Gold price forecast: Above $4,100 on Fed cut bets

- Gold rebounds above $4,100 as markets price in a December Fed rate cut despite the dollar remaining relatively firm.

- Macro Crossroad: XAUUSD is being driven by a broader battle between a dovish Fed path, tightening global liquidity, and ongoing geopolitical uncertainty.

- Technical Outlook: Gold is pressing into $4,140–$4,160 supply with continuation targets at $4,245 and $4,380, unless sellers trigger a mid-range breakdown.

Gold back on the offensive above $4,100

Gold has regained momentum, climbing back above $4,100 after a volatile stretch dominated by data delays, a resilient US dollar, and shifting expectations for the next Fed decision. The rebound is significant — traders are now pricing in a strong probability that the Federal Reserve will deliver a December rate cut, supported by cooling labor data and increasingly dovish commentary from policymakers.

Despite yields still elevated and the dollar not fully unwinding, gold continues to hold its long-term structure, defending the $4,000 region and maintaining upward momentum.

The macro crossroad driving Gold right now

Fed pivot vs Dollar resilience: The battle that matters most

The dominant driver behind gold’s recovery is the market’s belief that the Fed’s next policy adjustment will be lower, not higher. Rising unemployment, decelerating job creation, and softer business sentiment have all pushed markets toward expecting easier monetary conditions.

But the US dollar hasn’t broken down.

Investors continue to hold USD as a defensive hedge during a period of delayed data, shutdown overhang, and uneven macro signals.

This tug-of-war is exactly what is creating the intense battle around the $4,140–$4,160 supply zone.

Global liquidity tightening increases Gold allocation

Global liquidity conditions have quietly tightened again as Treasury issuance remains heavy and money markets rebalance liquidity buffers. Whenever liquidity tightens while rate cuts approach, flows rotate into gold as a stable, non-yielding asset with long-term value.

This is why gold continues to defend the $3,950–$4,000 region despite recent volatility.

Delayed data = Market blind spots = Gold advantage

With key economic reports pushed back during the prolonged shutdown, traders have been operating with less clarity and more forward-looking assumptions.

Periods of uncertainty naturally boost demand for gold, as investors hedge against informational risk.

This explains why XAUUSD recovered even before delayed reports were released.

Geopolitical pressures maintain a risk premium

Global geopolitical risks — from Middle East tensions to evolving US–China trade pressure — continue to add underlying support to gold. These factors don’t always generate immediate spikes, but they stabilize gold at higher structural floors.

