Gold continues to be a strong winner from the pandemic

European markets turned south on Friday led by a decline in travel and leisure stocks after the UK added France to its 14-day quarantine list. Yesterday, US stocks dipped after a run at the all-time highs failed again – the S&P 500 finished the day down 0.2%, but the Nasdaq eked out a small gain. Asian markets ticked up amid a mixed bag of data and economic indicators and European stocks slipped in early trade after falling across the board on Thursday. After a decent start to the week it looks like equity markets are finishing off rather meekly.

With France being added to the quarantine list for the UK, travel & leisure is under pressure. Shares in IAG, Ryanair, Tui and EasyJet were all sharply lower as the move will force a large swathe of cancellations right at the peak of the summer holiday season for one of the largest markets for UK tourists. Half a million Brits are thought to be in France right now. Related stocks were also hit. WH Smith – purveyor of overpriced sweets and free Evian – slipped down the board as a result. Apart from the immediate damage this will do at the height of the school holidays and peak summer season, the quarantine decision also underlines the inherent risk you take in booking a holiday abroad right now, which will do nothing for consumer confidence.

US jobless claims fell under 1m for the first time since the pandemic devastated the labour force, but unemployment levels remain exceptionally high and there remains the fear that too many temporary layoffs will become permanent. Initial unemployment claims dropped to 963k from almost 1.2m a week before, whilst continuing claims fell to 15.5m from more than 16m the previous week. Unemployment fell but remains above 10% and the twofold worry remains – after the initial resurgence upon reopening, the sustainable pace of recovery is too slow, and that some portion of the labour force is lost forever. The situation in the UK looks even more stark as the life support machine of furlough gets switched off.

Later today comes the US retail sales report for July, which are expected to drop back sharply to +2% from +7.5% the prior month, with core +1.3% from +7.3%. A smaller increase in retail sales is expected as pent-up demand drove the unusually high demand in May and June following the collapse in March and April. Going forward, the destruction in the labour market will force consumers to tighten purse strings – unless there is free money ad infinitum.

On that front, progress is slow to non-existent - Congress has broken up for the summer recess with no fresh stimulus deal in the offing. The improvement in the jobless numbers and apparent improvement in some of the other high frequency data may make it even less likely that US politicians can agree to a package, particularly with the election starting to dominate thinking.

Chinese retail sales slipped in July, declining 1.1% after a 1.8% drop in June, whilst industrial production rose a solid 4.8%, although this was also short of expectations. The disappointing retail sales number hit the luxury sector this morning but also underscores the weakness in the demand side of the recovery. Eurozone GDP figures later today are expected to confirm a sharp contraction in the second quarter as lockdown measures were in full force. This data is now pretty historic and won’t do anything for markets.

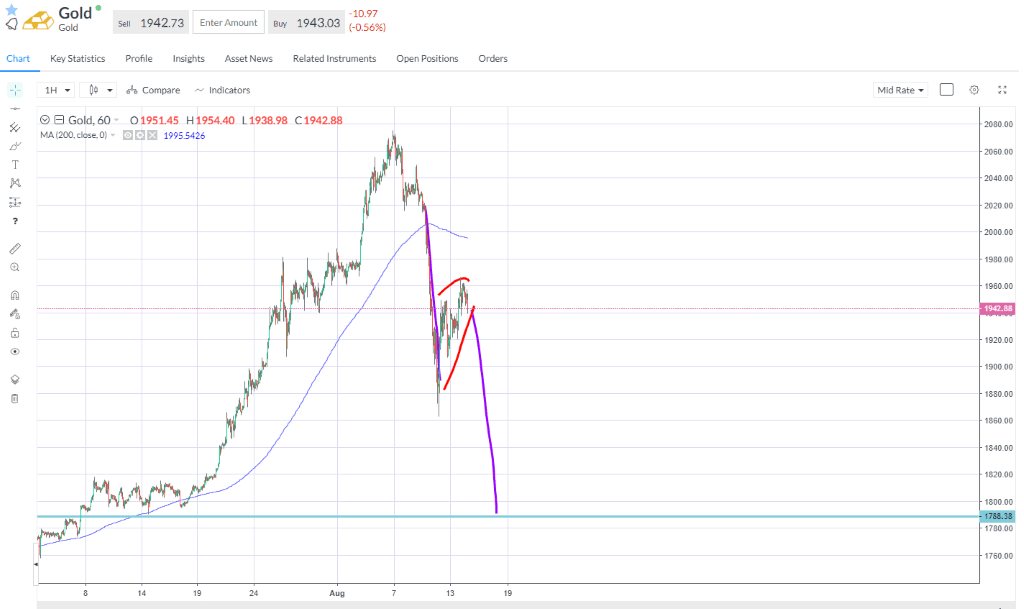

Gold is holding around $1950 but the bearish flag on the chart looks like there could be a further corrective move in the long-term uptrend. As US rates seem to be inclined to roll higher there is a risk of a further downswing. The yield on US 10yr Treasuries are above 0.7% and TIPS creep higher. Longer term you would feel that gold continues to be a strong winner from the pandemic.

Author

Neil Wilson

Markets.com

Neil is the chief market analyst for Markets.com, covering a broad range of topics across FX, equities and commodities. He joined in 2018 after two years working as senior market analyst for ETX Capital.