USD/JPY realises correction: BoJ policy weighs on Yen

USDJPY rose to 154.98 on Monday, with the yen continuing to fall. Pressure on the currency increased after statements by Japanese Prime Minister Sanae Takaichi. Over the weekend, the politician noted that a weak yen could be a significant advantage for export industries, indicating that Takaichi continues to favour a softer exchange rate. She later clarified that her comments concerned the need to build an economy resistant to currency fluctuations.

On Friday, the yen lost about 1% against the dollar after US President Donald Trump nominated Kevin Warsh as the next Fed chairman. The market regarded this choice as more "hawkish", supporting the dollar and adding to the pressure on the yen.

An additional factor of uncertainty remains the upcoming extraordinary vote in the lower house of parliament on 8 February. Takaichi's ruling party is expected to strengthen its position and advance expansive fiscal policies, increasing the risk of higher borrowing. Against this background, both Japanese government bonds and the yen were under pressure last month.

Expectations of fiscal stimulus and discussion of tax breaks increase the burden on public finances and restrain demand for the national currency.

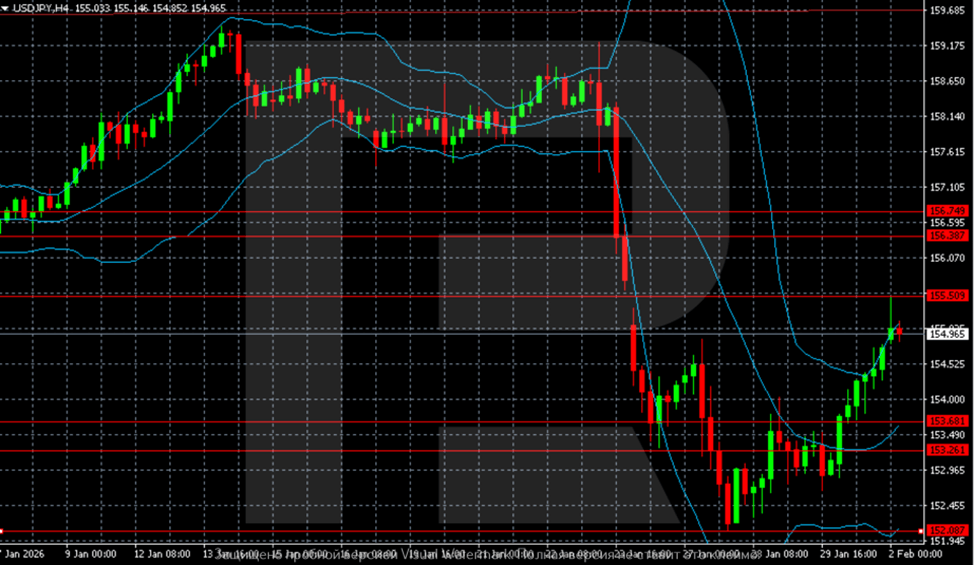

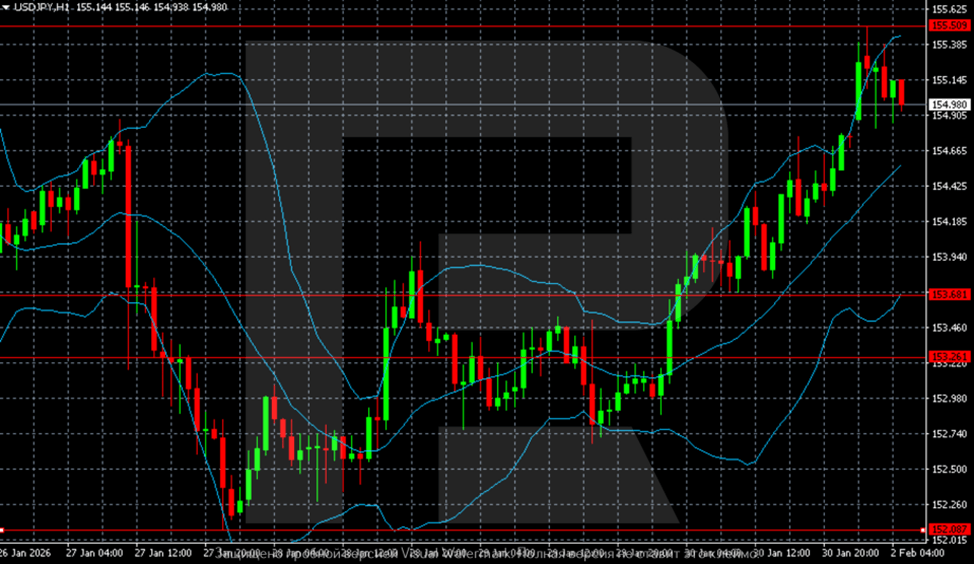

Technical analysis

On the H4 chart, a corrective rebound follows after a sharp drop from the 158.50–159.00 area. The price recovered from a low in the 152.00 zone and is testing the 155.50 area, but remains below medium-term resistance. The structure still looks corrective inside the broader downward phase until the quotes settle above 156.50–157.00.

The H1 chart shows that after a sharp decline, the pair entered a recovery phase and has been sequentially updating local maxima. The price climbed above the 153.26–153.88 zone and is trading along the upper end of the Bollinger Bands, indicating continued near-term momentum. A slowdown is observed near the 155.50–155.60 level, with a possible pause or pullback within the ongoing correction.

Conclusion

In summary, the USDJPY rebound is primarily a technical correction within a broader bearish context for the yen. The move is exacerbated by political commentary favouring a weaker currency and reinforced by a hawkish Fed appointment. While near-term momentum persists, the pair faces significant resistance ahead. The fundamental backdrop of anticipated expansive fiscal policy in Japan continues to apply structural pressure on the yen, suggesting the current recovery may be limited in scope before the larger downtrend potentially resumes.

Author

RoboForex Analysis Department

RoboForex

RoboForex Analysis Department provides timely market insights, expert technical analysis, and actionable forecasts across forex, commodities, indices, and equities.