Gold: Consolidation has turned to correction of the big March to August rally [Video]

![Gold: Consolidation has turned to correction of the big March to August rally [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/hand-full-of-gold-nuggets-53773200_XtraLarge.jpg)

Gold

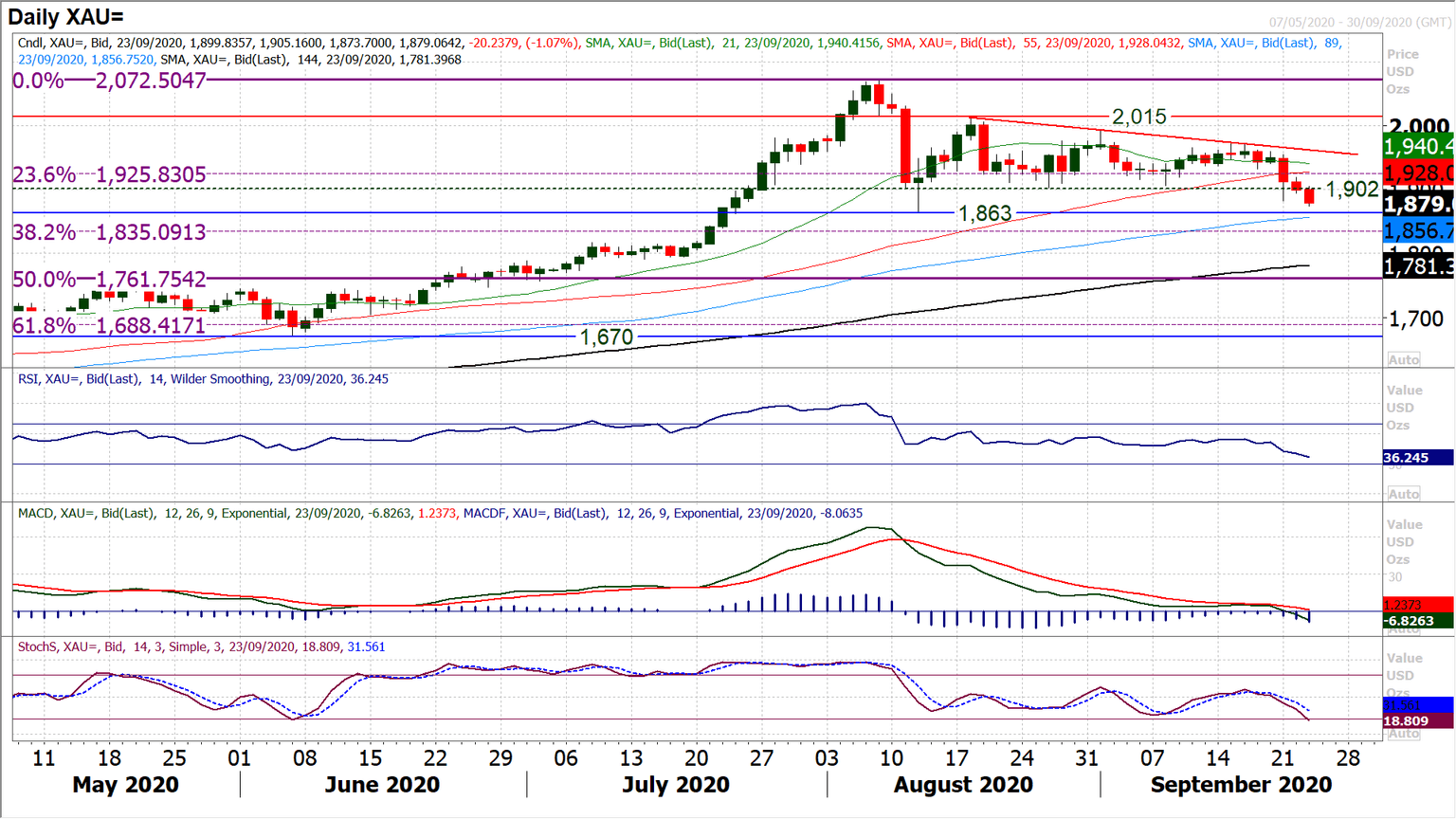

There has been a decisive shift in sentiment on gold in the past few sessions. Consolidation has turned to correction of the big March to August rally. This rally from $1451 to $2072 is now decisively retracing. Where the 23.6% Fibonacci retracement at $1926 had previously been supportive, now this has given way it has opened a move back towards the 38.2% Fib level at $1835. We have talked numerous time about the importance of the $1902 floor in this. Yesterday’s closing breach and continuation lower today show that this floor giving way opens the downside too. A test of the initial August spike low at $1863 is now on, however a deeper correction is now the risk. Momentum indicators are decisively corrective now, with RSI falling into the mid-30s whilst MACD and Stochastics accelerate lower. All have downside potential and suggest that near term strength is now a chance to sell. Below the spike low of $1863 the next real support is not until $1818. The hourly chart shows resistance building up around old supports too. Initial resistance this morning at $1894/$1906 with $1920 increasingly important now.

Author

Richard Perry

Independent Analyst