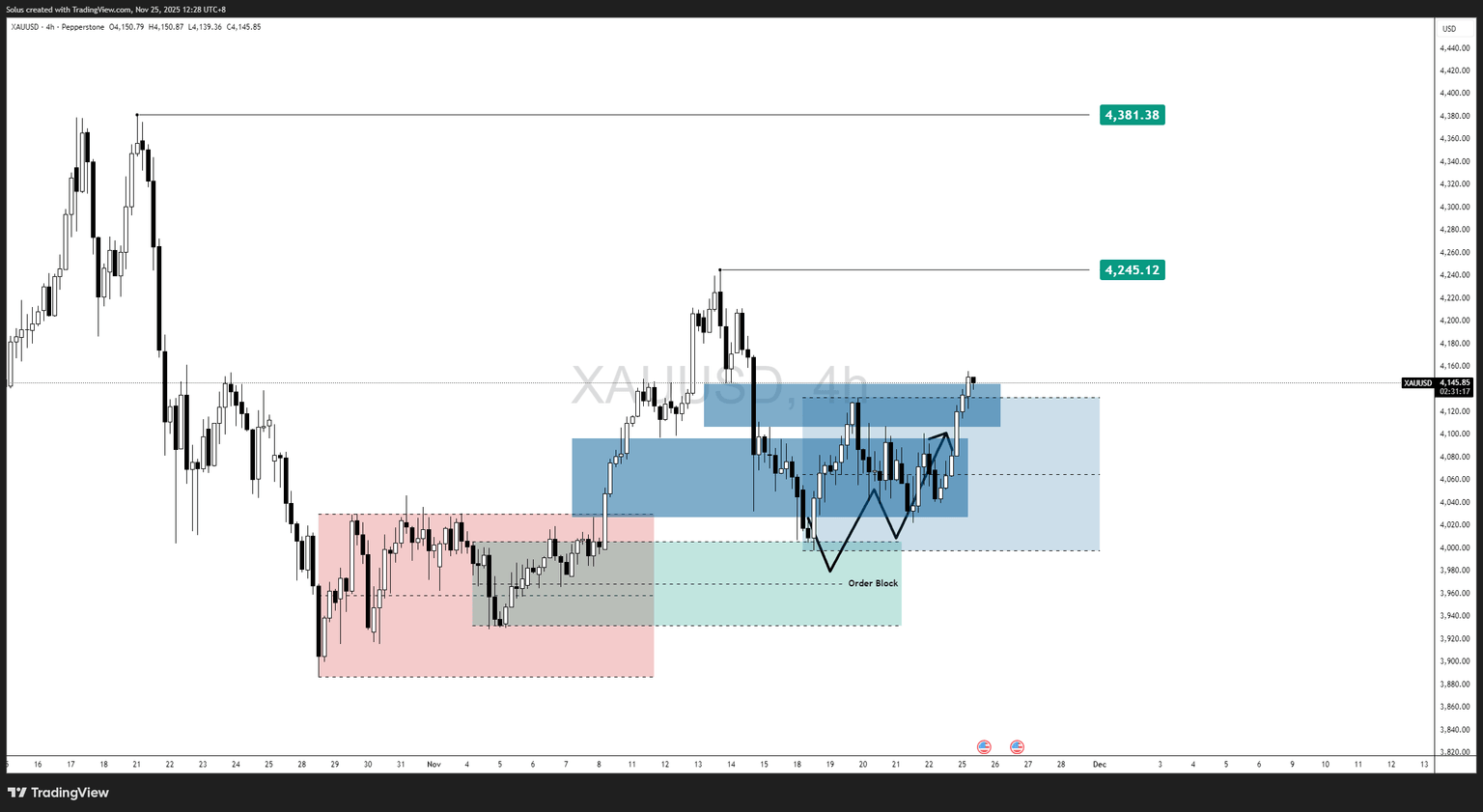

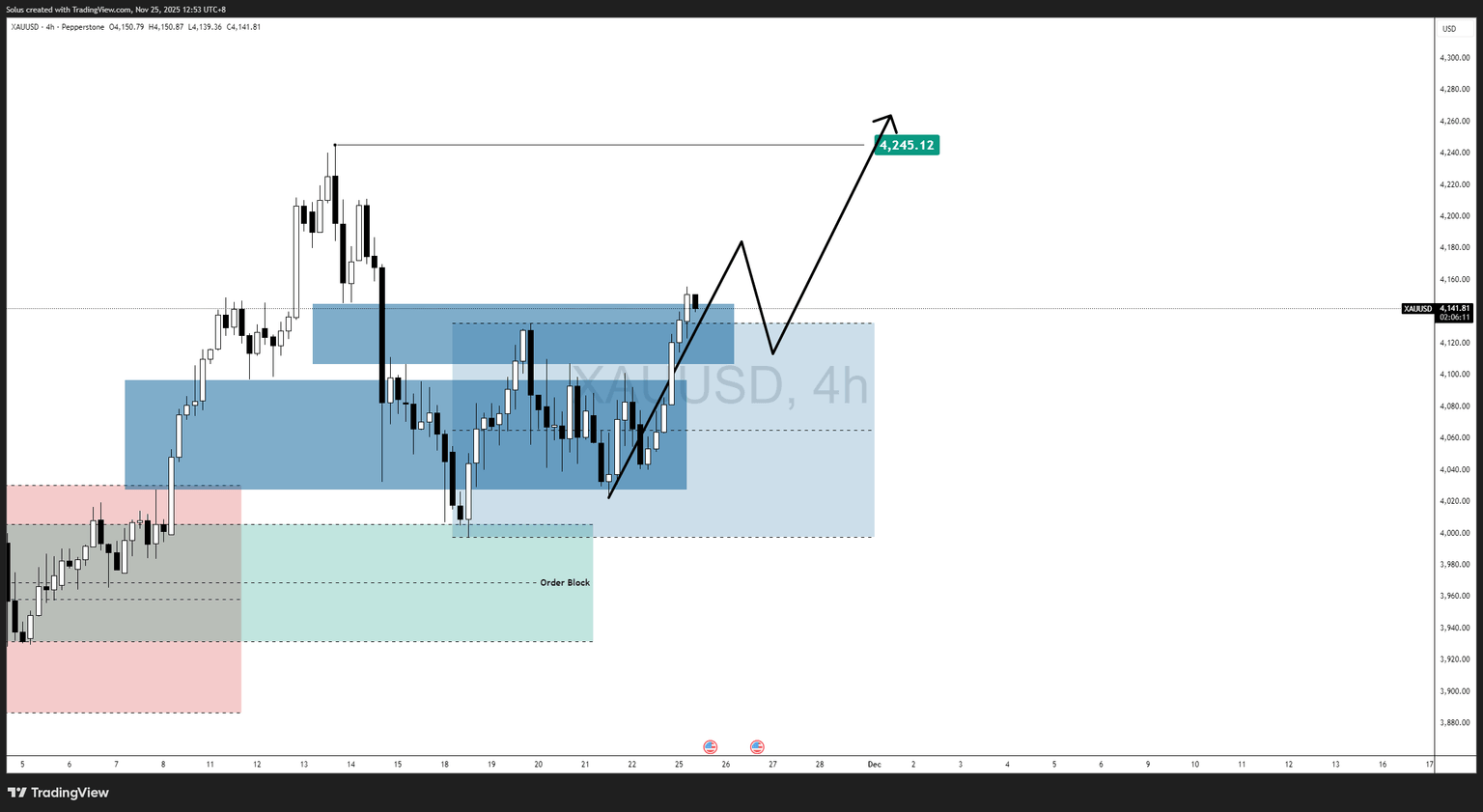

Technical outlook – Gold (XAU/USD) four-hour

Bullish scenario: Breakout above $4,160 and continuation to $4,245

1. Break and close above the $4,140–$4,160 supply zone

A decisive 4H close above $4,160 confirms that buyers have absorbed supply and signals continuation.

2. Controlled pullback into retest demand ($4,115–$4,135)

After breaking out, price is expected to retest the upper boundary of the accumulation zone.

A higher low in this area confirms the next bullish leg.

3. Expansion toward $4,245

Holding the retest opens a clean path toward:

- Primary target: $4,245 (prior swing high and liquidity pocket)

The bullish structure remains intact unless gold falls back into deeper demand zones.

Bearish scenario: Rejection at $4,160 and breakdown into deeper demand

1. Rejection at the upper supply region ($4,140–$4,160)

Failure to close above $4,160 signals exhaustion and potential short-term reversal.

2. First leg lower into the mid-range ($4,080–$4,100)

A rejection sends price back toward mid-range support.

Losing $4,100 shifts momentum toward the downside.

3. Formation of a lower high ($4,110–$4,130)

A weak retest forming a lower high confirms distribution and validates a deeper move.

4. Breakdown toward $3,960–$3,950

Once the lower high fails, price is projected to complete a full rotation into:

- Primary downside target: $3,960–$3,950 (Order Block).

A daily close below $3,950 exposes $3,920–$3,900.

Final thoughts

Gold’s price action is being driven by something larger than delayed data alone.

The market sits at a critical macro intersection:

- The Fed is edging toward a rate cut.

- The dollar remains stubbornly firm.

- Liquidity is tightening.

- Geopolitical uncertainty persists.

This combination keeps gold supported above key structural levels.

Unless the dollar triggers a fresh breakout, gold retains a clear path toward $4,245 and potentially $4,380.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.