Gold Price Forecast: Bear cross to challenge XAU/USD bulls ahead of US inflation

- Gold price holds above 50 DMA hurdle after running into the $1,800 resistance.

- Investors brace for key US inflation data for next Fed action on rate hikes.

- XAU/USD eyes a softer US CPI print for a big break above the $1,800 mark.

Gold price tested the $1,800 mark for the first time in over a month on Tuesday, having shrugged off resurgent demand for the US dollar even as the Treasury yields jumped across the curve. Growing concerns over global economic slowdown and China-Taiwan geopolitical tensions helped XAU buyers to extend the previous upside. Further, expectations that easing inflationary pressures in the US economy would dissuade the Fed from delivering super-sized rate hikes lifted the sentiment around the non-interest-bearing gold. The annualized US Consumer Price Index (CPI) is seen softening to 8.7% in July from 9.1% in June. The core figures, however, may have quickened over the year.

Also read: US July CPI Preview: What is the base effect and why it matters

Heading into the US inflation event risk, markets are pricing a 67.5% chance of a 75 bps Fed lift-off in September, slightly up from 65% seen a day before. Meanwhile, the two-year Treasury rate has surpassed the 10-year by nearly 50 basis points, indicating that the inversion is around the deepest since 2000 and that a recession is inevitable. Amid looming recession risks and aggressive Fed tightening expectations, the US inflation data release is expected to have a significant market reaction, especially as the American labor market remains extremely tight. The US CPI will help determine the size of the Fed’s next rate hike, which could have a tremendous impact on risk sentiment, dollar valuations and the gold price direction.

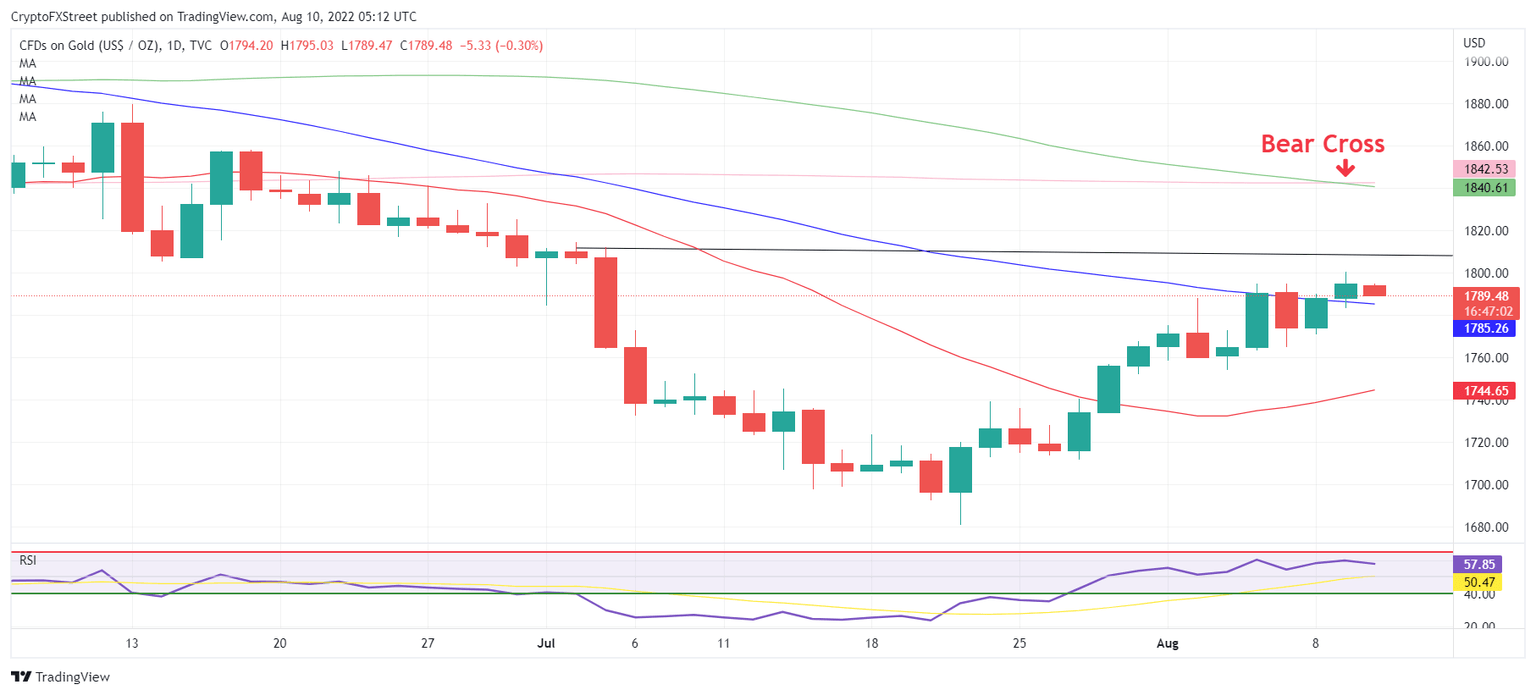

Gold price technical outlook: Daily chart

Technically, gold price hovers below $1,800 but well above the bearish 50-Daily Moving Average (DMA), now at $1,785.

A failure to sustain above the latter will revive bearish interest, triggering a drop towards Monday’s low of $1,771, below which the $1,765 demand area will come into play.

The August 3 high of $1,754 and the $1,750 psychological level could be tested if the US CPI surprises on the upside and jacks up big Fed rate hike bets.

With the 100 DMA having crossed 200 DMA for the downside, a bear cross is confirmed, which keeps sellers hopeful.

The 14-day Relative Strength Index (RSI) has turned south, although remains firmer above the midline. Therefore, the metal could defy the bearish odds if the inflation shows signs of peaking.

Gold bulls need acceptance above the $1,800 mark to continue with their recovery momentum. Bulls will then guard the July 5 high at $1,812 should the rebound gain traction.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.