Gold Price Forecast: $1,815 remains a tough nut to crack for XAU/USD bulls, focus on yields

- Gold turns south as the US two-year yields jump on recovery outlook.

- Holiday-thinned market conditions could exaggerate gold’s moves.

- Gold faces rejection once again at December highs as RSI ticks lower.

Gold price enjoyed good two-way businesses on Monday, having almost tested the $1,800 mark before rebounding to fresh weekly highs of $1,813. Gold price initially reversed its recent uptrend as the US dollar attempted a bounce, in the face of an alarming rise in Omicron cases world over. However, optimism over the US fiscal spending plan and strong holiday season sales report drove Wall Street indices to fresh record highs. The risk-on market mood faded the renewed upside in the dollar, lifting gold price to the highest in six days. Meanwhile, the US 10-year Treasury yields remained on the back foot below the 1.50% level, underpinning the bullish momentum in gold price.

On Tuesday, gold price is snapping its recovery mode, slipping back into the red zone amid a spike in the short-dated US Treasury yields. The two-year yield jumped to 0.758%, the highest level since early March 2020, on rising odds of a March Fed rate hike. Investors remain optimistic about the prospects of the US economic recovery, despite the new Omicron covid variant-induced risks. Money markets are now pricing in a 50% chance of a rate lift-off at the Fed's March meeting. This comes after a report from Mastercard Inc. showed that the US retail sales rose 8.5% during this year's holiday shopping season from November 1 to December 24, powered by soaring eCommerce sales. Looking forward, the Fed speculation-led dynamics in the yields and the greenback will influence gold price in the coming days amid a lack of top-tier US economic news and holiday-thinned trading.

Gold Price Chart - Technical outlook

Gold: Daily chart

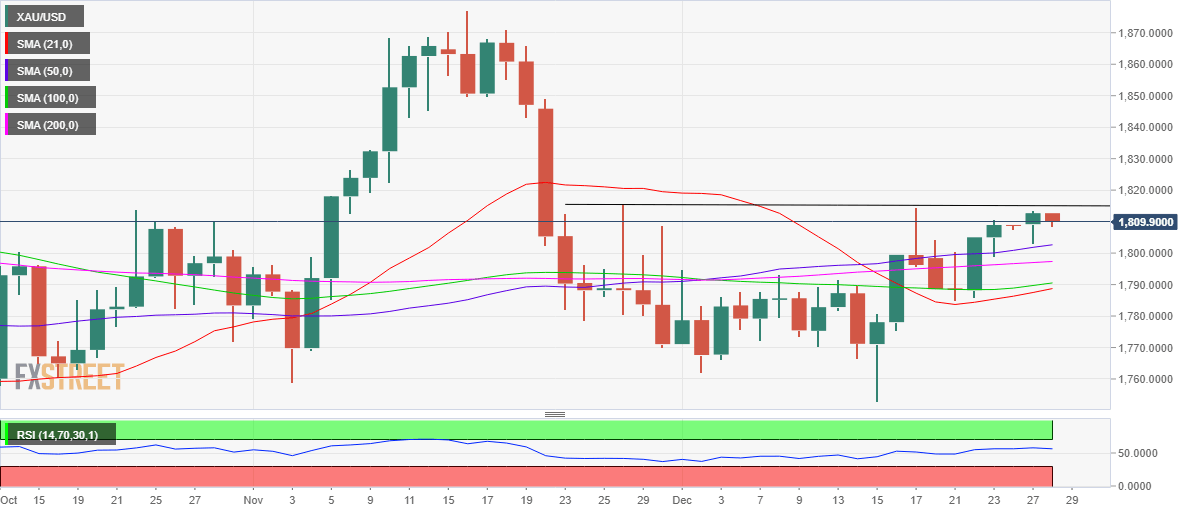

The daily technical setup for gold price paints the same picture, as the price continues to hold below the December highs of $1,814.

Bulls need a decisive break above the latter to resume the recent uptrend. The next critical bullish target is envisioned at the $1,820 round number.

Sustaining above all the major Daily Moving Averages (DMA) is boding well for the bright metal so far this week.

Meanwhile, the latest downtick in the 14-day Relative Strength Index (RSI) justifies the pullback in gold price from weekly highs.

Gold buyers, however, remain hopeful so long as the mildly bullish 50-DMA at $1,803 is defended.

A break below that level will expose the 200-DMA at $1,797. The 100-DMA at $1,791 is likely to offer strong support on additional declines.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.