Gold consolidates near record highs before US Retail Sales data amid volatility

Gold attracts investors during economic instability, making it a highly valued asset. As concerns grow over trade tensions, geopolitical risks, and monetary policy decisions, investors are becoming more cautious. As a result, they continue to turn to gold as a safe-haven asset. The price of gold is now hovering close to the $3,000 psychological level. This reflects strong demand and market uncertainty.

Trade tensions and rate-cut expectations keep Gold in focus

Gold price (XAU/USD) struggles to attract meaningful buyers, though it remains close to its all-time high. The precious metal reached below $3,000, driven by increasing global uncertainty. Trade tensions and geopolitical risks continue to drive investors toward gold as a hedge against volatility.

US Treasury Secretary Scott Bessent recently stated that market downturns are normal. He also emphasized that there are no guarantees regarding a recession. However, concerns about economic fallout due to US President Donald Trump's trade tariffs keep investors cautious. Additionally, geopolitical risks remain heightened. Houthi militants in Yemen have threatened US ships in the Red Sea. Meanwhile, military tensions in Gaza continue escalating, further supporting gold demand.

At the same time, expectations of multiple interest rate cuts by the Federal Reserve (Fed) this year also influence the market. The Fed funds futures indicate that rate cuts may occur in June, July, and October. This keeps the US Dollar under pressure and makes gold more attractive to investors. Moreover, China's recent stimulus measures to boost domestic consumption have improved investor sentiment. The market is now waiting for the US retail sales data for the next move in the gold market.

Gold consolidation at record highs

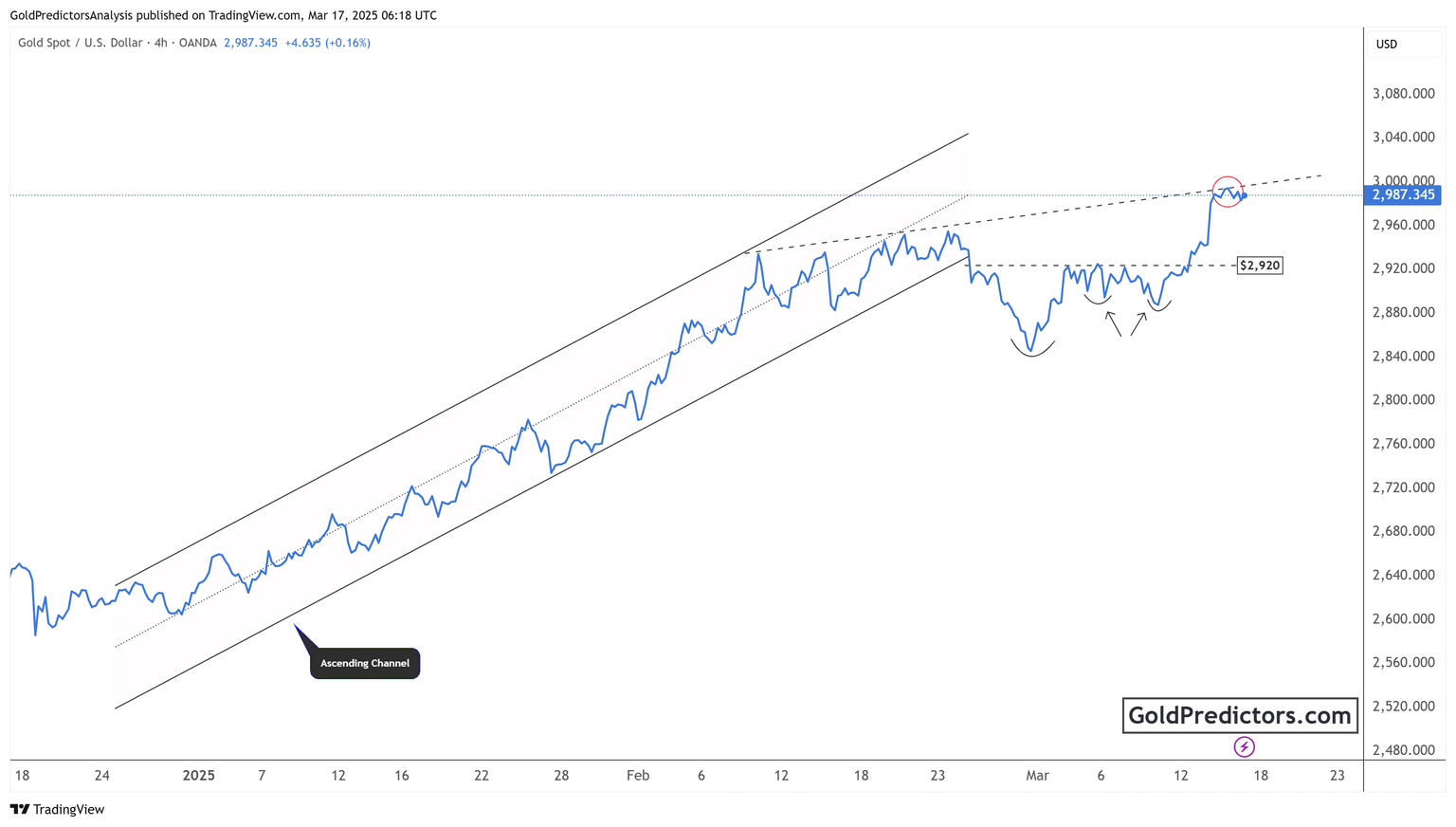

Gold has been in an uptrend, trading within an ascending channel in 2025. Strong bullish sentiment has supported the price action, with buyers stepping in at each retracement. However, the recent price movement suggests that gold is testing a key resistance level near the channel's upper boundary.

In the chart above, gold initially found support around $2,920 after a minor correction. This level acted as a solid base for the next leg higher. A clear inverted head-and-shoulders pattern formed at this support, signaling a potential bullish breakout. The breakout was confirmed as the price surged past $2,960 and reached $2,987.

Gold is struggling to break past the upper trend line, as seen in the red-circled area. This suggests that the metal may consolidate before attempting another move higher. If gold clears the $3,000 mark, it could trigger fresh buying interest and lead to a new all-time high. Conversely, failure to hold above $2,975 could result in a pullback toward $2,920 or lower support levels.

Conclusion

Gold prices remain near record highs, reflecting market concerns over trade and geopolitical risks. Additionally, the Fed's monetary policy stance is also influencing the market. Investors continue to seek gold as a hedge against uncertainty. Expectations of multiple interest rate cuts by the Fed further support the metal's appeal. However, optimism around China's stimulus measures has capped some of gold's gains. As traders anticipate key policy decisions, gold prices could see increased volatility in the coming days.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.