Gold Chart of the Week: XAU/USD bulls step in

- Gold bulls are forming a phalanx at critical support.

- The $1,770s are eyed for a daily target for the coming sessions.

The price of gold has been making the case for an upside recovery since rallying on the last day of September. In the prior week, the price corrected to key daily support, and this leaves the prospects for an upside extension favourable for the week ahead.

The following is a top-down analysis that illustrates such a bias for the meantime:

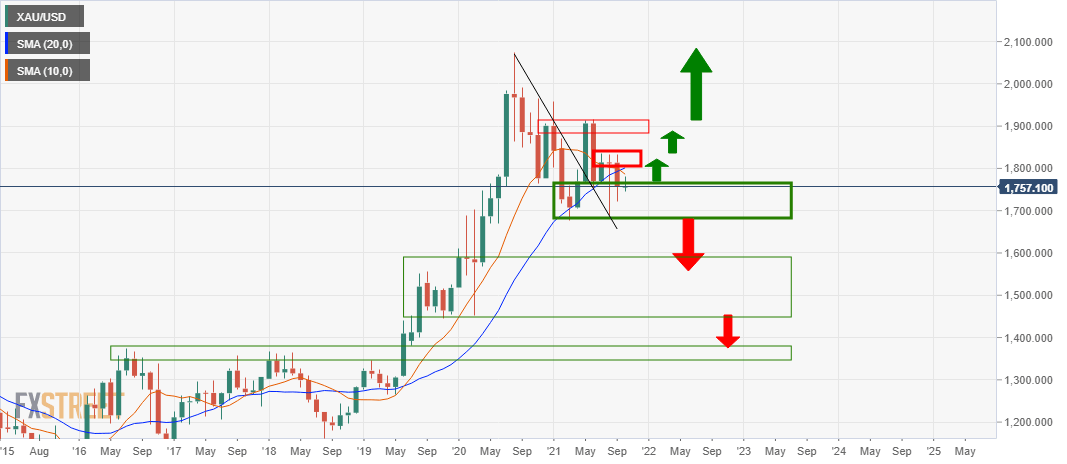

Gold monthly chart

The monthly gold chart shows that the price is vulnerable to the downside, although it is holding in the bullish territory outside the counter trend line by the skin of its teeth. That being said, the 10/20 moving average crossover to the downside is bearish, and a break of support risks territory to test $1,600 and $1,500. For the longer term in gold, bulls need to get above $1,900.

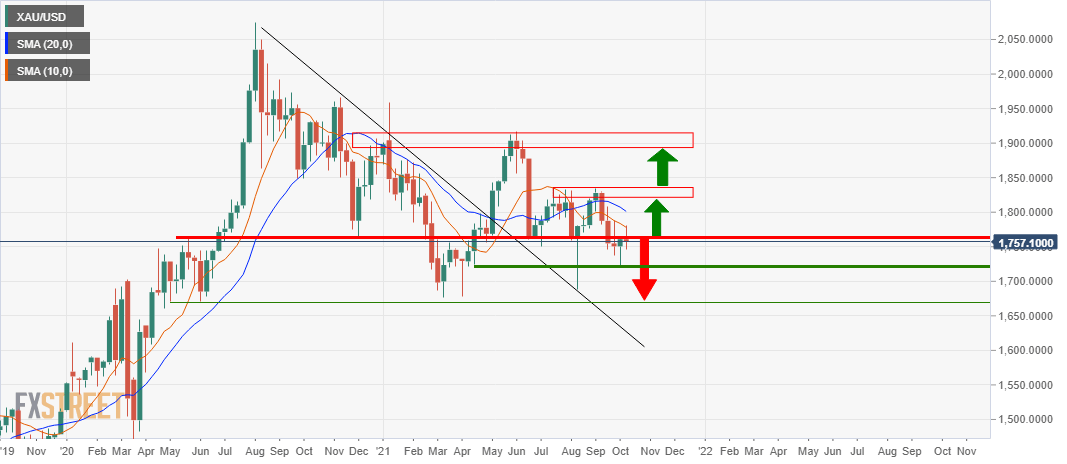

Gold weekly chart

There is a lack of direction from a weekly perspective for gold. The price needs to get above $1,760 and then $1,830 to target $1,900. If the gold price fails to get above $1,760 and hold with a bullish close in the forthcoming week, then the downside prospects will be more compelling toward $1,672.

