Gold futures pause near key long-term structure as intraday balance takes shape

Globex and COMEX price action highlight structural evaluation across weekly and intraday timeframes.

Gold futures pause near key long-term structure as intraday balance takes shape.

Gold futures are trading near elevated long-term structure following an extended multi-year advance, with recent price action suggesting a shift from expansion into evaluation. As key supply zones come into play, price behaviour across higher and lower timeframes is becoming increasingly informative.

From a longer-term perspective, the Globex weekly chart shows Gold futures reaching multiple major extensions originating from the 2018 and 2022 cycle lows. The breakout above the 3,753 level marked a decisive structural shift, accelerating price toward a critical extension zone near 4,350.

This area was tested twice during October 2025, reinforcing its role as a meaningful structural reference rather than a single-point target. Current weekly price action suggests Gold futures are transitioning into a phase where acceptance or rejection at elevated levels will likely shape the next phase of the broader trend.

As long as the price remains within the 4,350–3,753 structural range, the long-term bullish framework remains intact. Holding above the upper boundary would keep the scope open for further extension toward the 5,000–5,273 region, with intermediate micro-structure forming between 4,589 and 5,000. Conversely, failure to maintain acceptance above 4,350 could lead to a rotational response toward prior structural levels at 4,200, 4,080, and 3,992, without immediately invalidating the broader trend.

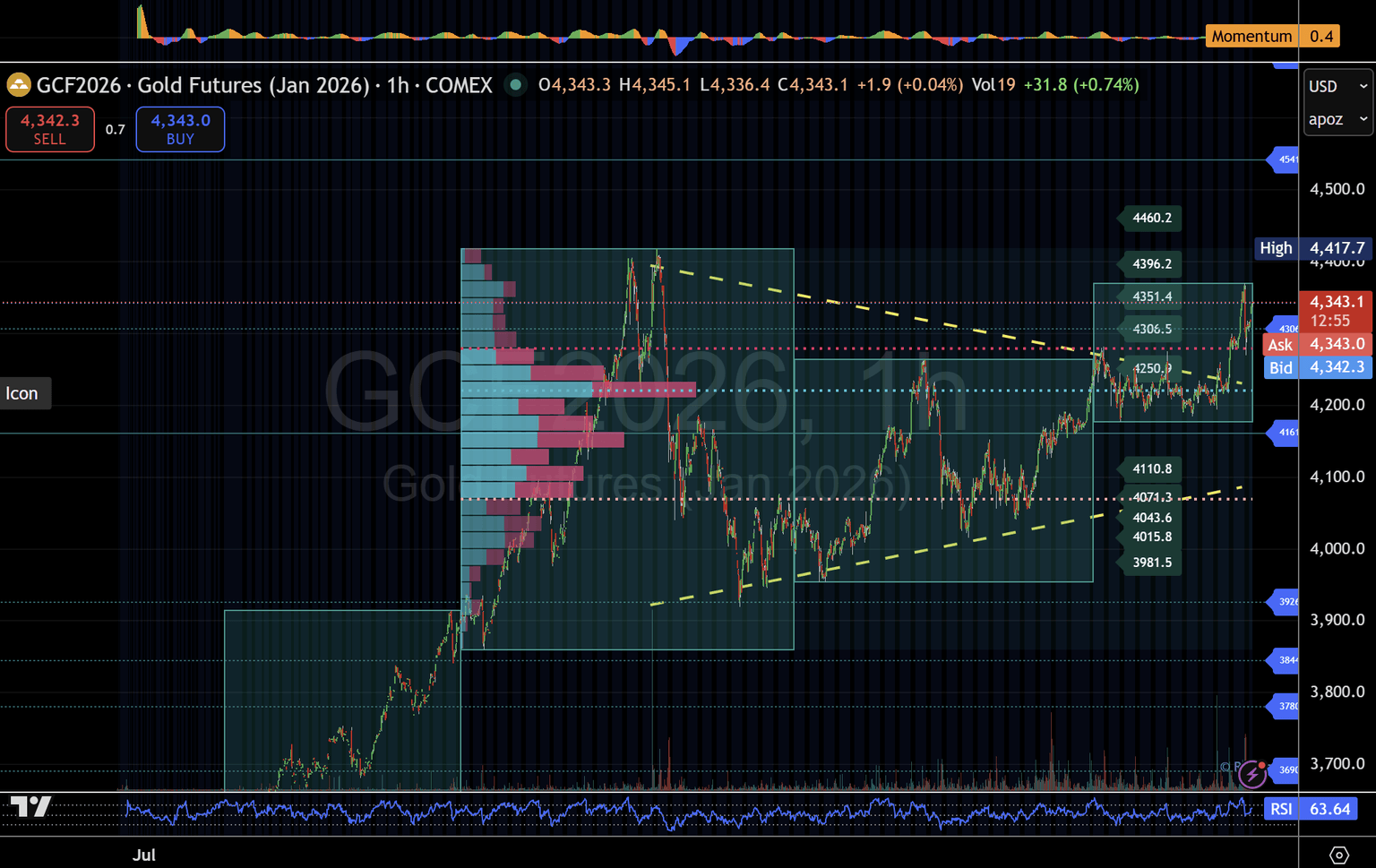

On the intraday timeframe, COMEX Gold futures (January 2026 contract) continue to trade within a clearly defined two-way structure.

The 1-hour chart shows the price centred around a key mid-structural pivot near 4,161, serving as a reference point for both continuation and rotational risk.

The upper intraday structure extends from 4,161 to 4,541, with micro levels developing between 4,250 and 4,460. As long as price remains accepted above the middle structure, these areas remain active reference points to monitor for response and balance. Failure to hold this middle pivot would shift focus toward the lower range between 4,161 and 3,926, with additional intraday reference zones around 4,110 to 3,981.

Both the weekly and intraday views suggest Gold futures are no longer in open expansion. Instead, price is navigating clearly defined structural boundaries across timeframes. In this environment, reaction and acceptance at key levels are likely to provide more insight than directional assumptions alone.

This analysis is for informational purposes only and does not constitute investment advice. Markets involve risk, and past performance does not guarantee future results.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.