Gold consolidates below $3,395 high, bulls aiming $3,450

- Concerns over Fed's independence spark Gold rush to safety.

- Strengthening Dollar puts some pressure on Gold.

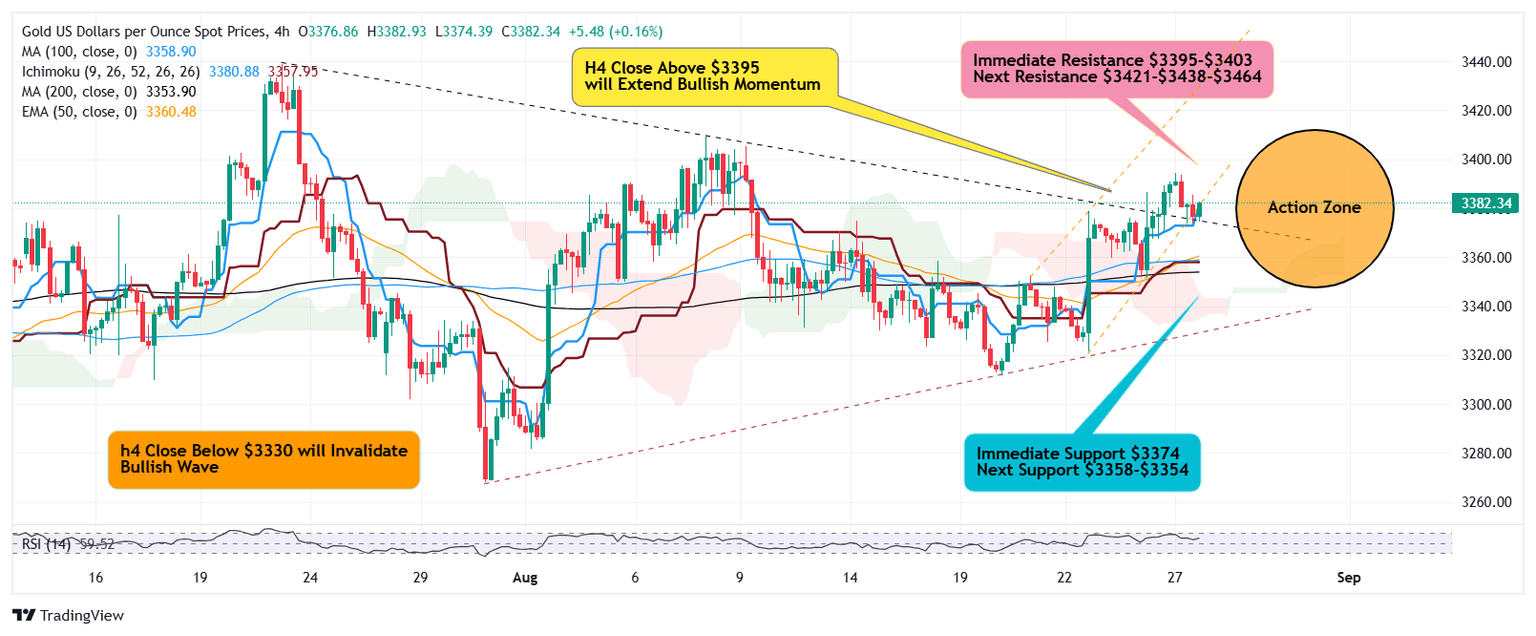

- Local support $3374 caps downside, $3395 acts as interim hurdle.

- Break below $3374 has next support at $3368-$3362-$3358-$3354.

- Clear break above $3395 targets $3403-$3421-$3438-$3465.

What's driving Gold rush?

As the US President Donald Trump attempts to sack Fed Governor Lisa Cook who defies and vows legal suit, political tensions rise on concerns of Fed's autonomy which trigger uncertainty causing sharp rally in Gold prices.

Strengthening Dollar which regains 98.50 caps Gold gains and retraces prices to $3372 causing sideways trades.

Bulls still remain committed for $3400 and $3450 in near term.

What's Cooking ahead?

Gold remains buoyant as long as horizontal demand zone $3360 and psychological zone $3350 hols as strong support and buyers keep stepping in for higher highs.

Meanwhile, occasional bullish spikes in Dollar continue to work capping Gold's gains causing a roller coaster swing.

Technical indicators are strong and favour strong rally towards $3400 and $3450 in near term.

Intraday outlook

As long as Gold maintains stability above immediate support $3372, bulls will attempt to break above immediate hurdle $3395 which next faces challenge at $3403.

If $3403 is taken strongly, bullish momentum will extend to $3421 followed by $3438-$3450-$3465.

On the lower side, break below $3372 will extend retracement to $3368-$3362-$3358-$3354.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.