Gold faces tight resistance as US tariffs and Fed uncertainty weigh on sentiment

Gold (XAUUSD) is trading with a cautious tone amid rising global uncertainty. Investors are reacting to the threat of new US trade tariffs and mixed signals from the Federal Reserve. Safe-haven demand supports the metal, but bullish momentum remains weak. The US dollar's recent softness has helped gold maintain its ground. However, strong resistance and limited policy clarity continue to keep prices in a tight range. Traders now look for fresh triggers to break this deadlock.

Gold struggles for direction as US tariff threats and Fed uncertainty weigh on sentiment

Gold prices continue to trade with a slight positive bias, but remain confined within a narrow range. Safe-haven demand has increased due to President Trump's aggressive trade policies. This is primarily driven by the announcement of new import tariffs, which take effect on August 1. The threat of a 15–20% tariff on the European Union, even in the event of a trade deal, has further heightened investor caution. These unpredictable moves have weakened market sentiment, prompting some investors to turn to gold as a haven. However, the demand hasn't been strong enough to push prices out of their current consolidation range.

On the policy side, the Federal Reserve's mixed signals are creating uncertainty. While Governor Christopher Waller supported the idea of a July rate cut, most market participants believe the Fed will hold off until September. Traders are currently pricing in two 25-basis-point cuts before the end of the year. This indecision, coupled with concerns over rising inflation and slowing growth, continues to limit any significant upside in gold.

Meanwhile, the US Dollar remains under pressure, trading below its late-June highs. This has given gold some support. However, comments from Fed Chair Jerome Powell suggest that tariffs could lead to higher consumer prices. This suggests that the Fed may maintain higher interest rates for a longer period. Adding to this, the University of Michigan's Consumer Sentiment Index rose unexpectedly to 61.8 in July, showing increased consumer optimism and reinforcing the Dollar. With no primary US data expected on Monday, traders will focus on trade headlines and upcoming global PMI data for fresh direction.

Gold price trades in tight triangle pattern ahead of a key breakout

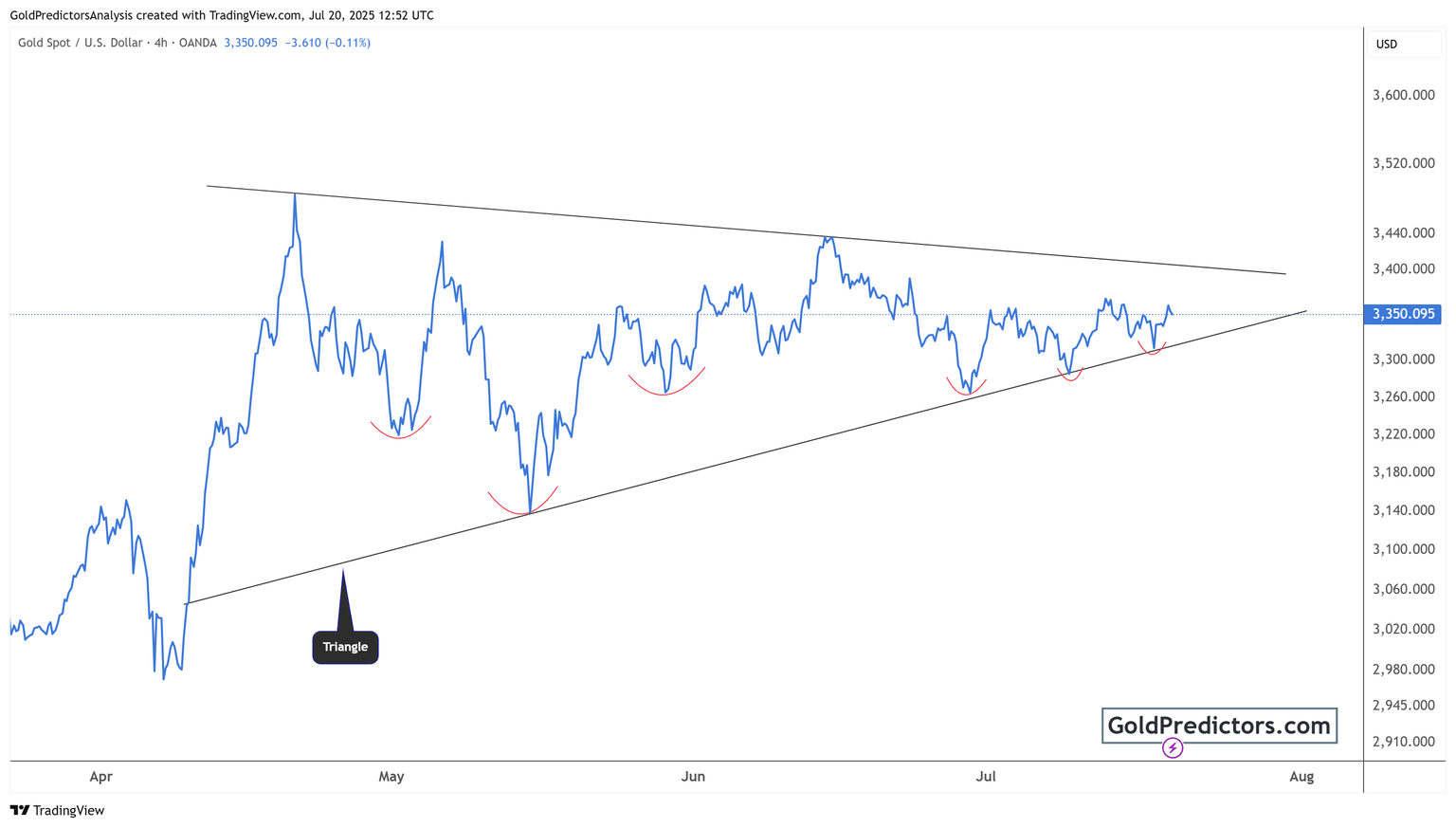

The chart below shows that gold is trading within a well-defined symmetrical triangle pattern that has been developing since April. Multiple touches on both the rising support line and the falling resistance line mark this formation. The base of the triangle started near the $2,950 level, and since then, the price has formed a series of higher lows and lower highs, steadily tightening the trading range.

Notably, several minor cup-like reversals have appeared along the ascending trendline. These suggest consistent buying interest near support zones. Despite this, every upward move has faced strong resistance at the upper boundary of the triangle. This repeated failure to break higher highlights the presence of significant selling pressure at key resistance levels, keeping gold trapped within the pattern.

Currently, gold trades near $3,350, right at the center of the triangle. The narrowing structure indicates that a breakout could be approaching soon. A decisive move above $3,400 or below $3,300 may signal the next major trend direction. However, the lack of volume spikes suggests that the market is waiting for a fundamental trigger, likely related to tariffs or Federal Reserve policy. Until then, gold remains in a neutral zone, with bulls and bears locked in a technical standoff.

Conclusion

Gold remains stuck in a tight range as traders weigh trade tensions and Fed policy signals. The symmetrical triangle pattern reflects this indecision, with neither bulls nor bears taking control. Safe-haven flows and a weaker dollar offer support, but strong resistance and policy uncertainty limit gains. A breakout above $3,400 or below $3,300 will likely decide the next significant move. Until then, gold is in a holding pattern, awaiting an apparent trigger.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.