Gold Price Forecast: A win-win amid Russia-Ukraine war, inflation woes, $2000 still eyed?

- Gold price keeps bullish potential intact amid Russia-Ukraine war-led safe-haven demand.

- Soaring energy prices trigger inflation and growth risks, adding to gold’s appeal.

- Gold bulls are back in the game, with eyes on $2,000 in coming sessions.

Gold price witnessed extreme volatility on Thursday, turning out to be one of the best days for traders, in the face of the fateful event of the Russian incursion of Ukraine. Gold price galloped to the highest level in 13 months at $1,975, in a run-away momentum after Russia’s President Vladimir Putin authorized a special military operation in East Ukraine. Subsequently, the escalation fuelled a war after both sides got into military action, which weighed heavily on the investors’ sentiments, as they scurried for safety in the ultimate store of value, gold. Further, soaring oil prices due to the Russia-Ukraine war have ramped up inflation expectations, which also collaborated with the upside in the inflation-hedge gold.

In the second half of the day, gold price saw a steep correction, which reversed the entire rally and knocked down the rates back below the $1,900 mark. The sharp reversal in the bright metal could be attributed to severe sanctions announced by the US, which offered some relief to the markets. “US President Joe Biden announced that they would sanction Sberbank, Russia’s largest lender, and four other financial institutions that represent an estimated $1 trillion in assets, as well as a broad swath of Russian elites and their family members,” per Bloomberg.

Moreover, the yellow metal suffered further headwinds from the March Fed rate hike expectations, which the Fed officials said remained intact despite the Ukraine crisis. This triggered a sharp rebound in the US Treasury yields across the curve.

This Friday, the uncertainty around the Russia-Ukraine war persists, as Kyiv came under the second attack by the Russian forces. Gold is seen consolidating the renewed upside above $1,900, awaiting a fresh impetus for the next push higher. Investors hope for a ceasefire, with Russia and Ukraine re-initiating negotiations. Meanwhile, US President Biden is expected to meet with heads of state/government from NATO countries on Friday. Gold is likely to remain underpinned going forward, as tensions remain elevated concerning the West, Russia and Ukraine. The top-tier US economic data, in the PCE inflation and Durable Goods, could have a limited impact on the markets, as geopolitics will continue to dominate the sentiment.

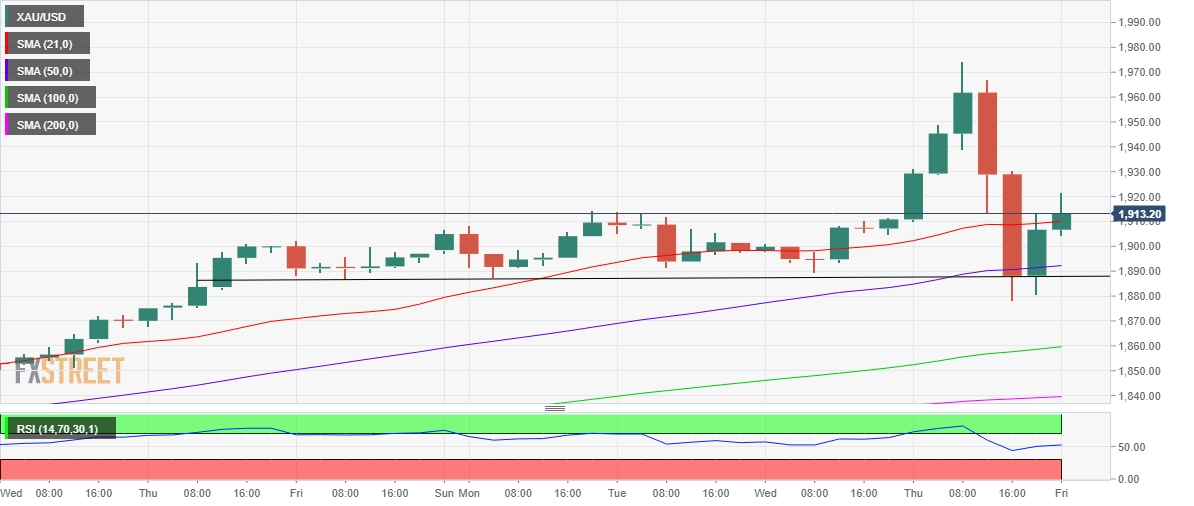

Gold Price Chart - Technical outlook

Gold: Four-hour chart

Gold’s four-hour chart is pointing to further upside risks, as the price recaptures the 21-Simple Moving Average (SMA) at $1,910. That level was the previous key resistance.

The road to recovery will likely extend towards the $1,950 level should the latter hold.

The next stop for bulls is seen at the multi-month tops of $1,975, above which a ride towards the $2,000 mark will be inevitable.

The Relative Strength Index (RSI) is pointing higher, having pierced through the midline in early trades, suggesting that there is room to rise for gold price.

However, if the bears fight back control, then a drop back towards the critical 50-SMA support at $1,892 will be inevitable.

It’s worth noting that gold price has managed to reclaim ground from the latter on a couple of occasions earlier on.

A four-hourly candlestick closing below the 50-SMA could fuel a fresh downswing in the metal towards the bullish 100-SMA at $1,860.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.