Gold Price Forecast: Bulls maintain the pressure above $1,850

XAUUSD Current price: $1,865.83

- Market players doubt how aggressive the US Federal Reserve would be.

- S&P Global PMIs showed that business activity in the US and Europe slowed in May.

- XAUUSD is pressuring its weekly high and has scope to advance towards $1,900.

Financial markets were in risk-off mode on Tuesday as lingering growth and inflation concerns came back under the spotlight. Global stocks traded with a soft tone, favoring the safe-haven gold that reached a fresh two-week high of $1,869.71 a troy ounce. The bright metal holds nearby as the American session undergoes, with Wall Street trimming most of its Monday’s gains.

Despite lingering inflation, market participants doubt how tight the US Federal Reserve monetary policy could be. Speculative interest is now considering two potential 50 bps hikes and then a less aggressive stance. President of the Federal Reserve Bank of Atlanta Raphael Bostic said rate hikes wouldn’t cause a recession and that the central bank can hike rates to deal with overly high inflation without sending the US economy into recession. Furthermore, he said that the Fed might need to pause rate increases in September and see how the economy performs then.

Meanwhile, growth-related data has been disappointing. According to S&P Global PMIs, business activity in the US and Europe slowed in May when compared to the previous month.

Gold Price short-term technical outlook

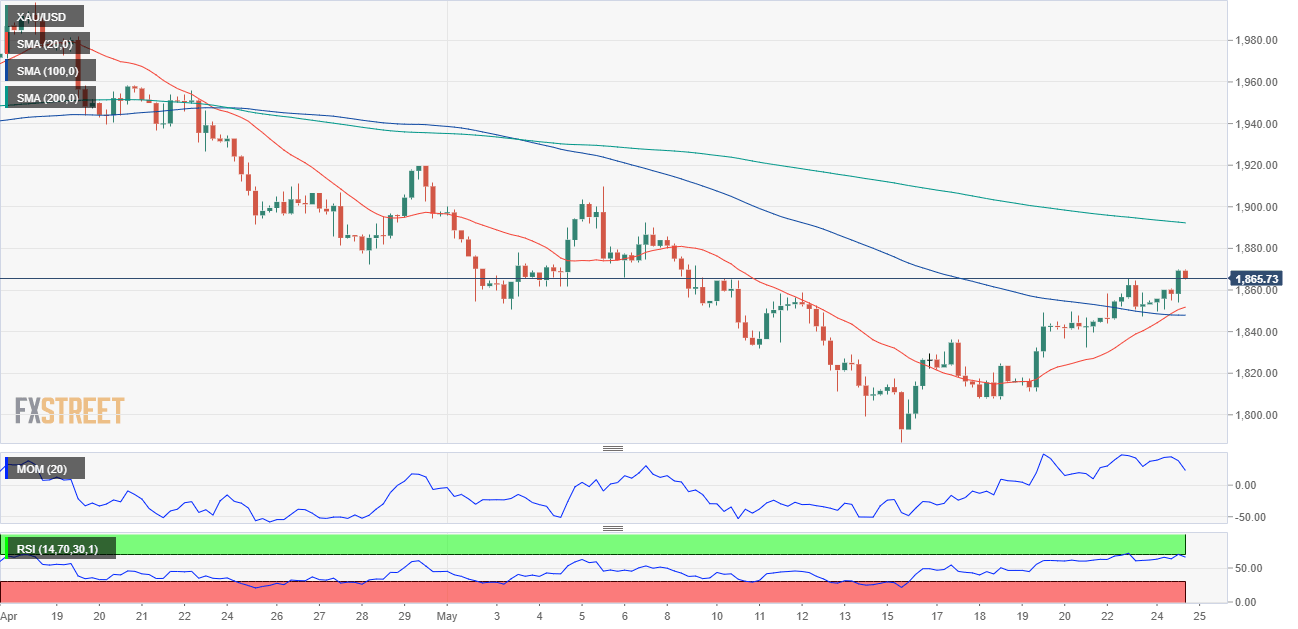

Gold Price is up for the fifth consecutive day, although it is developing below the weekly high posted earlier on Tuesday at $1,869.75 a troy ounce. XAUUSD's daily chart offers a neutral stance, as technical indicators remain around their midlines, lacking clear directional strength. A bearish 20 SMA provides intraday support at around $1,854.20, although a more relevant static support level comes at $1,849.20.

The 4-hour chart shows that the risk is skewed to the upside. The pair is developing above its 20 and 100 SMAs, with the shorter one crossing above the longer one, as technical indicators consolidate within positive levels, also without directional strength. Still, a break above the mentioned weekly high should open the door for an approach to the $1,900 threshold.

Support levels: 1,854.50 1,849.20 1,836.00

Resistance levels: 1,869.70 1,878.65 1,887.90

View Live Chart for the XAU/USD

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.