Gold outlook: Deeper correction or positioning for fresh push higher

Gold

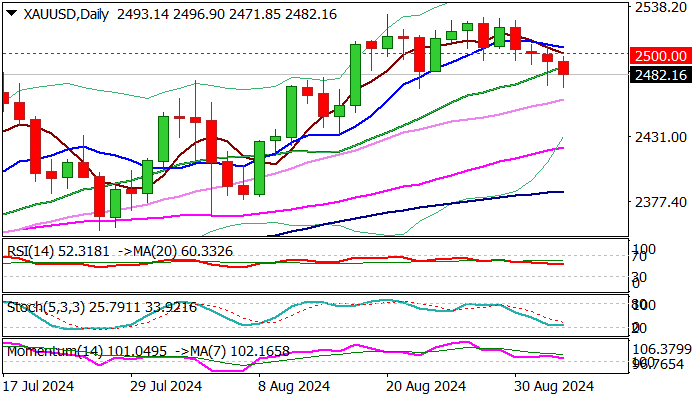

Gold price eased further on Wednesday, after loss of psychological $2500 support generated initial signal of potential deeper pullback.

Extension below 20DMA (2489) dented pivotal Fibo support at $2473 (38.2% of $2379/$2531 upleg) adding to weakening outlook.

Daily close below 20DMA to boost signal, while clear break of $2473 Fibo level to confirm.

Technical studies on daily chart are weaker, though overall picture is still positive and current pullback could mark a healthy correction before larger bulls regain full control.

Gold remains supported by geopolitical tensions and US rate cuts, but was deflated by the recent signals that Fed will very likely go for 25 basis points cut and skip aggressive actions at the start of easing cycle.

Markets focus on a series of reports from the US labor sector, which will provide more information and determine the magnitude of Fed’s action in September’s monetary policy meeting.

Res: 2489; 2500; 2505; 2526.

Sup: 2470; 2455; 2437; 2422.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.