Gold faces headwinds from Dollar strength and Warsh Fed outlook

Gold (XAUUSD) has come under renewed pressure after failing to hold above the $5,000 level. A stronger Dollar, easing geopolitical risks, and uncertainty around Fed policy have combined to stall its upward momentum. Recent comments from U.S. and Iranian leaders eased conflict concerns, reducing safe-haven demand. At the same time, markets remain focused on upcoming U.S. data, which could further influence gold’s short-term path.

Gold weakens on hawkish Fed outlook and rising Dollar pressure

Gold remains under pressure as it struggles to reclaim momentum after a sharp drop below the $5,000 mark. The Dollar regained strength after last week’s Fed messaging left markets uncertain about the pace of policy easing. Although Jerome Powell avoided strong forward guidance, the nomination of Kevin Warsh as the next Fed Chair sparked further volatility. Warsh is expected to prioritize balance sheet reduction, a move that typically supports the Dollar by tightening liquidity. This outlook limits gold’s upside in the near term and keeps pressure on the broader recovery.

Geopolitical tensions have eased slightly, reducing immediate demand for safe‑haven assets. Markets reacted positively to President Trump’s recent remarks suggesting possible negotiations with Iran. At the same time, Iran’s Supreme Leader warned of consequences if the situation escalates, yet the tone from both sides points toward diplomatic engagement rather than imminent conflict. This moderation in tensions reduces gold’s safe haven support in the near term.

Looking ahead, the upcoming U.S. ISM Manufacturing PMI will act as a key directional trigger for gold. A weaker print could revive expectations for rate cuts, weigh on the Dollar, and offer gold some relief. In contrast, a strong reading may support the Fed’s cautious stance and extend gold’s recent struggles. The ISM data will also help shape positioning ahead of Friday’s Nonfarm Payrolls report, with gold markets closely watching for signals on growth and inflation.

Gold attempts to stabilize after sharp channel reversal

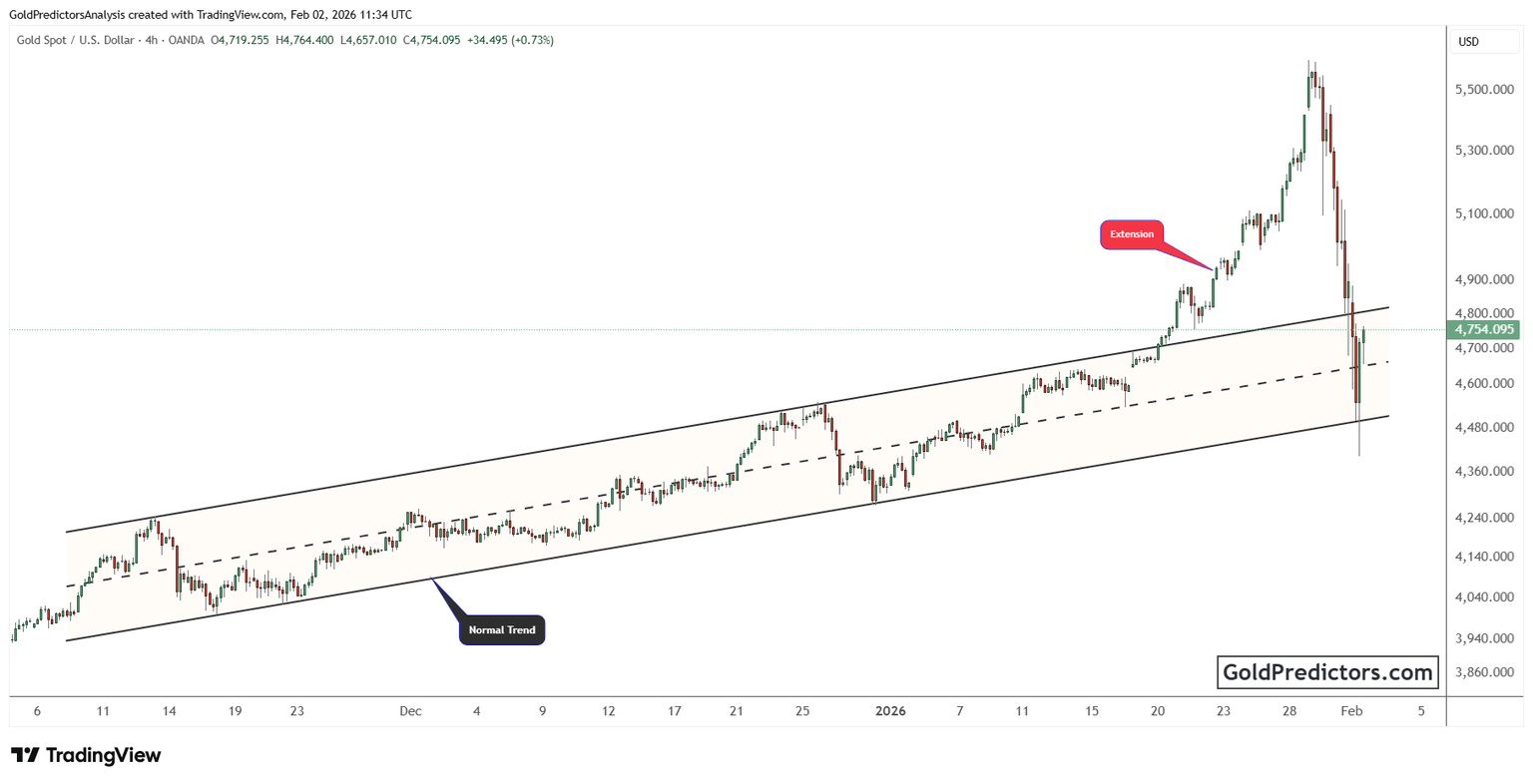

The gold chart below shows a well-defined ascending channel that has guided the broader uptrend over the past several months. During the rally, price action repeatedly respected the channel’s support and resistance levels. A sharp surge in late January pushed gold past the upper boundary, driving a fast move toward $5,600. This breakout marked a clear departure from the channel’s established trend structure.

However, the breakout proved unsustainable. After peaking near the upper extreme, gold reversed sharply and dropped back below the channel’s upper boundary. This rejection triggered a strong downside move that pushed price well beneath the midline. Momentum carried it into the lower edge of the channel, where gold momentarily dipped below support near $4,585.

Following the sharp breakdown, gold briefly dipped below the lower boundary but quickly rebounded. The recovery lifted price back above the mid-channel line, signaling an early attempt to stabilize. While the rebound shows initial buying interest, the price still trades below key resistance within the channel. Until it reclaims that zone, the broader structure still leans cautious, with further volatility likely if midline support fails again.

Gold outlook: Downside risks rise as support faces pressure

Gold remains under pressure as macro headwinds and technical signals limit its recovery. The failure to hold above $5,000, along with Dollar strength and easing geopolitical risks, has stalled momentum. Although the price rebounded above the mid-channel line, it still trades below key resistance. Upcoming U.S. data will be crucial in determining short-term direction, but gold must reclaim higher levels to regain bullish traction.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.