Gold climbs on Venezuela crisis and rising expectations for Fed cuts

Gold (XAUUSD) is gaining strength as geopolitical tensions and policy uncertainty fuel safe-haven demand. The crisis in Venezuela, coupled with rising risks across Latin America, has pushed market participants toward hard assets. At the same time, soft U.S. economic data has increased expectations for further rate cuts. This powerful combination of geopolitical stress and dovish monetary policy continues to support gold’s upward momentum.

Gold rises on Fed rate cut bets and escalating geopolitical tensions

Gold’s momentum continues to build as geopolitical risks escalate. The U.S. military’s direct involvement in Venezuela has created widespread concern about the potential for broader conflict across Latin America. President Donald Trump’s aggressive statements targeting Venezuela, Colombia, and Mexico only amplified fears. His warnings of additional military action triggered fresh demand for safe-haven assets.

Escalating regional risks have further fueled demand for gold. Capital rotated into hard assets as uncertainty deepened across Latin America. The capture of Maduro and the establishment of an interim government under Delcy Rodríguez amplified concerns. With U.S. involvement seen as a destabilizing force, the outlook remains volatile. In this environment, gold continues to serve as a reliable hedge against political and economic instability.

Meanwhile, attention is also turning to upcoming U.S. labor market data. Key employment figures could shape Federal Reserve policy expectations going into 2026. If economic uncertainty persists alongside global tensions, the Fed may lean further into rate cuts. This combination would create an ideal macro backdrop for continued gains in precious metals.

Gold sustains uptrend with strong support along rising trendline

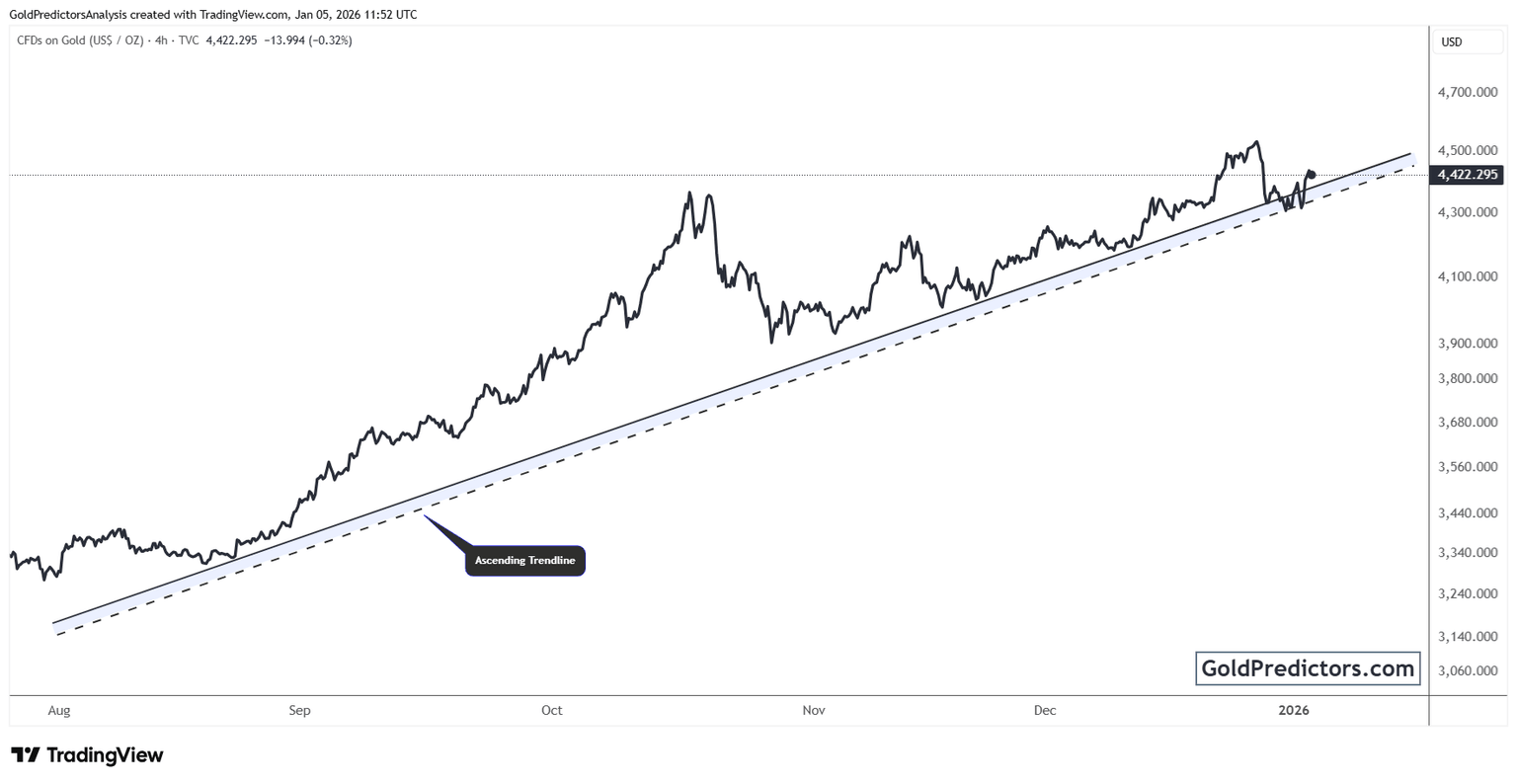

The gold chart below shows a strong, sustained uptrend anchored by a clearly defined ascending trendline. Since August, price action has respected this rising support line, bouncing off it multiple times. This trendline has provided consistent directional support, signaling sustained bullish momentum despite intermittent volatility.

During the correction phase in late December, gold briefly dipped below the trendline but quickly reclaimed it. This move validated the trendline’s strength and confirmed ongoing buyer interest at higher lows. The quick recovery restored market confidence and signaled trend continuation.

Most recently, gold surged back above $4,400, reclaiming momentum along the ascending trendline. The alignment between fundamental catalysts and technical structure remains tight. As long as the price holds above this ascending support, the broader uptrend stays intact. A break above recent highs could open the path toward further upside acceleration.

Gold forecast: Uptrend remains strong as macro tailwinds align

Gold remains in a strong position as geopolitical tensions and dovish monetary signals continue to support its rally. The crisis in Venezuela, coupled with broader regional instability, has driven investors toward hard assets. At the same time, weak U.S. data has strengthened the case for further Fed easing. This alignment of macro stress and technical strength keeps gold’s uptrend firmly intact. A break above recent highs could trigger the next leg higher.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.