Gold breaks higher to hit a new all time high at $3,291

Gold

-

Gold held strong support at 3220/3216 through most of the day in a very quiet session, although dipped to 3211 briefly at lunchtime.

-

After 2 days of the expected consolidation Gold beat the all time high at 3245 over night for a new buy signal to hit the next target of 3255/60

-

The break above 3260 has already hit the next target of 3271/74 & I expect to see 3280/83 before the end of the day.

-

Above 3285 look for 3300/3304.

-

Support at 3247/43 & longs need stops below 3233.

-

A break lower retests 3219/15 & longs need stops below 3209.

Silver

-

Silver holding above 3230 is a buy signal for this week targeting 3245/50 (hit as I write this morning) & even 3270/75 is likely.

-

Support at 3170/50 & longs need stops below 3130.

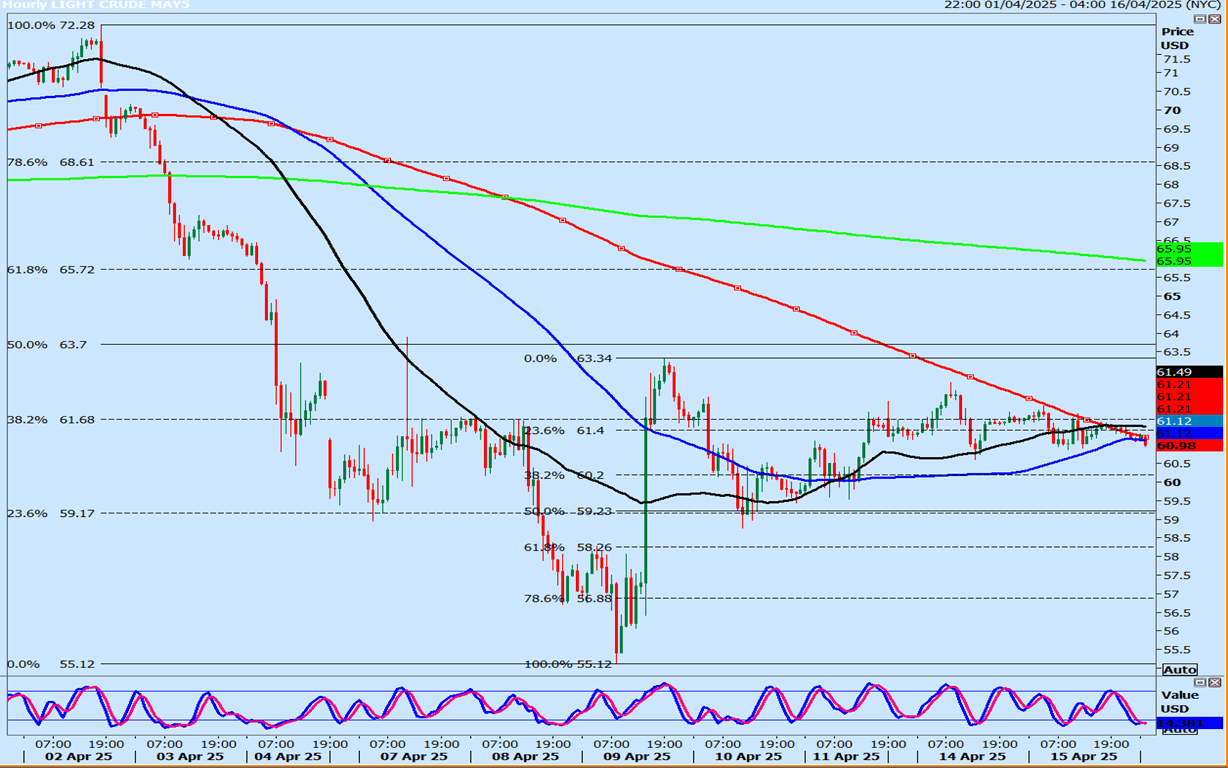

WTI Crude may future

Last session low & high: 6088 - 6206.

(To compare the spread with the contract that you trade).

WTI Crude held a small range inside of Monday's range.

A break above Monday's high of 6268 can retest minor resistance at 6340/80. Shorts need stops above 6420. A break higher can target 6550/6590 for profit taking on longs.

Minor support at 6080/40 but below here can target risks a retest of support at 5940/5900. Longs here need stops below 5830. A break below 5830 could hit 5700/5680.

Author

Jason Sen

DayTradeIdeas.co.uk