Gold: momentum indicators are flattening their improvements [Video]

![Gold: momentum indicators are flattening their improvements [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/raw-gold-55156544_XtraLarge.jpg)

Gold

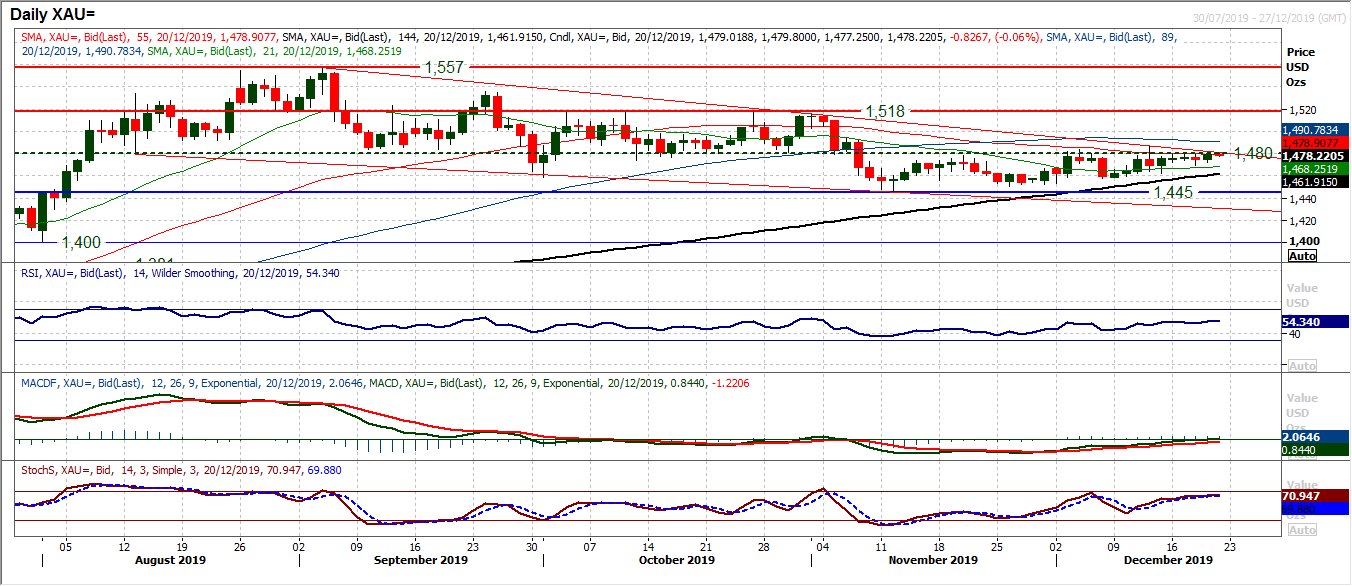

Yet another session of testing the resistance around $1480 but as yet no move of conviction. Extremely tight daily ranges (just $9 yesterday again below the Average True range of $12), along with small candle bodies all playing out under the key medium term resistance at $1480 means that this is an indecisive market. A marginally positive candle continues to ask questions of the old stale bulls (from August to October) around the overhead supply of $1480, but we are mindful that repeatedly the market has failed to rally decisively through this resistance. Once more coming into the European session there is a lack of conviction. The downtrend channel resistance at $1481 adds to the barrier to recovery. Momentum indicators are flattening their improvements, a shade above neutral configuration, means that this is a market in need of direction. A close above $1487 would open the upside, but for now this remains a deeply frustrating market. Initial support at $1470 and the hourly chart shows a pivot support around $1465.

Author

Richard Perry

Independent Analyst