Gold maintains strength at historic highs amid geopolitical tensions

The escalation of geopolitical tensions in the Middle East, particularly between Iran and Israel, has significantly impacted the gold market. Iran’s missile attack on Israel, in retaliation for Israel’s operations against Hezbollah in Lebanon, has heightened concerns of a broader regional conflict. The aggressive rhetoric from both sides, with Israeli Prime Minister Netanyahu vowing to respond and Iran threatening severe repercussions, has increased demand for safe-haven assets like gold. Whenever geopolitical risks rise, gold typically sees a surge in demand as investors seek a hedge against uncertainty and potential market volatility.

Adding to this backdrop, recent economic data from the United States has introduced further complexity to the gold market. The JOLTS report revealed an unexpected increase in job openings, which stood above 8 million in August, suggesting continued strength in the labor market. This resilience was somewhat offset by the ISM Manufacturing PMI, which remained stagnant at 47.2 in September, indicating ongoing contraction in the sector for the sixth consecutive month. These mixed signals make it challenging for investors to gauge the next move by the Federal Reserve, contributing to gold’s price consolidation at higher levels. Any sign of economic instability or dovish central bank policy could lend further support to gold prices.

Looking ahead, market participants are focusing on upcoming US employment data, especially the ADP report and the more comprehensive Nonfarm Payrolls (NFP) report. These data points are expected to provide clarity on the health of the US labor market, influencing the Federal Reserve’s policy stance. Speculation is already building around the likelihood of a 50 basis points interest rate cut in November, especially after Fed Chair Jerome Powell’s relatively hawkish comments earlier this week. If the labor market shows signs of weakness, expectations for a larger rate cut could grow, further supporting gold prices. Conversely, if the data is stronger than anticipated, it may temper expectations for aggressive monetary easing, potentially capping gains in the precious metal.

Gold price action at historic highs

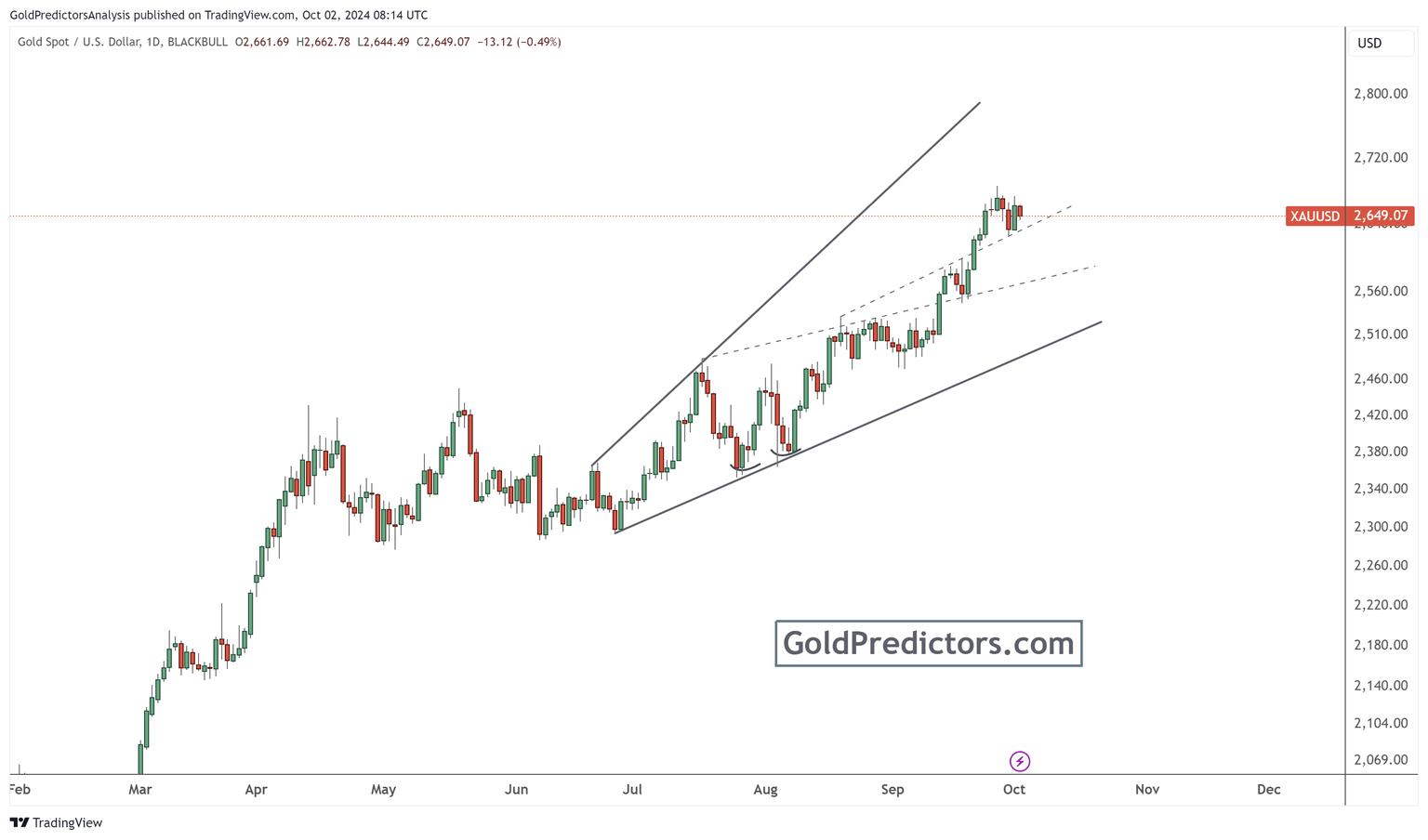

The technical outlook for the gold market remains strongly bullish, as illustrated in the daily chart below. The price is still within a robust bullish trend. Geopolitical tensions in the Middle East have been escalating since the beginning of 2024, driving gold to significantly higher levels. The chart indicates the formation of an ascending broadening wedge pattern, suggesting that prices are likely to expand over time, potentially leading to increased volatility in the future.

The recent correction from the record highs of $2,685 is primarily due to the market’s technically overbought conditions. However, this pullback is expected to be limited, with support seen near the dotted trend line within the price band of $2,630 to $2,580. The initial support level at $2,630 has triggered a strong rally in gold prices, reaffirming the underlying bullish momentum.

In the short term, the key focus will be on whether prices can maintain this support level and continue higher, or if further consolidation is needed before the next leg up. Investors should keep an eye on geopolitical developments and upcoming economic data, as these factors could act as catalysts for future price movements.

Bottom line

In conclusion, the gold market remains strongly bullish amid escalating geopolitical tensions in the Middle East and mixed signals from the US economic data. Iran’s missile strikes on Israel have fueled safe-haven demand, pushing gold prices higher, while uncertainty around the Federal Reserve's next policy move is adding complexity to the outlook. Technically, gold is showing strength, with key support levels expected to cap any further downside correction. Looking ahead, market participants will closely monitor geopolitical developments and US labor market data, as these will be critical in shaping gold's near-term direction.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.