Gold Daily News

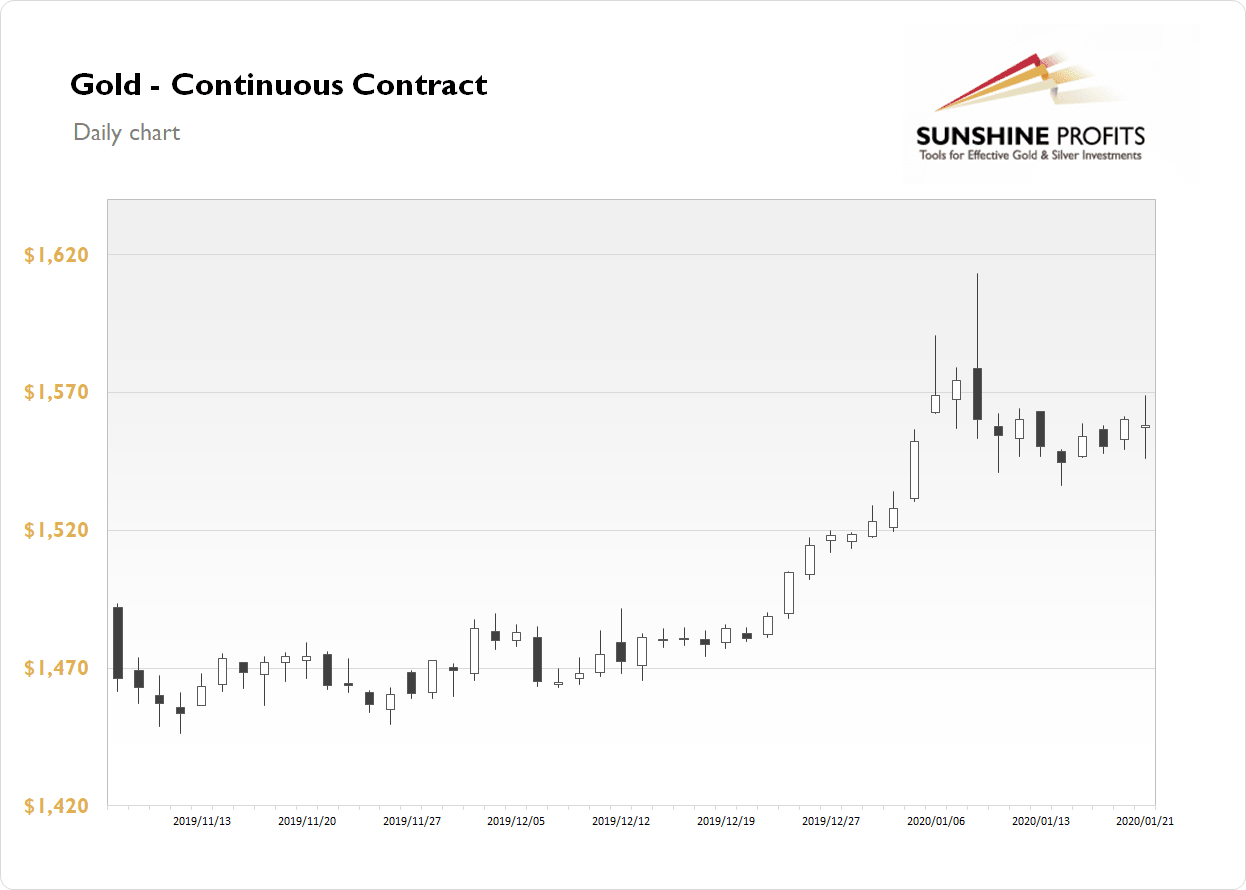

The price of gold lost 0.15% on Tuesday, as it extended its short-term consolidation following the previous week’s Wednesday’s record-breaking advance above $1,600 mark that ended with a sharp intraday downturn. However, the market got close to the $1,570 level yesterday, before getting back below the resistance level of $1,560.

The gold price has been tradingwithin an almost two-week long consolidation. despite the overall short-term risk-on action on the financial markets following last Wednesday’s U.S. and China Phase One trade deal signing. The gold is currently 0.1% lower, so it is extending the consolidation.

What about the other precious metals? The silver was relatively weaker than gold, as it failed to break above the last week’s Friday’s local high. Consequently, yesterday it fell 1.47% following bouncing off the resistance level of $18.00-18.20. Right now, it is 0.6% lower. The price of platinum trades within a range of $1,000-1,020 per ounce as it gains 0.2%. On the other hand, palladium gains 1.2%, however it remains much below yesterday’s new record high.

Today, the financial markets will continue to focus on the World Economic Forum in Davos. We will also have some quite important economic data releases from Australia and Canada.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.