Gold: Bulls need a serious response to prevent a near term corrective move [Video]

![Gold: Bulls need a serious response to prevent a near term corrective move [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-gm187363896-28836378_XtraLarge.jpg)

Gold

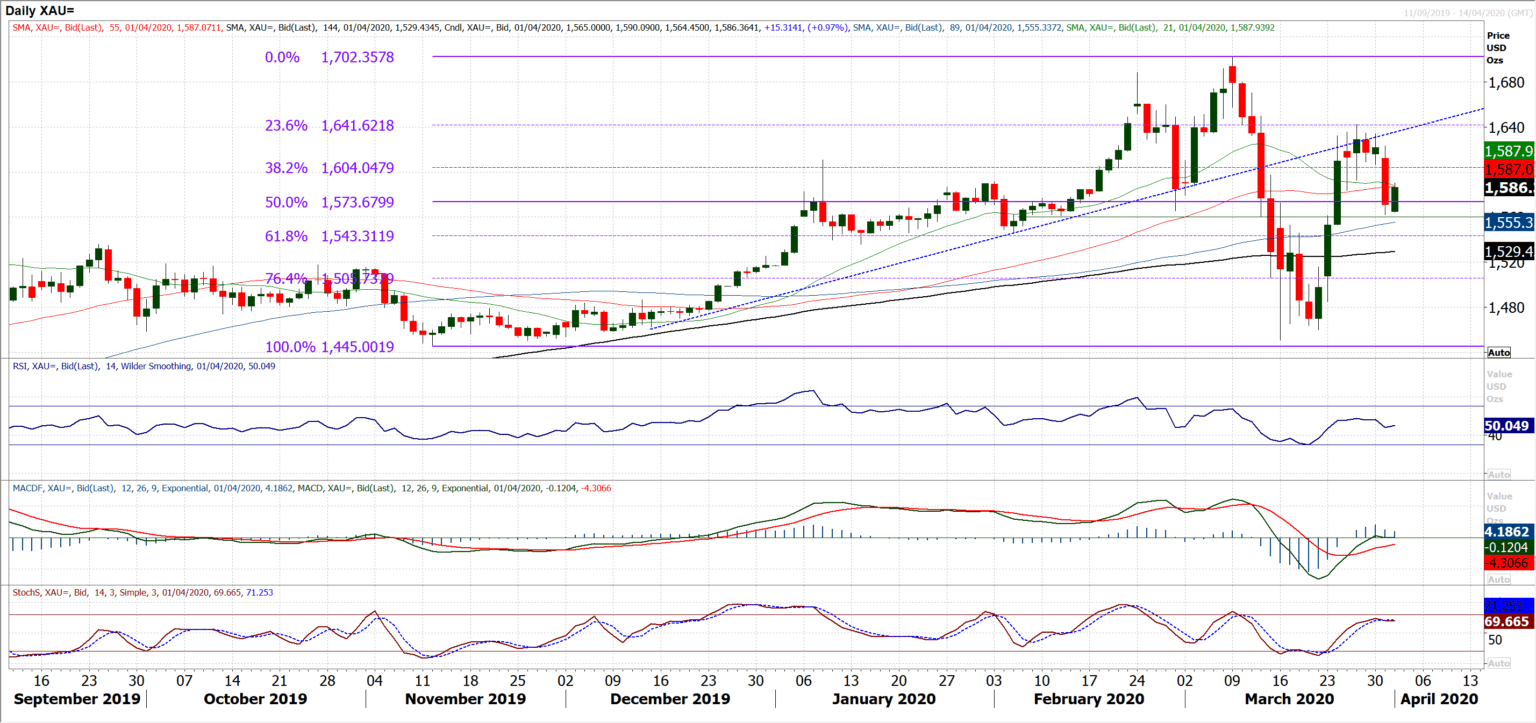

The near term consolidation broke sharply lower yesterday as a strong negative candle which saw the price decline by -$50 on the day. Closing below the previous support around $1584 has completed a breakdown which should now continue a move for pressure on the support band $1553/$1560 (which has been a pivot in recent weeks). The hourly chart has taken on this as a corrective configuration now with RSI failing in the 50s, hourly Stochastics failing between 50/60 and hourly MACD lines below neutral. This all suggests that today’s intraday rally is likely to be now seen as a near term chance to sell. There is resistance of overhead supply between $1584/$1595 and how the bulls react here today will be important as the initial negative move unwinds. The bulls need a serious response to prevent a near term corrective move gathering momentum. A bull failure of this rally today would suggest $1553/$1560 is a realistic target zone again. Hourly RSI failing around 50 today would be a concern for the bulls. We continue to believe this would be a near term move lower before the bigger positive medium/longer term outlook takes hold. It would represent a chance to buy under medium term time horizons then.

Author

Richard Perry

Independent Analyst