Gold climbs to record highs on global risks and policy uncertainty

Gold (XAU/USD) has surged to record highs as global risks intensify and policy uncertainty deepens. Rising conflicts in Venezuela and Iran, along with tensions over U.S. moves in Greenland, have driven strong safe-haven demand. At the same time, questions over the Federal Reserve’s future direction and leadership have added to market unease. These overlapping factors have pushed gold sharply higher, strengthening its appeal as a hedge against volatility.

Gold surges to record highs on geopolitical tensions and Fed policy uncertainty

Gold is currently in a strong uptrend and pushing toward new all‑time highs, with spot prices trading near record levels. Tensions in Venezuela, Iran, and Greenland have unsettled global markets, prompting a flight to safety. Market participants are shifting toward gold as a hedge against conflict and instability. The situation in Venezuela remains highly unstable, while frictions involving Iran continue to intensify.

Meanwhile, uncertainty over the next Federal Reserve Chair is adding to market risks. President Trump is set to nominate a replacement for Jerome Powell, and the decision is being closely watched. A dovish pick could shift policy toward further easing, increasing the likelihood of additional rate cuts. Lower interest rates enhance gold’s appeal by reducing the opportunity cost of holding non-yielding assets. Markets are already factoring in a more accommodative Fed in 2026.

Furthermore, central banks have steadily increased their gold holdings, adding strength to long-term demand. This sustained accumulation reflects deeper concerns over currency devaluation, political instability, and weakening confidence in fiat systems. Although the US–EU tensions over Greenland appear to be easing, structural drivers remain firmly in place. According to ING’s Ewa Manthey, the bull market remains intact, supported by persistent policy risks and continued central bank buying.

Gold tests key resistance within broadening wedge pattern

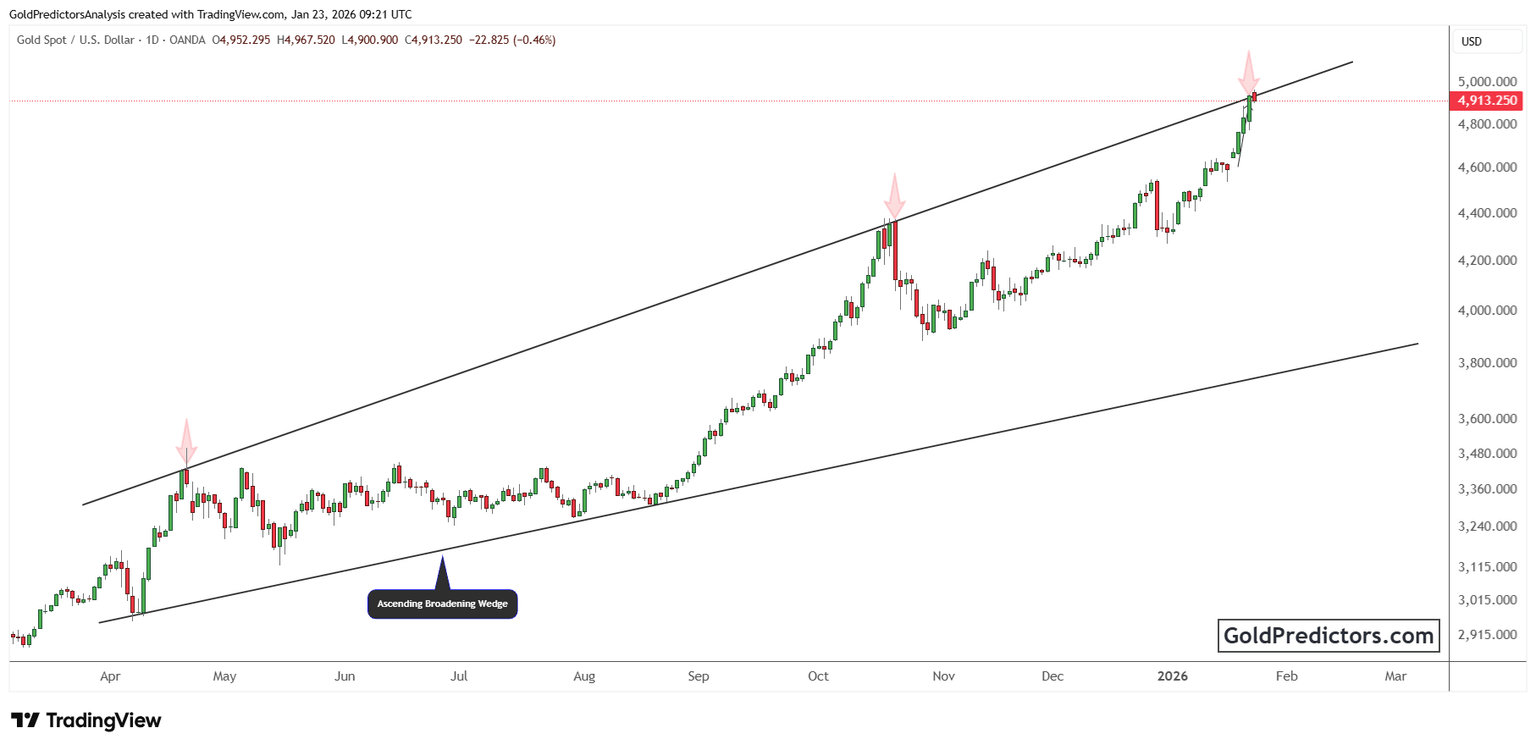

The gold chart below shows the price moving within a well-defined ascending broadening wedge. This pattern reflects increasing volatility and expanding price swings, with both support and resistance lines diverging. After consolidating near the lower boundary earlier in 2025, gold began a steady rally that intensified toward the end of the year. Each leg higher built on previous gains, with shallow pullbacks and rising momentum.

Gold is once again testing a key resistance level that has capped previous rallies. Earlier attempts to break the upper boundary were met with rejection, limiting further upside. In contrast, the latest move showed strong follow-through and touched the $4,950 resistance area, though prices have since pulled back slightly. This marks the third major test of the upper boundary since early 2025. Unlike previous efforts, the current push is supported by a sustained bullish trend, indicating stronger demand and raising the likelihood of a breakout above the wedge.

If gold closes decisively above the upper boundary, it would confirm a breakout from the broadening wedge and potentially trigger a vertical continuation. Volume and momentum indicators would likely validate this move, reflecting institutional participation. In that case, gold could enter a new price discovery phase, targeting levels well beyond $5,000. Until then, the wedge’s resistance remains a key technical barrier to monitor.

Gold market outlook: Geopolitical tensions and Fed uncertainty drive bullish case

Gold remains in a powerful uptrend, driven by escalating geopolitical tensions and deepening monetary uncertainty. The metal continues to attract safe-haven flows as conflicts in Venezuela and Iran, along with unease over U.S. leadership moves, fuel risk aversion. With central banks steadily adding to reserves and the Fed potentially shifting dovish, the fundamental and technical backdrop supports a breakout above key resistance. A decisive close beyond the $4,950 level could trigger a new leg higher, pushing gold into uncharted territory.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.