Gold extends rally on soft CPI and escalating geopolitical risks

Gold (XAUUSD) is gaining momentum as soft inflation data and rising geopolitical tensions drive renewed demand for safe-haven assets. A weaker-than-expected U.S. CPI report has strengthened the case for multiple Fed rate cuts, pressuring real yields and the dollar. At the same time, political uncertainty surrounding the Federal Reserve and escalating unrest in the Middle East are amplifying market risks. This combination of macro pressures and policy instability is strengthening gold’s bullish outlook.

Gold rises on weak CPI and growing global tensions

Gold is pushing higher and appears on track to retest recent record levels above $4,630. The softer-than-expected U.S. Consumer Price Index data released earlier this week provided fresh momentum to gold’s uptrend. Core CPI came in below analyst expectations, strengthening the case for multiple Federal Reserve rate cuts this year. This shift has pushed real yields lower and weakened the U.S. dollar, making gold more attractive as a non‑yielding asset.

Additionally, political developments in the U.S. are adding fresh uncertainty to the policy outlook. A criminal investigation involving Fed Chair Jerome Powell has raised concerns about the central bank’s independence. Growing fears of political influence over monetary decisions have increased demand for safe-haven assets like gold. This environment could limit the Fed’s flexibility and delay any shift toward tightening, further supporting the bullish case for gold.

Meanwhile, geopolitical tensions are intensifying, adding to global uncertainty. Reports of widespread protests and a violent government crackdown in Iran have raised concerns about potential U.S. involvement. President Trump’s latest warnings have further heightened tensions in the region. With internet access restricted by Iranian authorities, limited visibility on the ground is amplifying uncertainty and supporting flows into defensive assets like gold.

Gold builds momentum within expanding wedge after channel breakout

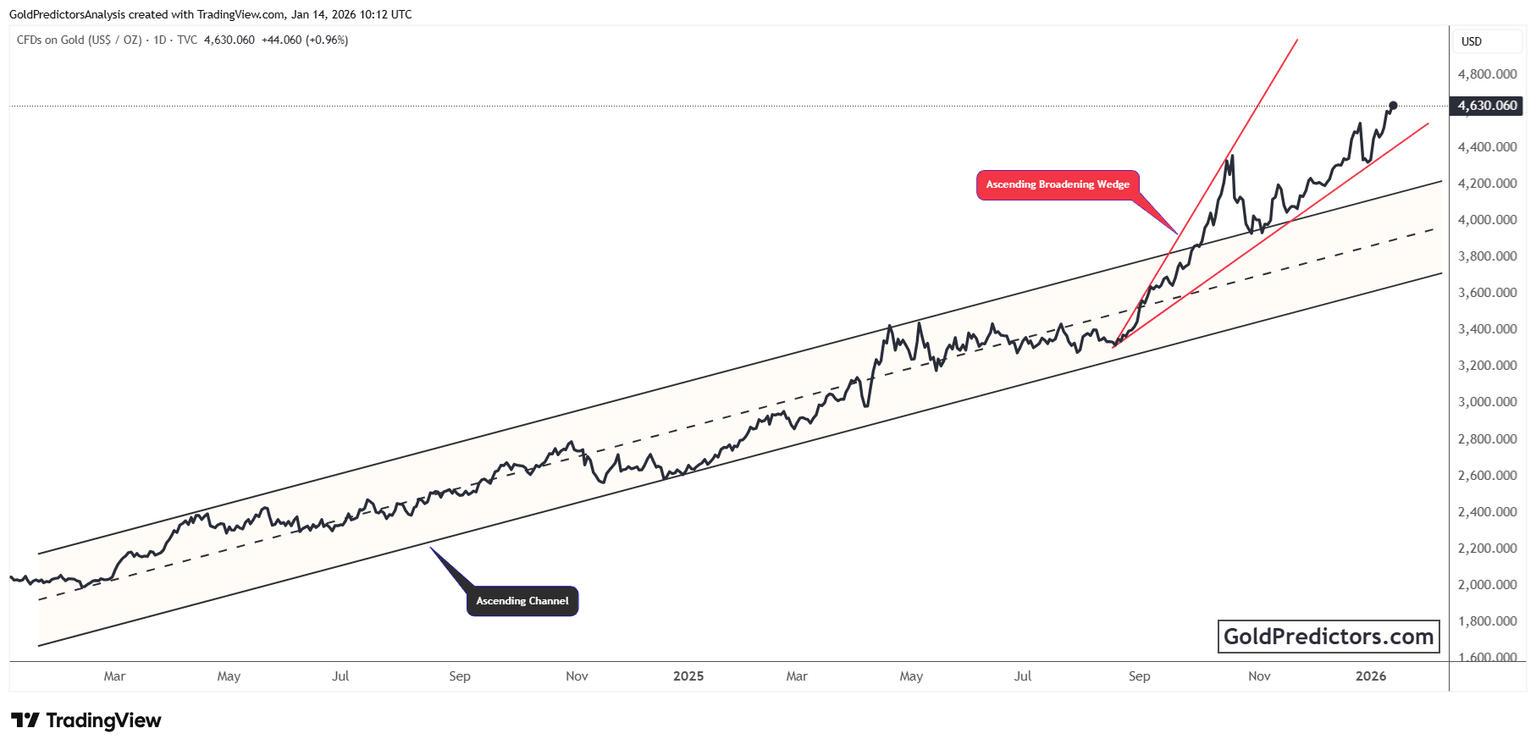

The gold chart below shows a well-defined ascending channel that has shaped price action since early 2024. For more than a year, gold consistently respected both the lower support and upper resistance boundaries, advancing steadily along the channel’s midline. This orderly progression reflects sustained accumulation and highlights the strength of the broader uptrend.

In October 2025, gold broke above the upper boundary of the channel, signaling an acceleration phase. This breakout led to the formation of an ascending broadening wedge, marked by expanding highs and lows. The wedge highlights increased volatility and a more aggressive upward push, often seen in the later stages of a bullish trend.

Currently, gold is trading near the upper line of the broadening wedge and remains well above the original channel. This positioning signals ongoing upward pressure but also reflects rising volatility, which could lead to sharper price swings. As long as gold holds within the wedge, the technical structure remains bullish, with upward momentum likely to persist despite rising volatility.

Gold outlook: Soft CPI, policy risks, and bullish structure support further gains

Gold remains in a strong uptrend, fueled by soft inflation data and renewed rate cut expectations. Political pressure on the Fed and intensifying conflict risks are boosting safe-haven flows. The technical structure also favors further upside as price holds within the broadening wedge. As long as macro risks persist and volatility stays elevated, gold is likely to remain supported and continue moving higher.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.