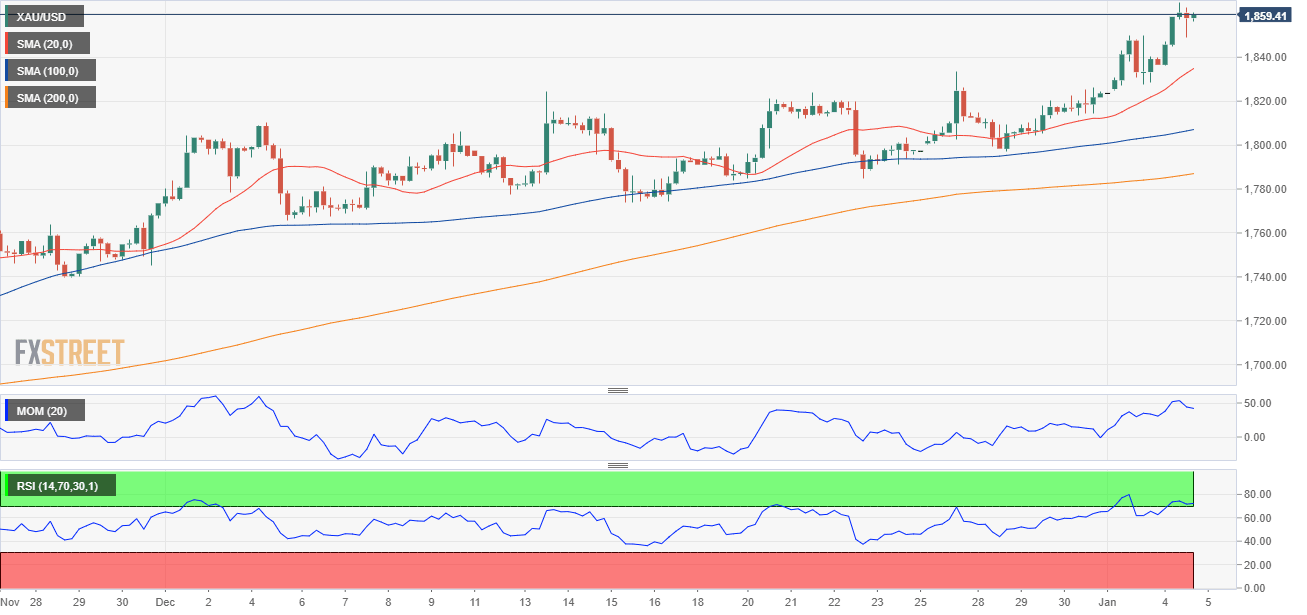

The daily chart for XAU/USD shows that it is up for a fourth consecutive day, with a firmly bullish stance. The pair is developing well above its moving averages, with the 20 Simple Moving Average (SMA) accelerating north above the longer ones. At the same time, the Momentum indicator hovers directionless above its midline, while the Relative Strength Index (RSI) heads firmly north at around 67, in line with another leg higher.

In the near term, and according to the 4-hour chart, gold is overbought but without giving signs of upward exhaustion. XAU/USD trades far above bullish moving averages, while technical indicators ticked higher but overall consolidate at extreme levels. The bright metal would need to overcome $1,865.15 to gain traction enough to test the $1,900 threshold.

Support levels: 1,819.30 1,806.70 1,793.10

Resistance levels: 1,865.15 1,878.90 1,890.50

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.