Gold in focus! Is this the perfect time to buy gold?

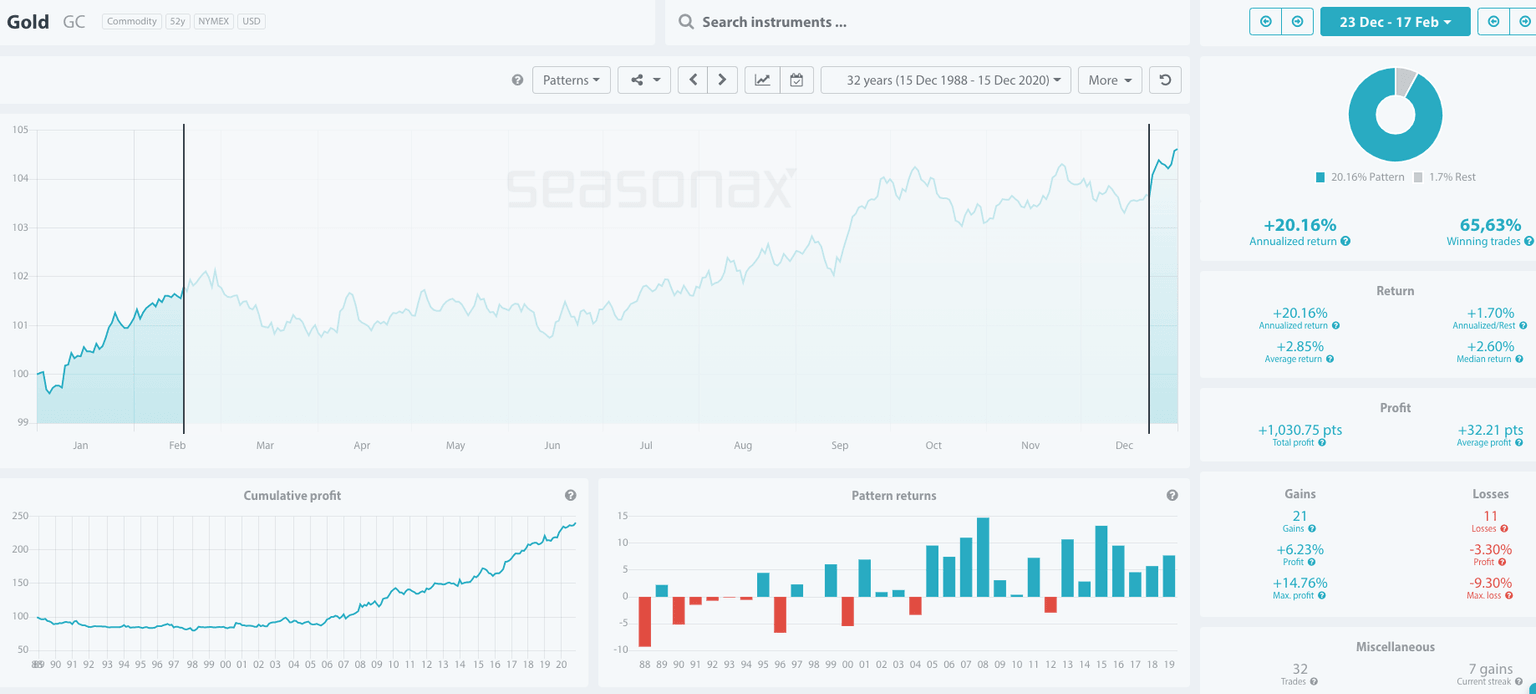

Gold tends to rise at this time of year due to strong demand from China for the Chinese Lunar New Year. Over the last 32 years gold has risen 21 times between December 23 and February 17. The average gain has been +2.85%. The largest gain was in the QE world of 2008 with a whopping +14.76% profit. With the Fed committing to ultra loose easy monetary policy is this the best time to buy gold now?

Trade Risks:

-

The main risk to this trade is if there is strong risk off trading heading into year end on the US stimulus bill not being passed.

-

Another key risk is a large increase in gold ETF selling. It has steadied recently, but an acceleration in selling could drag gold prices lower.

-

A cancellation of the Chinese Lunar New Year holiday.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.