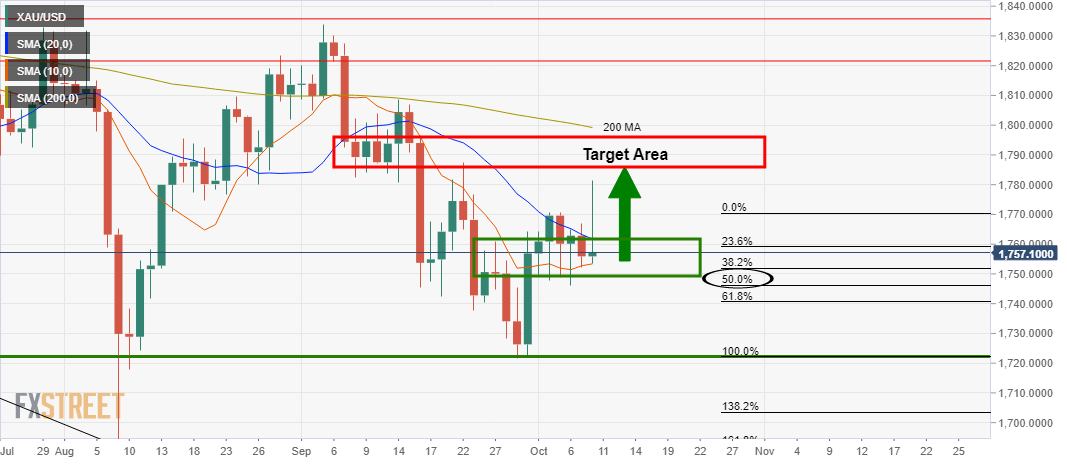

Gold daily chart

However, given the daily bullish close at support and the wick, the expectations are for it to be filled in by price action in the next few sessions. The target area for gold is based on a -272% Fibonacci retracement of the 50% mean reversion and corrective range. This comes in at $1,790 with a confluence of the prior structure en route to gold's 200-day moving average.

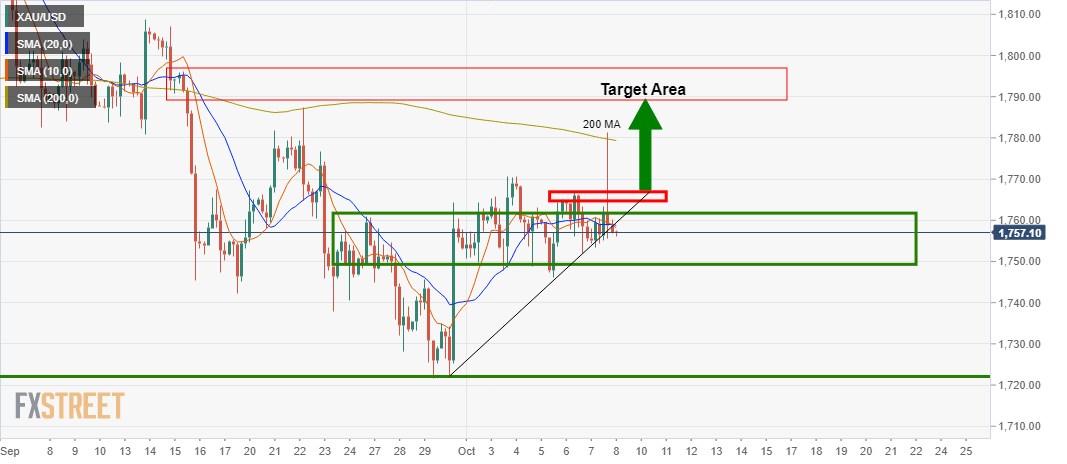

Gold 4-hour chart

From a 4-hour perspective, gold bulls would be prudent to see the price make a move in the direction of the target to break the near term resistance around $1,770. In engaging above this area, there is a higher probability of a bullish continuation for gold this week.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.