Gold breakout, new record high $3,508, retracement to $3,470 – What next?

- Macro factors add fuel to Gold bullish momentum, sets new record high $3508.

- Dollar Index slumps to 97.50 and recovers to 98.40.

- Markets price in 90% odds of 25 BPS Fed rate cut in mid September.

- Concerns on Fed's independence at stake and Court ruling against Trump tariff create chaos.

Fundamental drivers

Gradual and consistent selling pressure in Dollar keeps pushing to 97.50 and some heavy lifting efforts to revive for 98.40 hardly takes an Oxford degree to understand growing de-dollarization campaign, though under the sheets as of now.

Markets price in 90% chances of a 25 BPS rate cut during Fed meeting this mid September, again keeping dollar under check and making dollar denominated Gold attractive.

Price action and momentum footprints

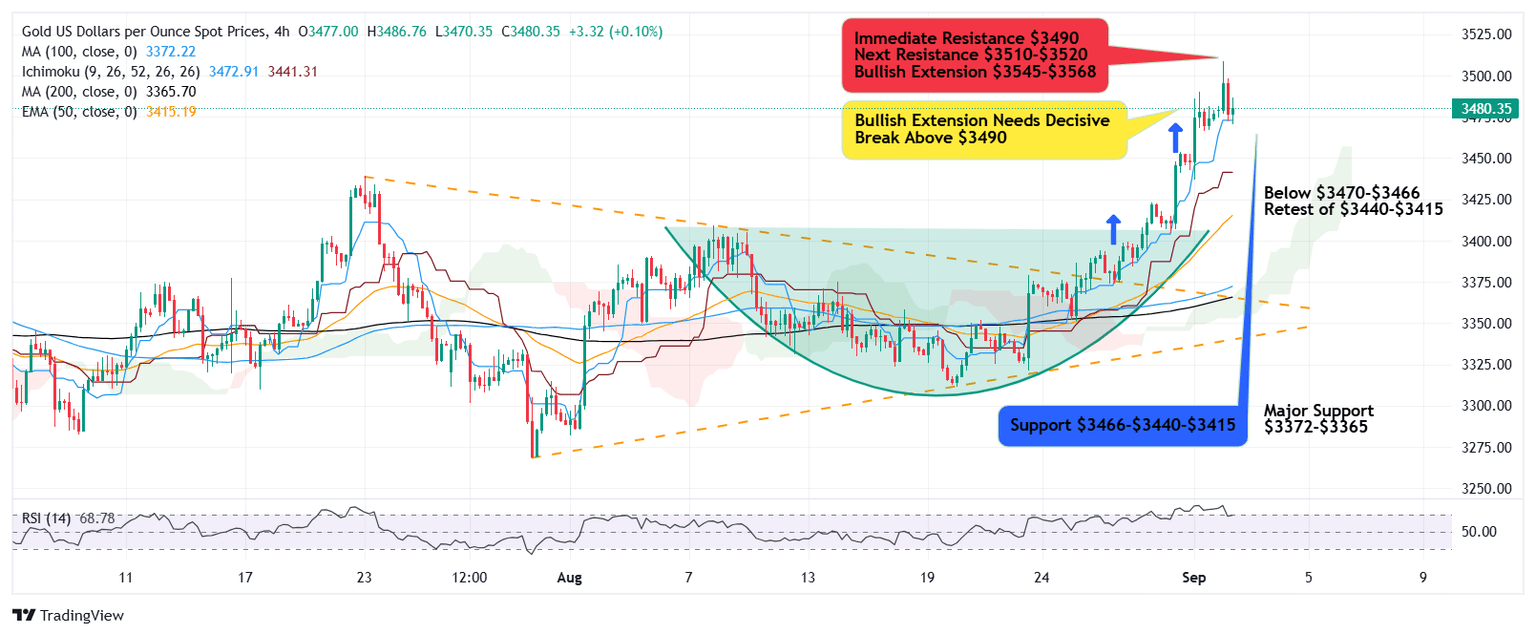

Diverse macro factors giving tailwind to Gold safe haven rush which translated in to bullish rally extending beyond $3500 psychological mark and record high set in 22nd April as today Gold clocks at $3508.50 just a tad below 141% Fibonacci extension of $3439-$3268 down wave aligning with $3509.5.

As usually seen, any new record high is often witnessed by a retail profit booking that shows immediate retracement towards support base followed by momentum gathering for renewed rally or continuation of retracement before any new attempt to rise.

Sharp drop from $3508 followed till $3470 and a consolidation begins leading to retest of $3495 zone which bulls will need to reclaim in order to resume rally.

What's ahead

A strong break above $3495 will revisit $3500 followed by $3509 above which next upside target sits at $3521 followed by $3545.

On the flip side, break and stability below immediate support $3470-$3466 will be followed by extended drop to $3454-$3447-$3441-$3438 while next downside retracement may potentially aim $3415.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.