Gold maintains strength on trade risks and Fed Chair uncertainty

Gold (XAU/USD) is holding firm just above the $5,050 mark after a strong advance. Rising geopolitical tensions and renewed trade threats have lifted demand for safe-haven assets. President Trump’s call for 100% tariffs on Canadian goods has sparked fears of a broader trade conflict. Meanwhile, uncertainty over Federal Reserve leadership is adding to the bullish tone. Markets now await key U.S. data and Fed guidance, keeping gold supported in a consolidative range.

Gold steadies above $5,050 as tariff threats and Fed uncertainty fuel demand

Gold is consolidating just above the $5,050 level after a strong upward move. The metal remains supported by heightened geopolitical risks and unpredictable U.S. trade actions. President Trump’s threat to impose 100% tariffs on Canadian imports has revived concerns of a renewed trade war. His comments follow tensions with other U.S. allies, deepening fears of broader economic disruption. This environment has driven renewed demand for gold as a traditional refuge in times of political uncertainty.

At the same time, uncertainty around Federal Reserve leadership is adding to the bullish tone. Trump has finished interviewing candidates for the next Fed Chair, and markets are increasingly anticipating a more dovish appointee. A dovish tilt would increase the likelihood of further rate cuts in 2026. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, which helps sustain buying interest and supports the ongoing uptrend.

Markets are also preparing for key U.S. data releases this week. Upcoming U.S. economic data and the Federal Reserve’s policy decision remain in focus. The Fed is expected to hold rates steady, yet Chair Powell’s remarks will be closely analyzed for future guidance. Any dovish shift would likely lift gold further, while hawkish comments could trigger a temporary pullback.

Gold tests channel resistance after breakout from bullish structure

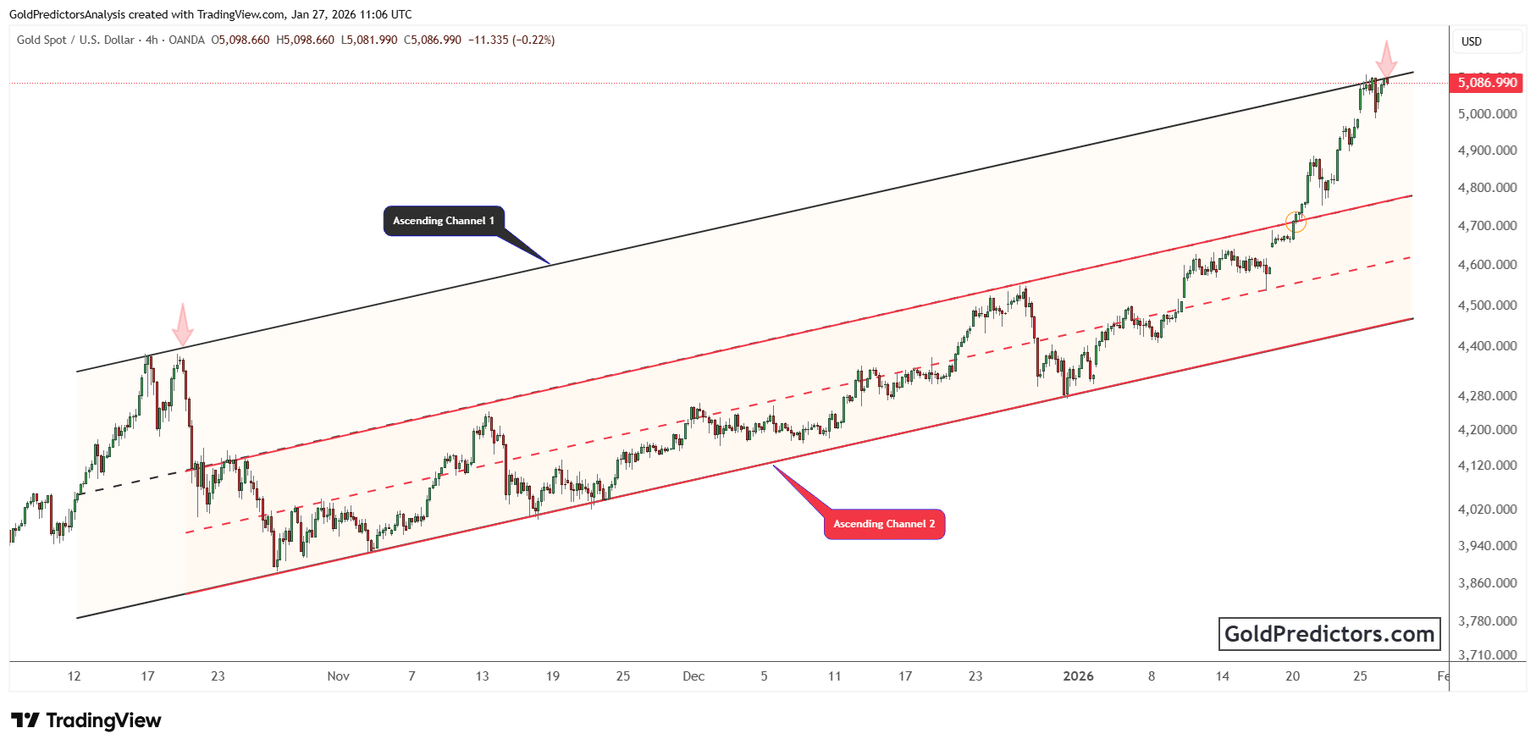

The gold chart below shows a clear breakout from Ascending Channel 2, signaling accelerating bullish momentum. Price moved steadily within this channel for over two months, forming higher highs and higher lows. This structure reflected steady accumulation on each dip, with the lower boundary acting as dynamic support throughout the rally.

After a brief period of consolidation in January, gold staged a breakout above the upper boundary of Channel 2. This breakout unleashed a strong rally, driving price into the upper section of the broader Ascending Channel 1. The move confirmed underlying strength and opened the door for continued upward momentum.

Currently, gold is testing the upper edge of Ascending Channel 1, a key resistance zone. This level previously capped the October rally, and another rejection could prompt short-term consolidation. However, the breakout from Channel 2 remains intact, and any pullbacks are likely to find support near $4,800 or $4,700. The structure favors continued upside, especially if macro drivers remain supportive.

Gold outlook: Consolidation continues as Fed decision looms

Gold continues to consolidate near $5,050 level, supported by a mix of geopolitical stress and policy uncertainty. The breakout from Channel 2 remains valid, while the ongoing test of Channel 1 resistance reflects sustained upward pressure. With markets awaiting direction from the Fed, gold holds its ground and remains poised for further gains if conditions align.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.