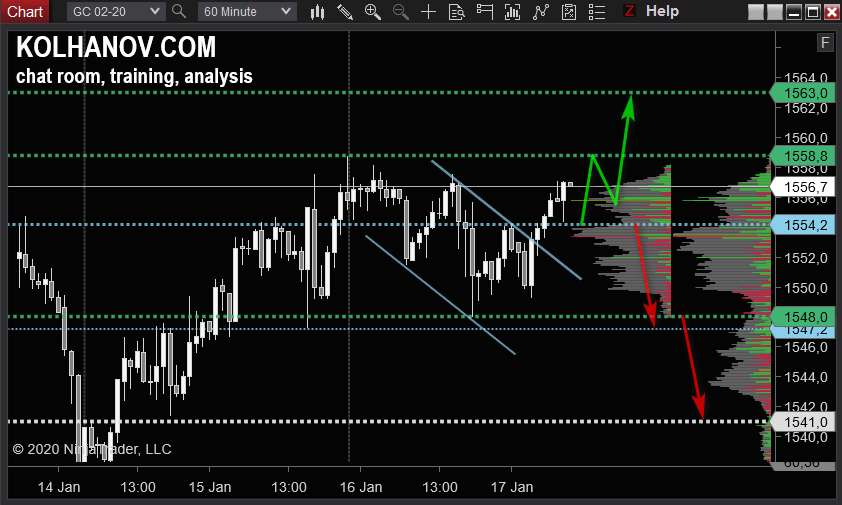

Gold going to resistance 1563 while tradong above support 1554

Gold, GC Futures market - Friday forecast, January 17

Uptrend

The uptrend may be expected to continue, while pair is trading above support level 1554, which will be followed by reaching resistance level 1558.8 and 1563.

Downtrend

Gold, spot market Friday forecast, January 17

Uptrend

The uptrend may be expected to continue, while pair is trading above support level 1554, which will be followed by reaching resistance level 1558 and 1563.

Downtrend

Weekly forecast, January 13 - 17

Most important news of this week

Monday: -

Tuesday: US Core CPI (YoY) (Dec)

Wednesday: US-China trade war phase 1 deal, Crude Oil Inventories

Thursday: EU ECB Publishes Account of Monetary Policy Meeting, US Core Retail Sales (MoM) (Dec)

Friday: EU Core CPI (YoY) (Dec)

Forecast and technical analysis

Uptrend

The uptrend may be expected to continue, while pair is trading above support level 1540, which will be followed by reaching resistance level 1575 and if it keeps on moving up above that level, we may expect the pair to reach resistance level 1611.

Downtrend

An downtrend will start as from resistance 1575, as the pair drops below support level 1540, which will be followed by moving down to support level 1513.

Monthly forecast, January - February

Uptrend

The uptrend may be expected to continue, while pair is trading above support level 1557, which will be followed by reaching resistance level 1616.

Downtrend

An downtrend will start as soon, as the pair drops below support level 1557, which will be followed by moving down to support level 1513.

Author

Anton Kolhanov

Anton Kolhanov

Anton Kolhanov is a trader and an analyst. He started to study the Forex market in 2003.